Is It Too Late To Consider Annaly Capital Management After Its Strong Multi Year Run?

- Wondering if Annaly Capital Management is still good value after its big run, or if you might be late to the party? This breakdown will walk through what the current price is really baking in.

- Despite a recent 2.4% dip over the last week and a modest 1.0% gain over the past month, the stock is still up 20.9% year to date and 29.5% over the last year, with a 53.8% gain over three years and 27.2% over five years.

- Those moves have come as investors refocus on income plays like Annaly in a shifting interest rate environment, reassessing how resilient mortgage REITs might be if borrowing costs stay elevated for longer. Broader market conversations about credit quality, funding conditions and the housing backdrop have all fed into how investors are pricing Annaly's risk and opportunity.

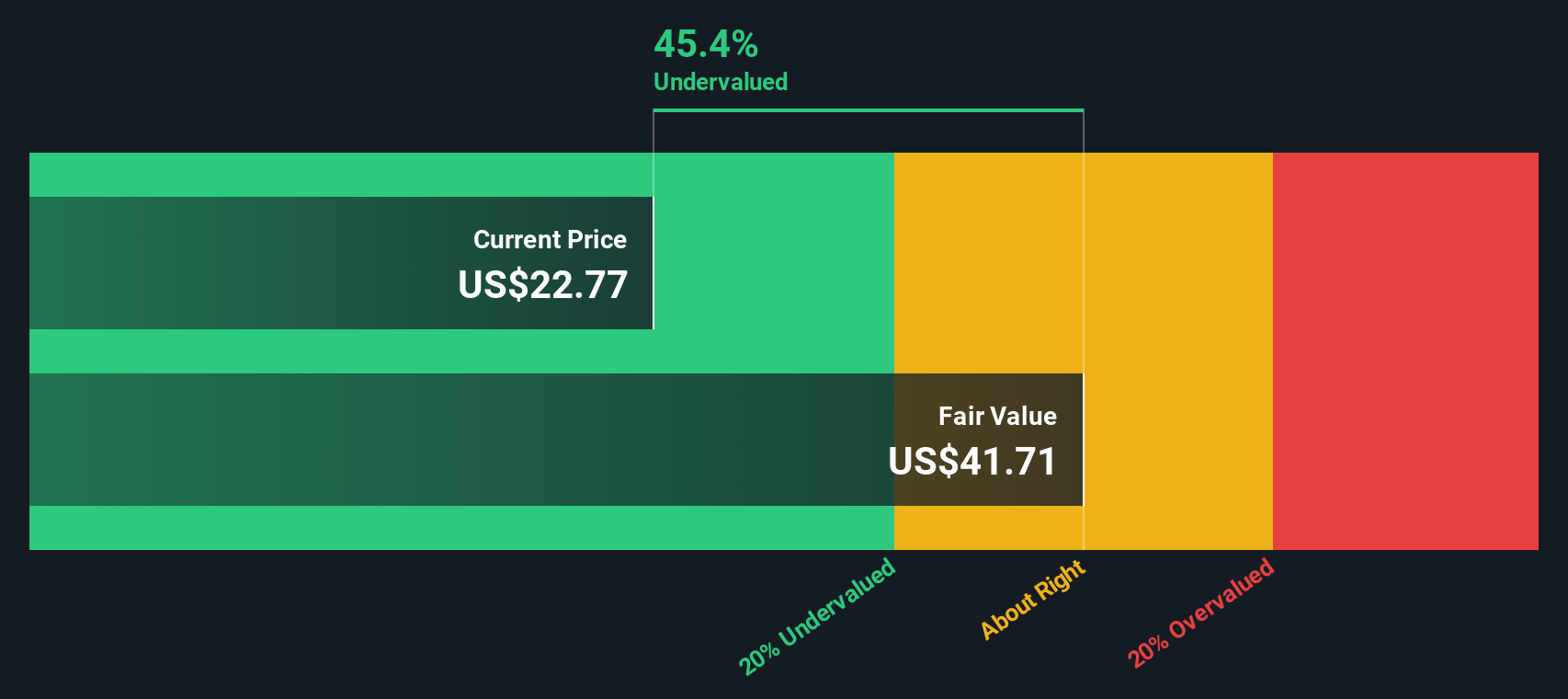

- Right now, Annaly posts a valuation score of 5/6, suggesting it screens as undervalued on most of the checks we run, but that headline number is only part of the story. Next, we will unpack what different valuation approaches say about the stock, and then finish with a more holistic way to think about Annaly's true worth beyond any single model.

Approach 1: Annaly Capital Management Excess Returns Analysis

The Excess Returns model looks at how much value Annaly Capital Management can create above the return that investors demand for holding its equity. In simple terms, it compares the profit Annaly can earn on its book value to the cost of that equity, then projects how long that value creation can continue.

Annaly is estimated to have a Book Value of $19.25 per share and a Stable EPS of $3.13 per share, based on weighted future Return on Equity estimates from 4 analysts. Against a Cost of Equity of $1.84 per share, this implies an Excess Return of $1.29 per share. With an Average Return on Equity of 15.58% and a Stable Book Value projected at $20.12 per share, Annaly is modeled as continuing to earn returns meaningfully above its equity cost.

