European Stocks That May Be Undervalued In December 2025

As the European markets navigate a landscape marked by hopes of interest rate cuts and mixed economic signals, investors are closely watching for opportunities amid fluctuating indices. With the STOXX Europe 600 Index showing modest gains and inflationary pressures persisting, identifying potentially undervalued stocks could offer strategic entry points for those seeking value in a complex market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Straumann Holding (SWX:STMN) | CHF95.58 | CHF187.25 | 49% |

| Sanoma Oyj (HLSE:SANOMA) | €9.14 | €18.16 | 49.7% |

| PVA TePla (XTRA:TPE) | €22.60 | €44.28 | 49% |

| Ottobock SE KGaA (XTRA:OBCK) | €70.25 | €138.58 | 49.3% |

| Jæren Sparebank (OB:JAREN) | NOK379.95 | NOK754.39 | 49.6% |

| Gentili Mosconi (BIT:GM) | €3.34 | €6.53 | 48.8% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.395 | €0.78 | 49.1% |

| Exail Technologies (ENXTPA:EXA) | €86.30 | €171.25 | 49.6% |

| E-Globe (BIT:EGB) | €0.61 | €1.22 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €2.56 | €5.05 | 49.3% |

Let's dive into some prime choices out of the screener.

Thales (ENXTPA:HO)

Overview: Thales S.A. is a global company offering solutions in defence and security, aerospace and space, and digital identity and security markets, with a market cap of €46.91 billion.

Operations: Thales S.A. generates revenue from its key segments, including Aerospace (€5.81 billion), Cyber & Digital (€4.08 billion), and Defence excluding Digital Identity & Security (€11.96 billion).

Estimated Discount To Fair Value: 38.1%

Thales is trading at €228.4, significantly below its estimated fair value of €368.96, suggesting it may be undervalued based on cash flows. Recent developments include the launch of the AI Security Fabric to enhance security for AI applications and a partnership with Airbus and Leonardo in space activities, which could drive future growth. The company's earnings are forecasted to grow faster than the French market, supported by strategic initiatives and robust financial health despite large one-off items impacting results.

- The growth report we've compiled suggests that Thales' future prospects could be on the up.

- Navigate through the intricacies of Thales with our comprehensive financial health report here.

Zehnder Group (SWX:ZEHN)

Overview: Zehnder Group AG, along with its subsidiaries, develops, manufactures, and sells indoor climate systems across Europe, North America, and China with a market cap of CHF865.88 million.

Operations: The company's revenue is primarily derived from its Ventilation segment, which accounts for €474.10 million, and its Radiators segment, contributing €269.80 million.

