ROHM (TSE:6963): Assessing Valuation After a Strong Year-To-Date Share Price Rally

ROHM (TSE:6963) has quietly outperformed this year, with the stock up about 43% year to date and over 53% in the past year, even as longer term returns remain mixed.

See our latest analysis for ROHM.

With the share price now around ¥2,152.5 and a 1 month share price return of 8.4%, recent gains build on strong year to date momentum, even though the 3 year total shareholder return remains negative.

If ROHM’s run has you thinking about what else is moving in semiconductors and adjacent tech, this could be a good moment to explore high growth tech and AI stocks.

Yet with earnings rebounding, a modest discount to analyst targets, and longer term returns still underwhelming, should investors view ROHM as an overlooked value in semiconductors, or has the market already priced in its next leg of growth?

Most Popular Narrative: 2% Undervalued

With ROHM last closing at ¥2,152.5 against a narrative fair value near ¥2,204.6, the story leans toward modest upside driven by future profitability.

Significant cost reduction measures are being implemented, including a plan to decrease annual fixed costs by ¥20 to 30 billion over the next three years and increased outsourcing, which is expected to improve net margins and profitability.

Want to see how steady growth, margin rebuild, and a richer future earnings multiple combine into that valuation call? The underlying assumptions might surprise you.

Result: Fair Value of ¥2,204.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be derailed if industrial demand keeps sliding or EV related SiC adoption slows, which would pressure both revenue growth and margin recovery.

Find out about the key risks to this ROHM narrative.

Another View: Rich On Cash Flows

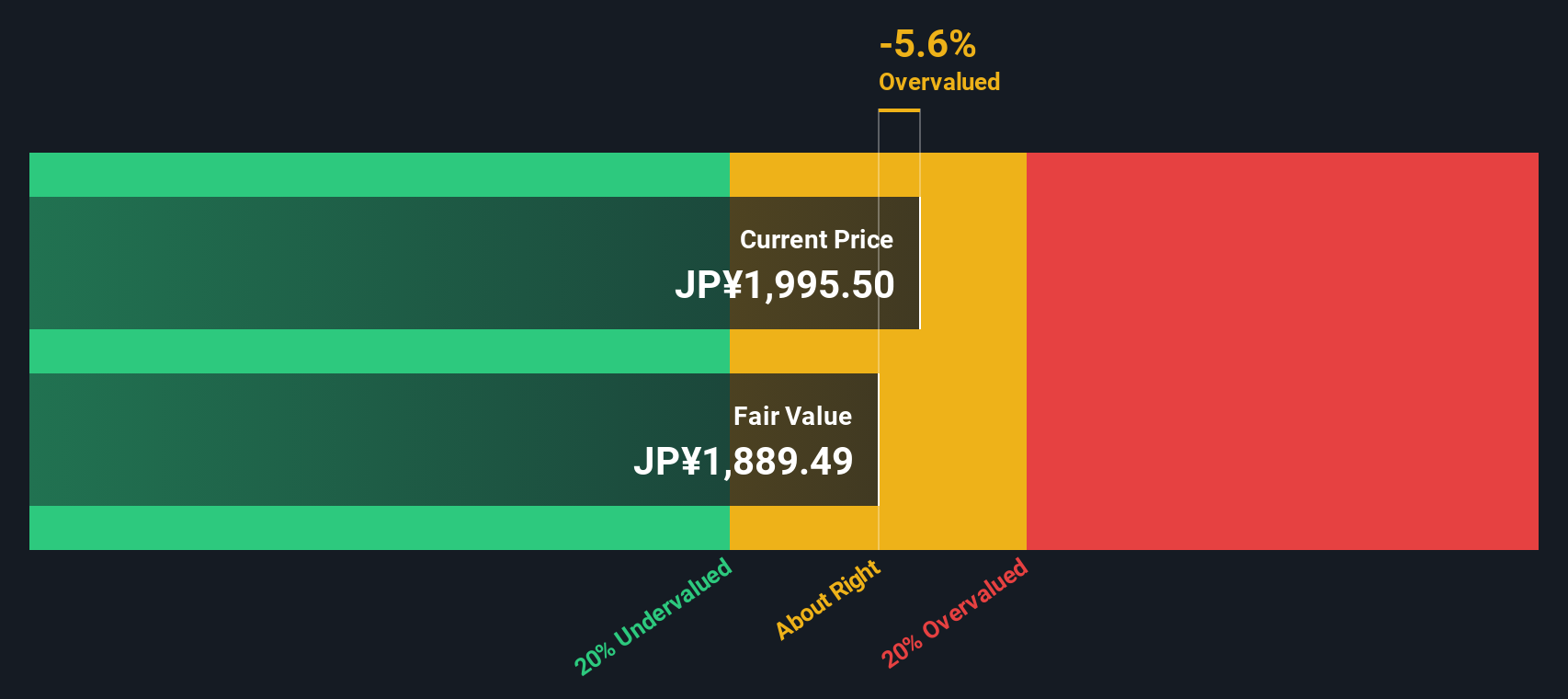

There is a catch. While the narrative fair value suggests ROHM is about 2% undervalued, our DCF model paints a very different picture, implying fair value near ¥753.8 versus a market price of ¥2,152.5, which looks significantly overvalued based on cash flow assumptions.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ROHM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ROHM Narrative

If you see the story differently, or simply prefer to dig into the numbers yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your ROHM research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may wish to explore your next opportunity using the Simply Wall Street Screener, or risk missing stocks quietly setting up their next big move.

- Scan these 905 undervalued stocks based on cash flows for potential mispriced opportunities that could offer stronger upside than widely followed names.

- Target these 25 AI penny stocks to gain exposure to companies positioned at the center of rapidly expanding AI adoption.

- Focus on these 12 dividend stocks with yields > 3% to help strengthen your income stream with potential cash returns alongside long term growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報