On this basis, the Excess Returns valuation points to an intrinsic value of about $41.93 per share, which implies the stock is roughly 47.0% undervalued versus its current trading price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Annaly Capital Management is undervalued by 47.0%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

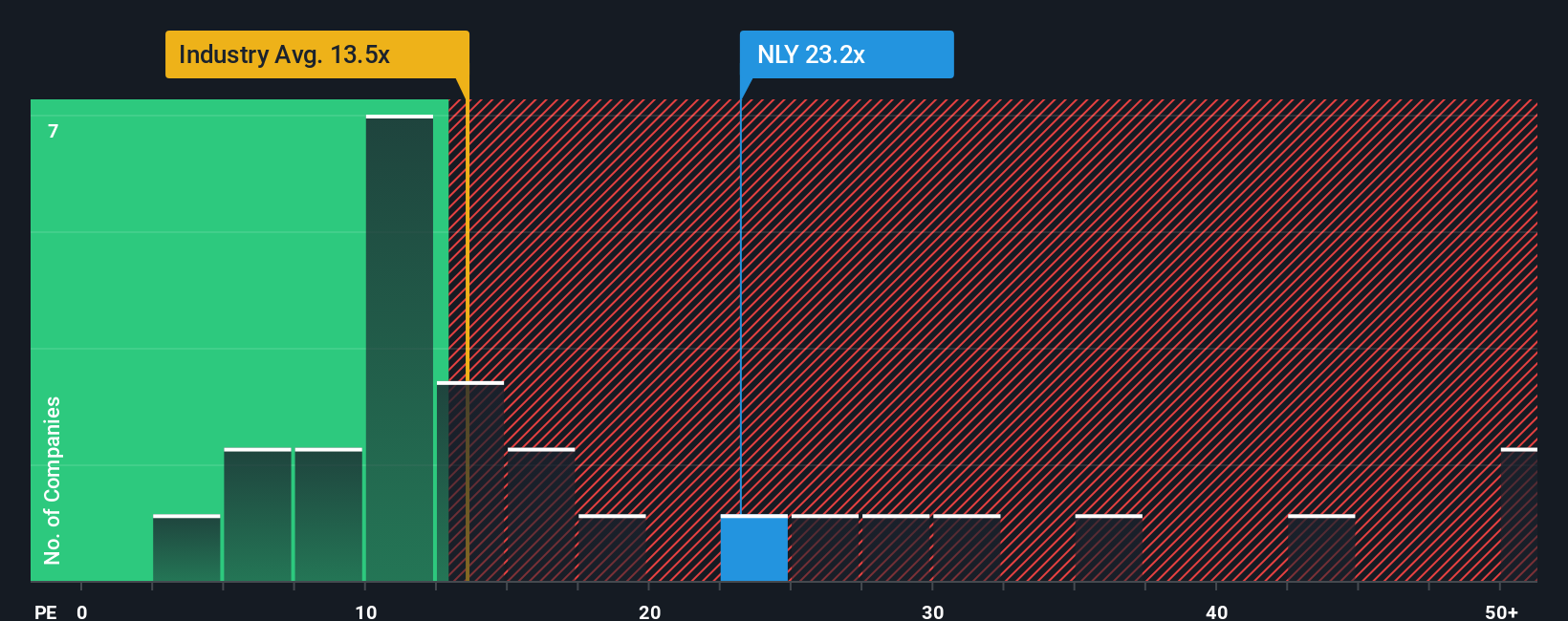

Approach 2: Annaly Capital Management Price vs Earnings

For a profitable income vehicle like Annaly, the price to earnings, or PE, ratio is a practical way to gauge how much investors are willing to pay for each dollar of current earnings. In general, stronger growth and lower perceived risk justify a higher PE, while slower growth or higher risk usually cap the multiple investors are comfortable with.

Annaly currently trades on a PE of 11.32x, which sits below both the Mortgage REITs industry average of 13.14x and the broader peer group average of 13.62x. Simply Wall St also calculates a Fair Ratio of 17.94x for Annaly, which is the PE level you might expect once you factor in its earnings growth profile, profit margins, industry positioning, market cap and risk characteristics.

This Fair Ratio is more tailored than a simple comparison with sector averages, because it adjusts for Annaly specific strengths and vulnerabilities rather than assuming all REITs deserve the same multiple. Set against that 17.94x Fair Ratio, the current 11.32x PE suggests the market is still pricing Annaly at a noticeable discount on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Annaly Capital Management Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is a simple framework on Simply Wall St’s Community page where you connect your view of Annaly’s business to a set of numbers, from revenue and earnings growth to margins and a fair value estimate. You can then compare that fair value to today’s price to decide whether it looks like a buy, hold or sell for you personally. The platform dynamically updates those Narratives as new news, earnings and rating changes arrive. You can see, for example, one investor building a bullish narrative around easing mortgage rates, tighter agency spreads and an upward shifting fair value near 22.10 dollars. Another investor may take a more cautious view that rising rates, refinancing cyclicality and index removal warrant a lower fair value and wider margin of safety. This illustrates how the same data can support different, but clearly articulated, investment decisions.

Do you think there's more to the story for Annaly Capital Management? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報