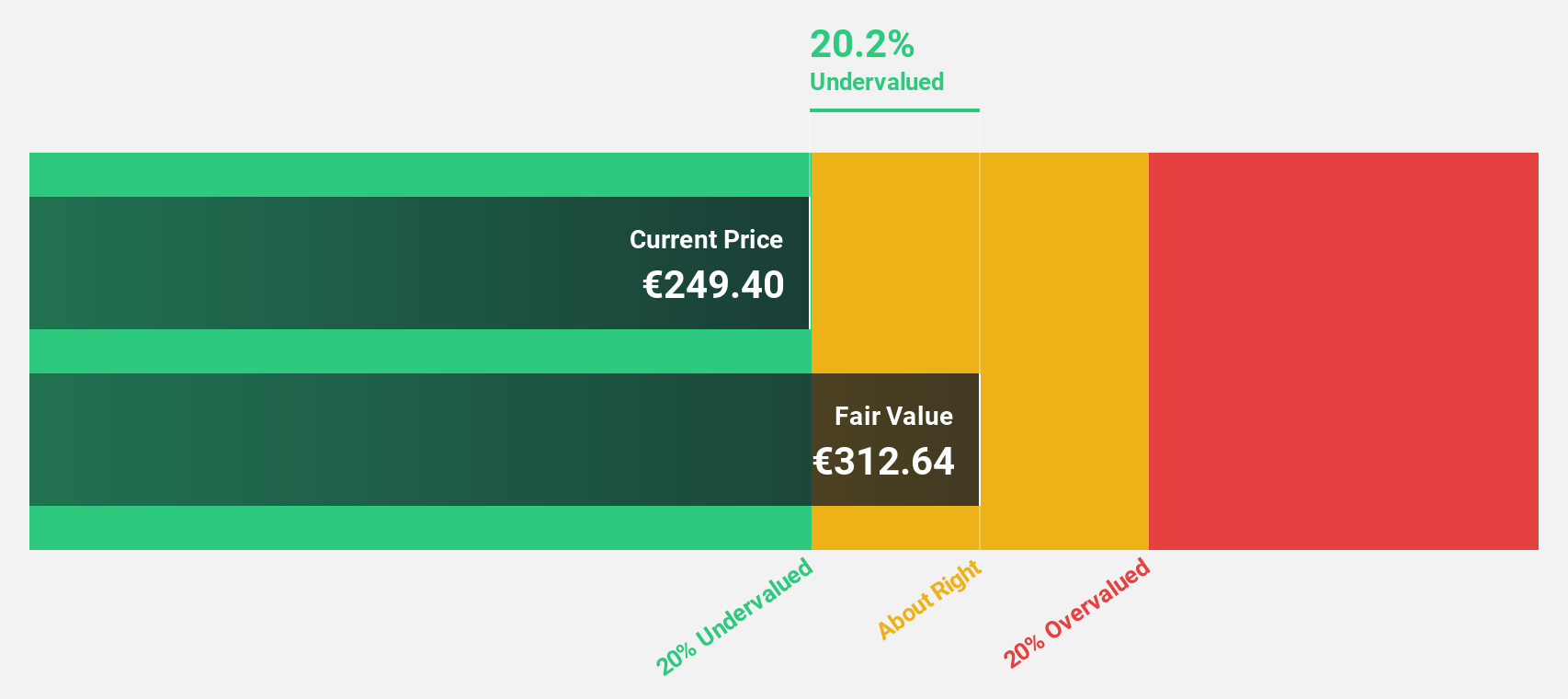

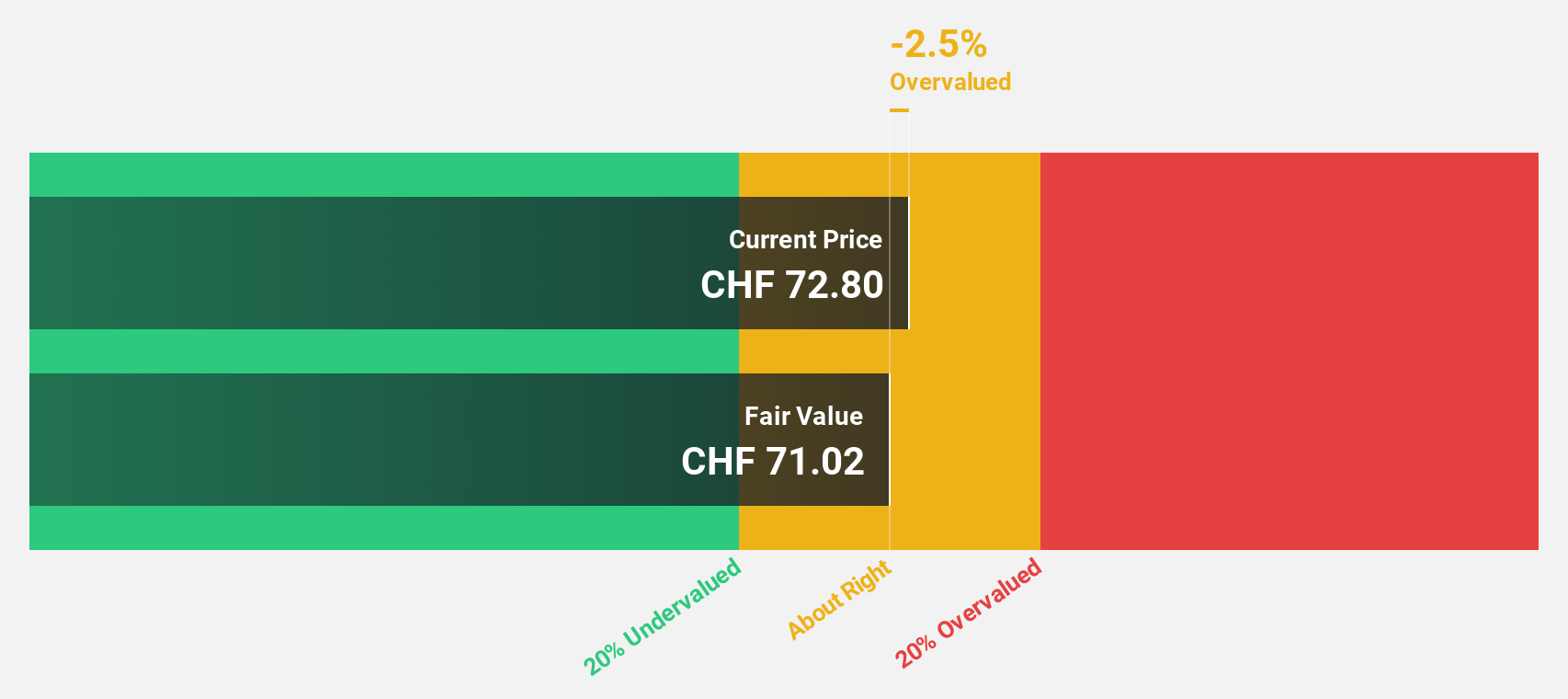

Estimated Discount To Fair Value: 18.9%

Zehnder Group is trading at CHF77.8, below its estimated fair value of CHF95.88, indicating potential undervaluation based on cash flows. The company confirmed steady revenue growth and an operating profit margin target for 2025, while seeking strategic bolt-on acquisitions to bolster its ventilation business and technological capabilities. Despite low forecasted return on equity, Zehnder's earnings are expected to grow significantly faster than the Swiss market average, although large one-off items affect financial results.

