Has the 78% 2025 Rally in Exact Sciences Already Priced In Its Cancer Screening Growth?

- If you are wondering whether Exact Sciences at around $101 a share is still a smart buy or if the easy money has already been made, you are not alone and that is exactly what we are going to unpack.

- The stock has climbed 50.2% over the last month and is up 78.1% year to date, while still carrying a 127.2% gain over 3 years despite being 25.5% lower than 5 years ago, a rollercoaster that clearly signals shifting views on its growth potential and risk.

- Much of that renewed enthusiasm has been tied to growing optimism around Exact Sciences role in cancer screening and diagnostics, including wider adoption of its flagship colorectal test and investor focus on its broader pipeline. At the same time, regulatory developments and competitive moves in the liquid biopsy and screening space have kept sentiment lively, with markets debating how much of that future opportunity is already reflected in today’s price.

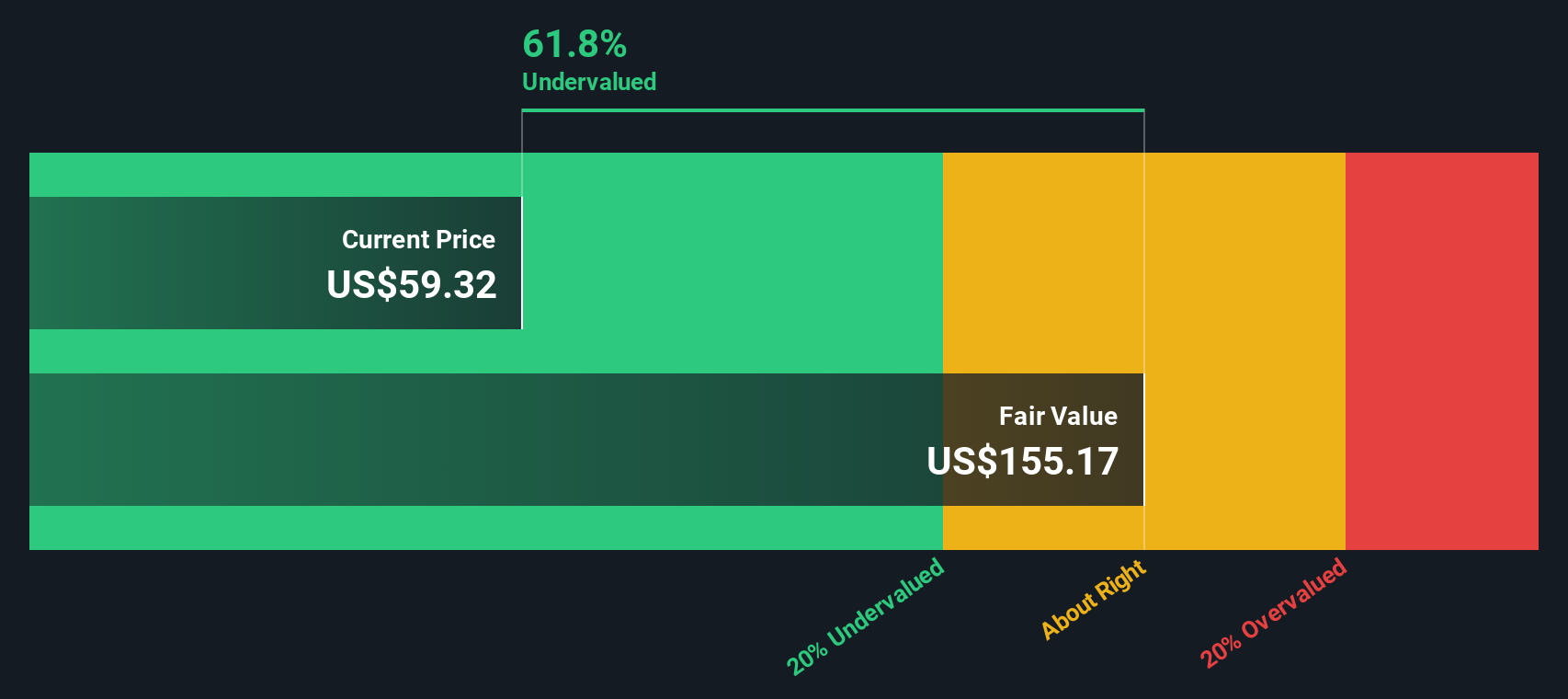

- On our checks, Exact Sciences scores a 4/6 valuation score, suggesting it looks undervalued on several fronts but not across the board. Next, we will break that down using different valuation approaches before circling back to a more nuanced way of thinking about its true worth.

Approach 1: Exact Sciences Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting its future cash flows and then discounting them back to today to reflect risk and the time value of money. For Exact Sciences, the model uses a 2 Stage Free Cash Flow to Equity approach.

The company generated trailing twelve month Free Cash Flow of about $222.4 million, with analysts expecting $78.0 million in FCF for 2024 as investment and growth spending fluctuate. Beyond the initial forecast years, Simply Wall St extrapolates growth, with projected FCF rising to roughly $1.31 billion by 2035 in dollar terms, reflecting expectations for a scaling diagnostics business.

