Evertz Technologies (TSX:ET) Q2: Strong Margins Reinforce Bullish Narrative On Discount Valuation

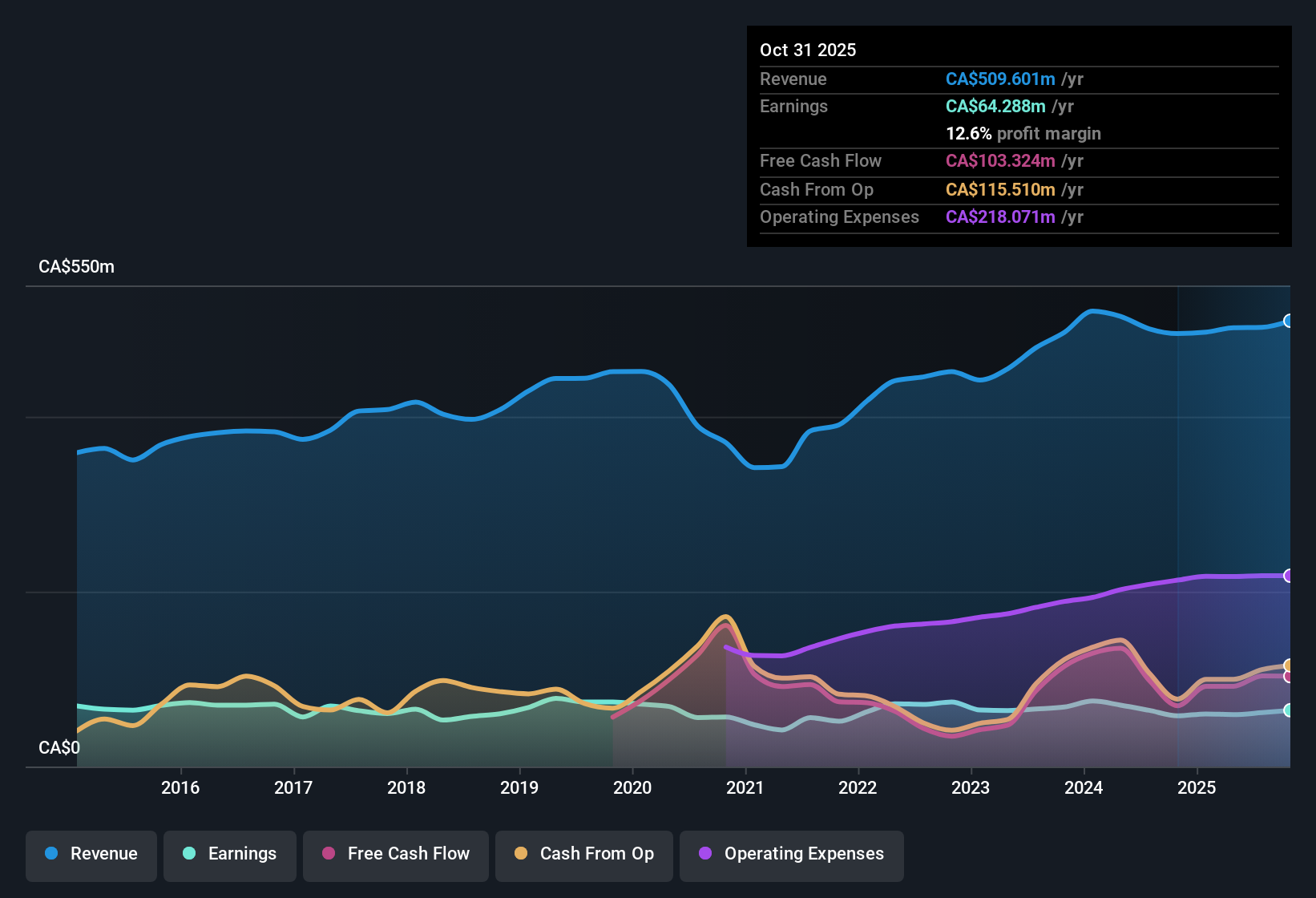

Evertz Technologies (TSX:ET) has just posted Q2 2026 results, reporting revenue of CA$132.7 million and basic EPS of CA$0.25, alongside trailing 12 month net income of CA$64.3 million supporting EPS of about CA$0.85. The company has seen quarterly revenue move from CA$125.3 million in Q2 2025 to CA$132.7 million this quarter, while trailing 12 month revenue has held around the CA$500 million mark. This gives investors a clearer view of how current EPS trends fit into the broader earnings run rate. With net profit margins sitting in the low teens over the last year, this earnings print presents Evertz as a consistently profitable operator heading into its next phase.

See our full analysis for Evertz Technologies.With the latest numbers on the table, the next step is to see how this performance lines up with the dominant narratives around Evertz, covering areas such as growth expectations and perceived risks in its earnings profile.

See what the community is saying about Evertz Technologies

Margins Hold Near 12.6 Percent

- Over the last 12 months, Evertz converted CA$509.6 million of revenue into CA$64.3 million of net income, giving a 12.6 percent net profit margin compared with 11.7 percent a year earlier.

- Consensus narrative highlights that a growing mix of software and services, now 44.4 percent of revenue and up 17.8 percent year over year, should support higher margins, yet:

- Trailing earnings growth of 10.9 percent in the last year versus a 3.4 percent five year annualized rate supports the bullish idea that software driven revenue is lifting profitability.

- At the same time, analysts still only expect earnings to grow about 2.6 percent annually, so the stronger recent margin performance has not translated into aggressive long term growth assumptions.

Valuation Screens Cheap Versus Peers

- With the share price at CA$14.80, the trailing P E of 17.4 times sits well below peers at 39.1 times and the wider industry at 30.7 times, and also below a DCF fair value of about CA$27.55 based on trailing fundamentals.

- From a consensus narrative angle, investors see rising demand for digital video infrastructure and a strong order backdrop as supporting this apparent discount, but there are trade offs:

- Revenue over the last 12 months was CA$509.6 million and is forecast to grow around 4.5 to 5.0 percent per year, which is slower than the Canadian market benchmark but still positive for a company trading at a discount multiple.

- Forecast net income is expected to move from roughly CA$59.4 million today toward CA$64.3 million by 2028, so the valuation case leans on steady but not rapid profit growth to close the gap to the DCF fair value.

Dividend Yield High, Coverage Tight

- The stock offers a 5.41 percent dividend yield, but that payout has been poorly covered by trailing 12 month earnings even as net profit margin has only recently reached 12.6 percent.

- Critics highlight a bearish risk that heavy cash returns are hard to sustain if growth slows, and the numbers give some support to that concern:

- Analysts expect earnings to grow just 2.6 percent per year, below the Canadian market reference of 12.4 percent, leaving less room for dividend increases without squeezing coverage further.

- Customer concentration is high, with the top 10 clients accounting for 44.7 percent of annual sales, meaning any hit to revenue would quickly pressure both earnings and the ability to fund a 5 plus percent yield from profits.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Evertz Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use your own lens on the latest figures and build a tailored view of Evertz in just a few minutes, Do it your way.

A great starting point for your Evertz Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Evertz pairs solid margins and an attractive yield with sluggish earnings growth, tight dividend coverage, and elevated customer concentration that could pressure future payouts.

If you want income that looks safer than this tight coverage, check out these 1931 dividend stocks with yields > 3% to focus on companies offering stronger, more sustainable dividend profiles right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報