Burlington (BURL) Valuation Check After Boosted 2026 Store Expansion Target and Joann Lease Opportunity

Burlington Stores (BURL) is getting fresh attention after management nudged its 2026 expansion plans higher, lifting the target to 110 net new stores, supported by 45 leases picked up from Joann Fabrics’ bankruptcy.

See our latest analysis for Burlington Stores.

The expansion news lands at a mixed moment for the stock, with a recent 7 day share price return of 4.9% helping to offset a weaker year to date share price return and a modestly negative 1 year total shareholder return. At the same time, the 3 year total shareholder return above 40% still points to a longer term growth story that investors have largely been rewarded for sticking with.

If Burlington’s growth plans have caught your eye but you want to see what else is building momentum in retail and beyond, now could be a good time to explore fast growing stocks with high insider ownership.

With the shares trading at a roughly 25% discount to analyst targets despite solid margin progress and an ambitious store rollout, is Burlington a mispriced off price opportunity, or is the market already baking in that growth?

Most Popular Narrative: 19.9% Undervalued

With Burlington Stores’ fair value in the narrative set meaningfully above the recent close, the story leans on sustained growth and margin expansion to justify the gap.

Ongoing investments in automation (such as the new West Coast distribution center) and enhanced inventory management through reserve buying and supply chain initiatives allow Burlington to improve merchandise margins and achieve operating leverage, supporting long-term earnings growth.

Want to see the math behind this confidence? The narrative quietly leans on accelerating earnings power, rising margins, and a richer future multiple. Curious which assumptions really move that fair value line?

Result: Fair Value of $336.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer comps and Burlington’s heavy reliance on aggressive store expansion could quickly expose its margins if consumer demand or traffic weakens.

Find out about the key risks to this Burlington Stores narrative.

Another Lens on Value

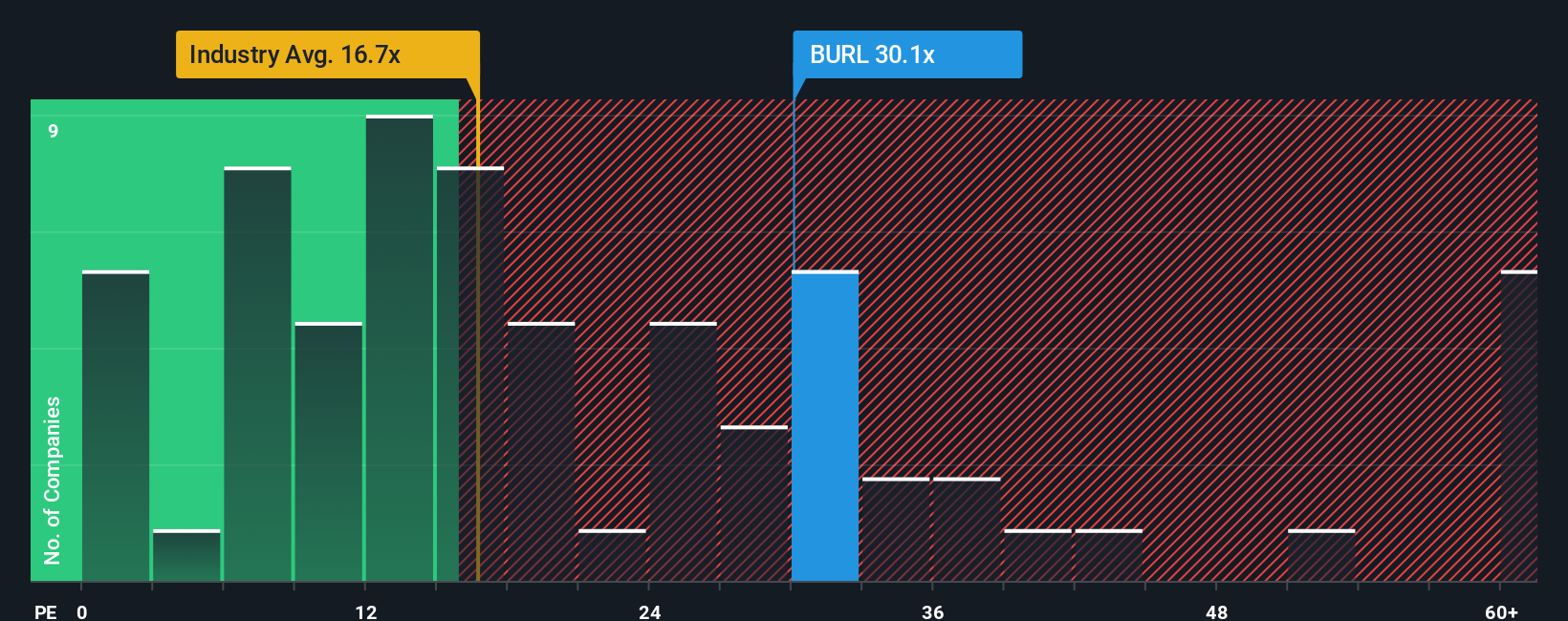

On earnings, Burlington looks richly priced, trading on a price to earnings ratio of 29.9 times versus 19.7 times for the US Specialty Retail industry and 16.7 times for close peers, and even above a fair ratio of 21 times. Is this premium a reward for execution, or a valuation risk if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Burlington Stores Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can build a custom view in minutes, Do it your way.

A great starting point for your Burlington Stores research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few fresh watchlist candidates using the Simply Wall St Screener so you are not chasing the market later.

- Capture potential turnaround opportunities by scanning these 3609 penny stocks with strong financials that already back their low prices with real financial strength.

- Explore the next wave of innovation by targeting these 25 AI penny stocks that may benefit as artificial intelligence reshapes entire industries.

- Find value focused candidates with these 905 undervalued stocks based on cash flows that trade at meaningful discounts to their cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報