Discounting this stream of cash flows back to today yields an estimated intrinsic value of $118.07 per share. Compared to the current share price of around $101, the model implies the stock is about 14.2% undervalued, indicating potential upside if these cash flow assumptions are broadly met.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Exact Sciences is undervalued by 14.2%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

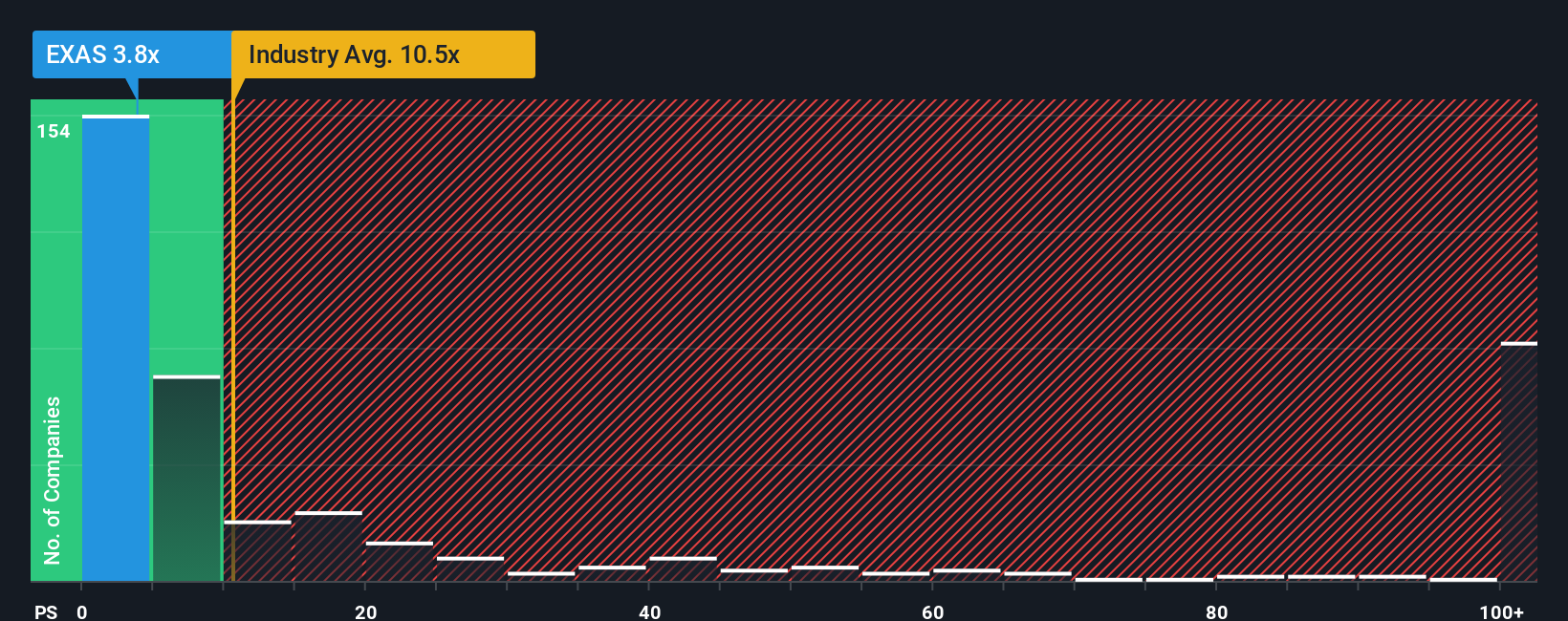

Approach 2: Exact Sciences Price vs Sales

For a business like Exact Sciences that is still scaling and not yet consistently profitable, the Price to Sales ratio is often the cleanest way to compare valuation, because revenue is less volatile and less affected by accounting choices than earnings.

In theory, faster growing and less risky companies deserve a higher multiple, while slower or riskier names warrant a discount, so what counts as a fair Price to Sales ratio will move with expectations for long term growth and margins.

Exact Sciences currently trades on a 6.24x Price to Sales multiple, below both the broader Biotechs industry average of 12.26x and the peer group average of 7.41x. Simply Wall St’s Fair Ratio framework estimates that, given Exact Sciences growth profile, industry, profit margins, market cap and risk characteristics, a more appropriate multiple would be around 6.93x. This company specific view is more informative than a simple peer or industry comparison, because it explicitly adjusts for what makes Exact Sciences different rather than treating all biotechs as interchangeable.

With the actual 6.24x multiple sitting below the 6.93x Fair Ratio, the shares screen as modestly undervalued on a revenue basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Exact Sciences Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Exact Sciences story with a financial forecast and a fair value estimate, rather than just relying on static ratios. A Narrative is your story behind the numbers, where you spell out what you expect for future revenue, earnings and margins, and then link that directly to what you think the shares are really worth. On Simply Wall St, Narratives live in the Community page, where millions of investors can quickly create, share and compare these story driven valuations, then see whether their Fair Value suggests EXAS is a buy, hold or sell versus the current price. Because Narratives on the platform update dynamically when new information like earnings, guidance or deal news arrives, your investment thesis evolves automatically with the facts. For Exact Sciences, one investor might build a bullish Narrative around accelerating cancer screening adoption and margin expansion that supports a fair value well above the current price, while another might focus on competitive and execution risks, resulting in a much lower fair value and a more cautious stance.

Do you think there's more to the story for Exact Sciences? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報