Nokia (HLSE:NOKIA): Assessing Valuation After New 5G Partnerships and Network Automation Deals

Nokia Oyj (HLSE:NOKIA) is back in focus after unveiling three new partnerships that push its 5G, automation and Network as Code strategy deeper into India, the Middle East and offshore energy infrastructure.

See our latest analysis for Nokia Oyj.

Those deals have landed as momentum returns to the stock, with Nokia Oyj’s 90 day share price return of 41.19 percent and one year total shareholder return of 31.87 percent, which suggests improving sentiment around its 5G and automation story.

If these moves have you thinking beyond just one stock, it might be a smart time to explore other high growth tech and AI names using high growth tech and AI stocks.

Yet with the shares now close to analyst targets and a strong multi year run already behind them, investors have to ask: is Nokia still trading below its true potential, or is the market already pricing in that future growth?

Most Popular Narrative Narrative: 0.5% Undervalued

With Nokia Oyj closing at €5.41 against a narrative fair value of €5.43, the storyline leans toward slight upside while hinging on a few powerful growth engines.

Strong demand from hyperscalers (cloud/AI data centers) and U.S./European infrastructure stimulus is expanding Nokia's addressable market for high-capacity network equipment, supporting future top-line growth.

Ongoing global build-out of fiber and advanced 5G/6G networks, accelerated by regulatory programs and large CSP capex, provides a multi-year runway for increased product and service revenues, particularly in Fixed and Optical Networks.

Want to see what turns that demand story into hard numbers? Revenue, margins and future earnings are all pushed to ambitious levels. Curious how bold those targets really are?

Result: Fair Value of €5.43 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency headwinds and tougher telecom capex could stall margin expansion and delay the AI driven growth embedded in the current narrative.

Find out about the key risks to this Nokia Oyj narrative.

Another Angle on Value

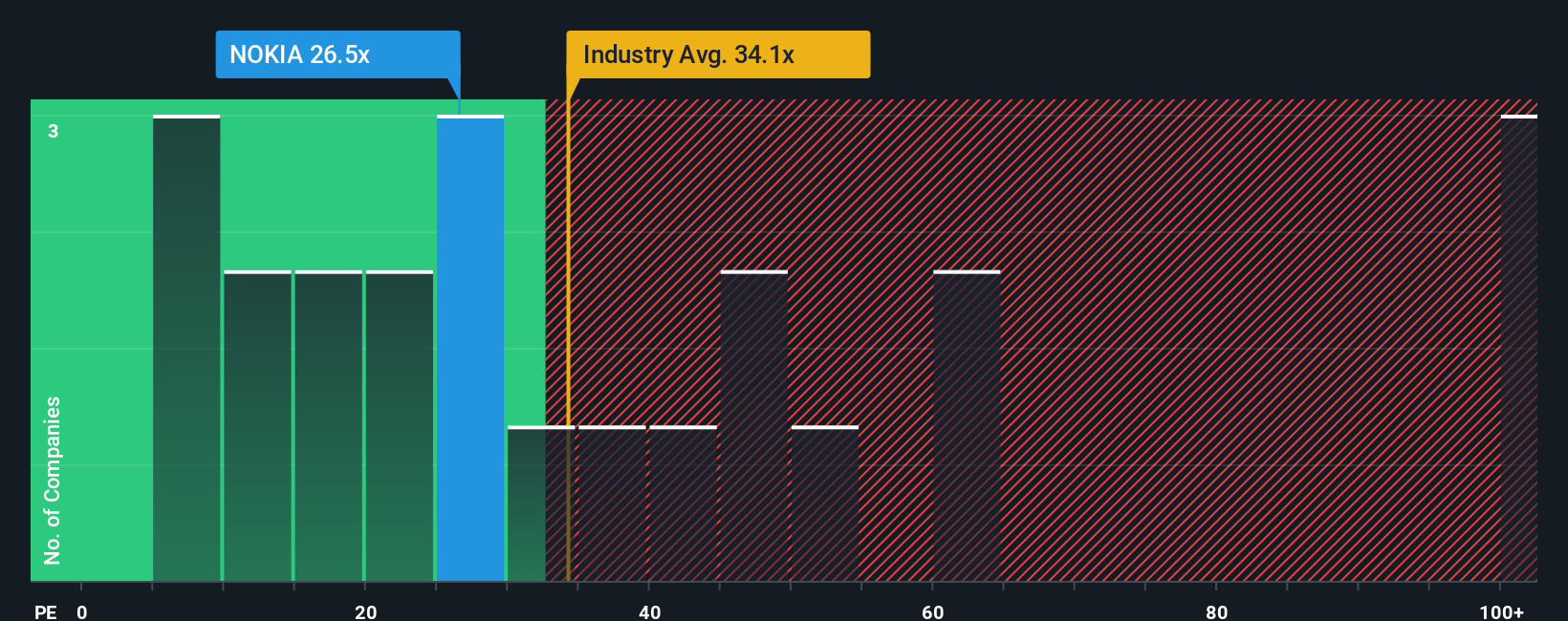

Step away from the narrative of fair value and the picture gets tougher. On earnings, Nokia trades at 35.6 times profits versus a 33.6 fair ratio, 29.3 for peers and 38.7 for the wider European communications group. That premium narrows the margin for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nokia Oyj Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a fresh take in just minutes, Do it your way.

A great starting point for your Nokia Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investing ideas?

If Nokia has sharpened your appetite for opportunity, do not stop here. Use the Simply Wall St Screener to uncover your next high conviction move today.

- Capture early stage growth potential by targeting resilient businesses using these 3609 penny stocks with strong financials before the crowd catches on to their momentum.

- Capitalize on the AI transformation by focusing on innovators powering automation, analytics and intelligent infrastructure through these 25 AI penny stocks.

- Lock in value by spotting companies trading below their cash flow potential with these 905 undervalued stocks based on cash flows, before the market fully closes the gap.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報