Texas Pacific Land (TPL) valuation after stock split amendment and expanded share authorization

Stock split amendment reshapes Texas Pacific Land’s share structure

Texas Pacific Land (TPL) just moved to formalize a stock split by filing an amendment that will more than triple its authorized common shares. The change will take effect in late December under Delaware law.

See our latest analysis for Texas Pacific Land.

That move comes after a choppy year for Texas Pacific Land, with a 1 year to date share price return of minus 24.56 percent but a positive 5 year total shareholder return of 292.59 percent, suggesting that long term momentum has not fully broken.

If this kind of structural change has you rethinking your energy exposure, it might be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas beyond TPL.

With earnings still growing, a modest intrinsic value discount and a sharp pullback from recent highs, is Texas Pacific Land quietly slipping into undervalued territory, or is the market already discounting all of its future growth?

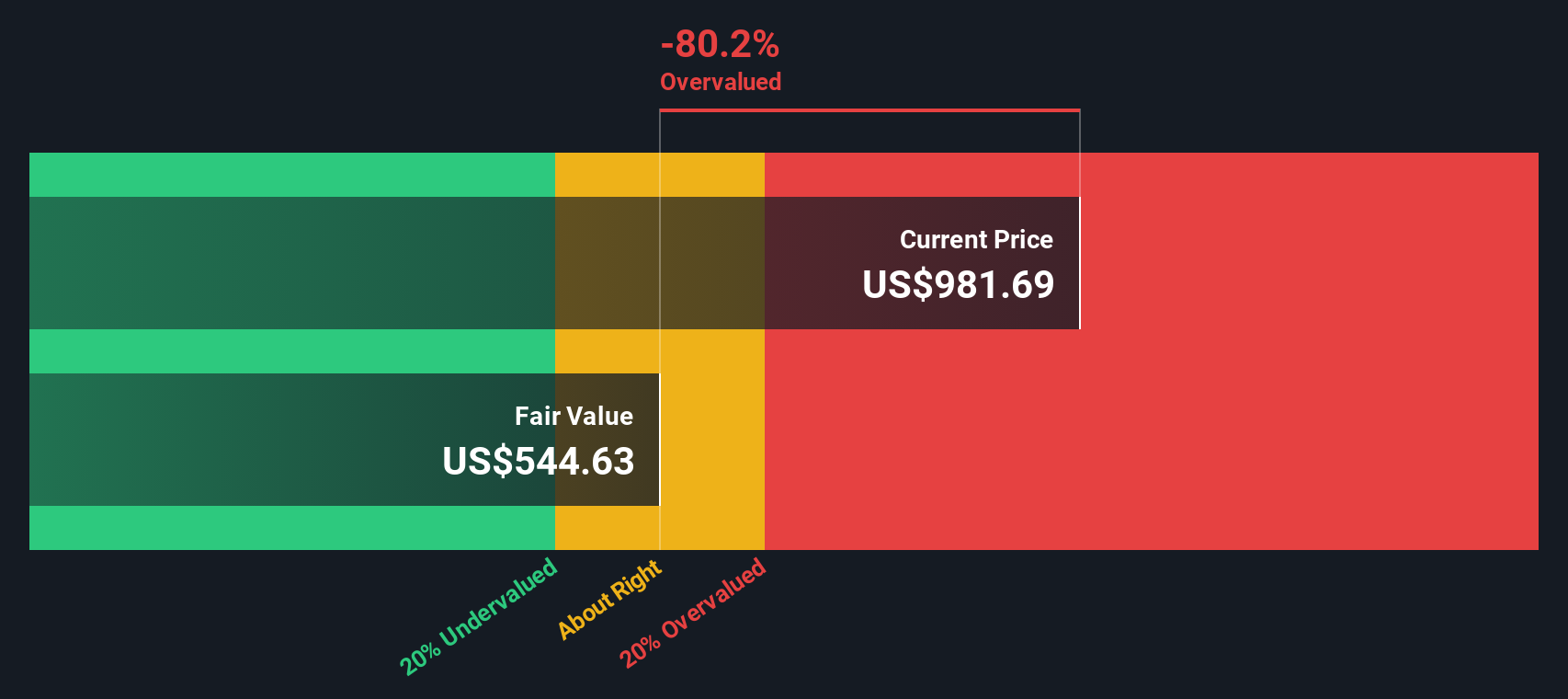

Most Popular Narrative Narrative: 5.7% Overvalued

With Texas Pacific Land last closing at $890.30 against a narrative fair value of $842.50, the story points to a market pricing in more optimism than its model suggests.

Beneficial reuse and desalination initiatives, combined with advancing transmission and data center infrastructure in the Permian, provide exposure to future monetization avenues (industrial water supply, renewable energy, land leases), enhancing potential for diversified long-term revenue and asset value growth.

Want to see what kind of revenue build, margin path, and future earnings multiple could justify today’s premium tag on TPL’s shares? The full narrative breaks down a surprisingly aggressive growth runway, a still rich future valuation multiple, and a tighter margin profile that together produce this fair value call. Curious how those moving parts fit into one coherent forecast? Dive in to unpack the numbers behind the story.

Result: Fair Value of $842.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained double digit water services growth, or durable royalty volumes from long lived Permian developments, could support higher earnings and challenge this cautious valuation.

Find out about the key risks to this Texas Pacific Land narrative.

Another View on Valuation

Our DCF model paints a slightly different picture, suggesting Texas Pacific Land is about 1.7 percent undervalued at $890.30 versus a fair value near $905.48. If cash flows point to upside while the narrative still flags downside, which signal matters more for you?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Texas Pacific Land for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Texas Pacific Land Narrative

If you question these assumptions or prefer to dig into the numbers yourself, you can shape a personalized view in just a few minutes: Do it your way.

A great starting point for your Texas Pacific Land research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas beyond Texas Pacific Land?

Scale up your next move by scanning fresh opportunities through the Simply Wall St Screener, where curated ideas save you time and sharpen your edge.

- Capture high-upside potential by targeting underpriced businesses with these 905 undervalued stocks based on cash flows. This can help you pair robust cash flows with room for sentiment to catch up.

- Ride structural growth trends by zeroing in on innovators driving real-world disruption through these 25 AI penny stocks across automation, data, and intelligent software.

- Strengthen your income stream by focusing on resilient payers via these 12 dividend stocks with yields > 3%. This can help anchor total returns through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報