Concurrent Technologies And 2 Other UK Penny Stocks To Watch

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China, highlighting concerns over global economic recovery. Amidst these broader market fluctuations, investors often turn their attention to smaller companies that can offer unique opportunities for growth and value. Penny stocks, despite being an older term, remain relevant as they represent smaller or newer companies that may provide significant returns when supported by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.185 | £480.11M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.00 | £161.57M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.28 | £330.38M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.835 | £12.61M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.37 | £30.07M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6075 | $353.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.442 | £177.56M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.445 | £69.78M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.495 | £42.67M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £177.02M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 309 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Concurrent Technologies (AIM:CNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Concurrent Technologies Plc designs, develops, manufactures, and markets single board computers for system integrators and original equipment manufacturers, with a market cap of £201.26 million.

Operations: The company generates revenue of £44.57 million from the design, manufacture, and supply of high-end embedded computer products.

Market Cap: £201.26M

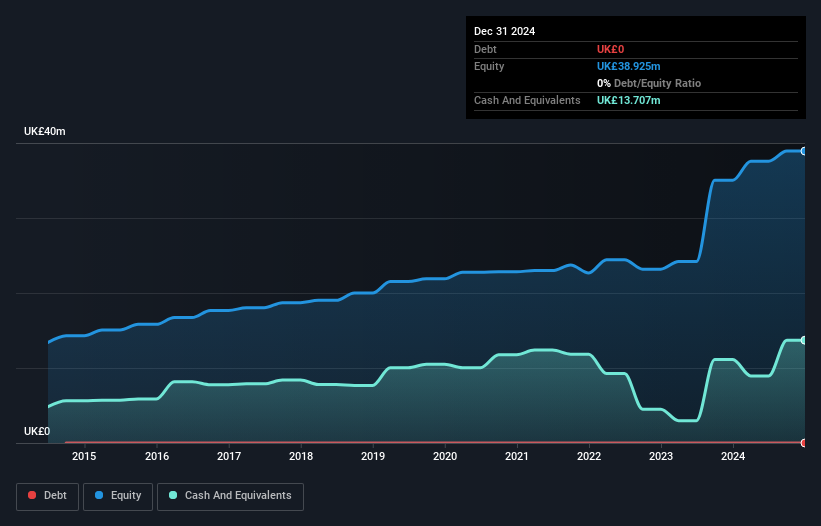

Concurrent Technologies Plc, with a market cap of £201.26 million and revenue of £44.57 million, recently secured a $5.25 million contract with a major US defence contractor, marking its first foray into outsourced design services. This aligns with industry trends favoring agile solutions and open standards. Financially stable, the company is debt-free and has not diluted shareholders recently; its short-term assets significantly exceed liabilities. Despite a slight dip in net profit margins to 10.8%, earnings have grown by 13.6% annually over five years, outpacing the tech industry's decline last year, with future growth forecasted at 17.92% annually.

- Unlock comprehensive insights into our analysis of Concurrent Technologies stock in this financial health report.

- Assess Concurrent Technologies' future earnings estimates with our detailed growth reports.

Springfield Properties (AIM:SPR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Springfield Properties Plc, with a market cap of £145.23 million, operates in the United Kingdom focusing on residential housebuilding and land development through its subsidiaries.

Operations: The company generates revenue primarily from its Housing Building Activity, which amounts to £280.56 million.