- In light of our recent growth report, it seems possible that Zehnder Group's financial performance will exceed current levels.

- Get an in-depth perspective on Zehnder Group's balance sheet by reading our health report here.

Allegro.eu (WSE:ALE)

Overview: Allegro.eu S.A. operates a commerce platform for consumers in Poland, the Czech Republic, and internationally, with a market cap of PLN32.17 billion.

Operations: The company generates revenue through its commerce platform operations across Poland, the Czech Republic, and internationally.

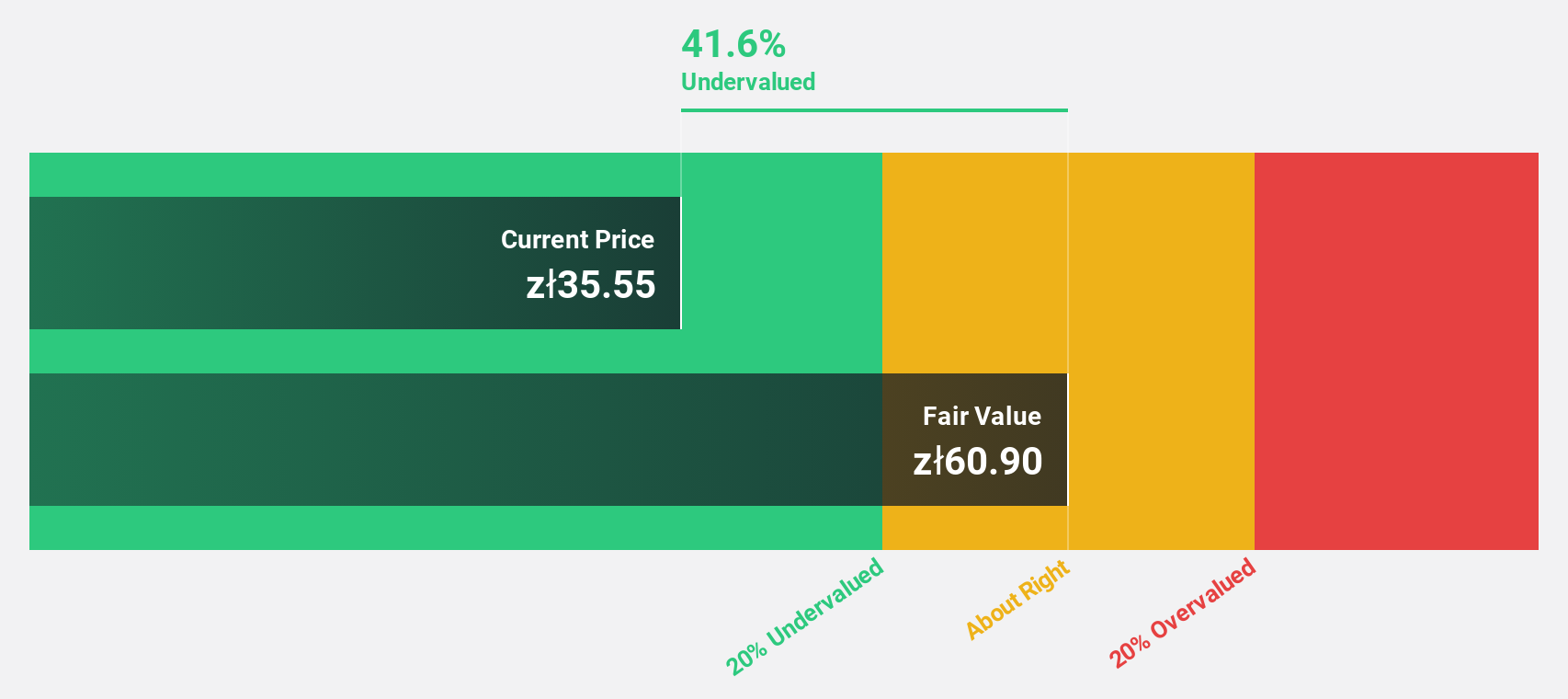

Estimated Discount To Fair Value: 47.8%

Allegro.eu is trading at PLN31.61, significantly below its estimated fair value of PLN60.51, suggesting it may be undervalued based on cash flows. The company reported robust earnings growth, with net income more than doubling year-over-year in Q3 2025 to PLN396.2 million. Despite revenue growth forecasts trailing earnings expectations, Allegro's strategic buyback of shares for PLN148.56 million and anticipated profit growth outpacing the Polish market highlight its strong financial positioning and potential for value appreciation.

- Our growth report here indicates Allegro.eu may be poised for an improving outlook.

- Take a closer look at Allegro.eu's balance sheet health here in our report.

Next Steps

- Click this link to deep-dive into the 195 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報