Market Cap: £145.23M

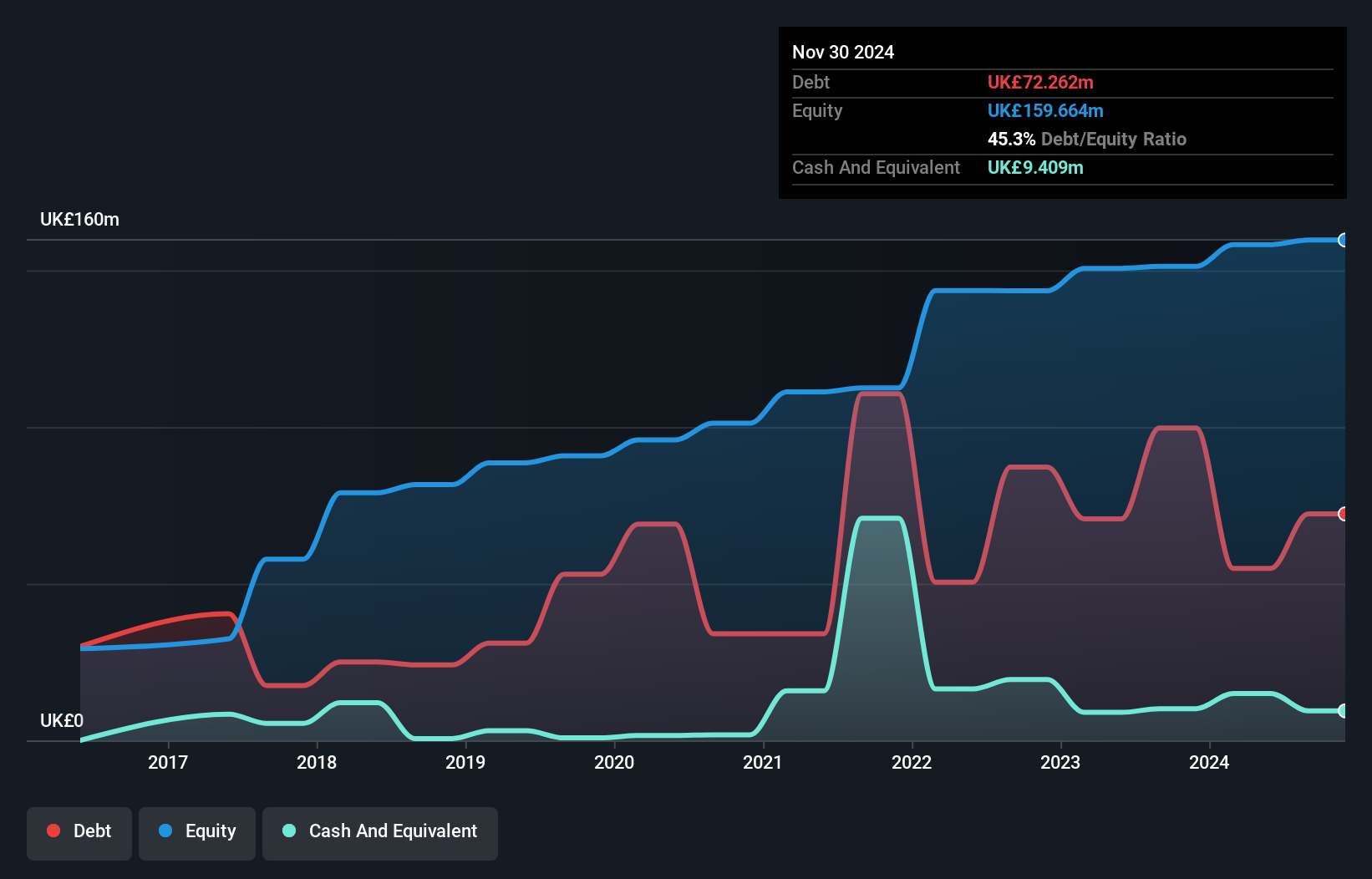

Springfield Properties Plc, with a market cap of £145.23 million, has shown robust earnings growth of 86.8% over the past year, surpassing its five-year average decline. Despite this positive trend, earnings are forecasted to decline by 5.3% annually over the next three years. The company demonstrates financial stability with short-term assets exceeding liabilities and a reduced debt-to-equity ratio from 72% to 17.7%. Management is seasoned with an average tenure of seven years and recent board changes include appointing Alasdair Gardner as Non-executive Director. A final dividend increase to 2 pence per share reflects confidence in ongoing revenue growth for 2026.

- Click to explore a detailed breakdown of our findings in Springfield Properties' financial health report.

- Review our growth performance report to gain insights into Springfield Properties' future.

Cairn Homes (LSE:CRN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cairn Homes plc is a homebuilder operating in Ireland with a market cap of approximately £1.10 billion.

Operations: The company generates revenue primarily through its building and property development activities, amounting to €778.20 million.

Market Cap: £1.1B

Cairn Homes plc, with a market cap of £1.10 billion, trades at a substantial discount to its estimated fair value and offers good relative value compared to peers. Despite high-quality past earnings, the company faced negative earnings growth last year. Short-term assets of €1.3 billion comfortably cover both short- and long-term liabilities, yet operating cash flow remains negative, impacting debt coverage. The net debt-to-equity ratio is high at 40.3%, though interest payments are well covered by EBIT (9.9x). While dividends yield 4.06%, they aren't well supported by free cash flows; however, earnings are forecasted to grow annually by 15.31%.

- Jump into the full analysis health report here for a deeper understanding of Cairn Homes.

- Learn about Cairn Homes' future growth trajectory here.

Taking Advantage

- Take a closer look at our UK Penny Stocks list of 309 companies by clicking here.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報