Praxis Precision Medicines (PRAX): Revisiting Valuation After Major FDA Progress and Positive CNS Trial Updates

Praxis Precision Medicines (PRAX) just checked several big regulatory boxes, with the FDA signaling a path toward New Drug Applications for relutrigine and ulixacaltamide while elsunersen’s EMBRAVE3 trial shifts into a faster single arm design.

See our latest analysis for Praxis Precision Medicines.

Those rapid fire regulatory wins have gone hand in hand with a powerful rerating, with Praxis posting a roughly 609% 3 month share price return and a 627% 3 year total shareholder return, suggesting momentum is clearly building around its CNS pipeline.

If you are looking beyond Praxis for what else could surprise to the upside in neurology and rare disease, this is a good moment to explore healthcare stocks.

With shares already up more than sixfold and analysts racing to lift price targets, does Praxis still offer mispriced optionality around its epilepsy and tremor pipeline, or is the market already discounting years of future growth?

Price-to-Book of 19.5x: Is it justified?

Praxis’s last close at $267.28 translates into a steep 19.5x price to book multiple, signaling that investors are paying a rich premium versus peers.

The price to book ratio compares a company’s market value with its net assets on the balance sheet, a common yardstick for asset light, R&D heavy biotechs. A 19.5x reading implies the market is assigning substantial value to Praxis’s future CNS pipeline cash flows despite its currently negative earnings and equity returns.

Given that Praxis is still unprofitable with a negative return on equity today and only forecast to reach modestly positive ROE in three years, such a lofty multiple suggests investors are front loading expectations for rapid revenue and earnings inflection. While our DCF work points to deep upside potential, the market is clearly already pricing in a sizeable share of those long dated growth assumptions via this elevated book value multiple.

Compared with the broader US biotech industry average of about 2.7x price to book and an already elevated 12x for close peers, Praxis’s 19.5x stands out as aggressively higher. This gap underscores how far sentiment has raced ahead of the sector norm, and signals that any disappointment around trial timelines or uptake could prompt a sharp reset from these premium valuation levels.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 19.5x (OVERVALUED).

However, setbacks in late stage CNS trials or slower than expected commercial uptake could quickly deflate sentiment and challenge today’s premium valuation.

Find out about the key risks to this Praxis Precision Medicines narrative.

Another Way to Look at Value

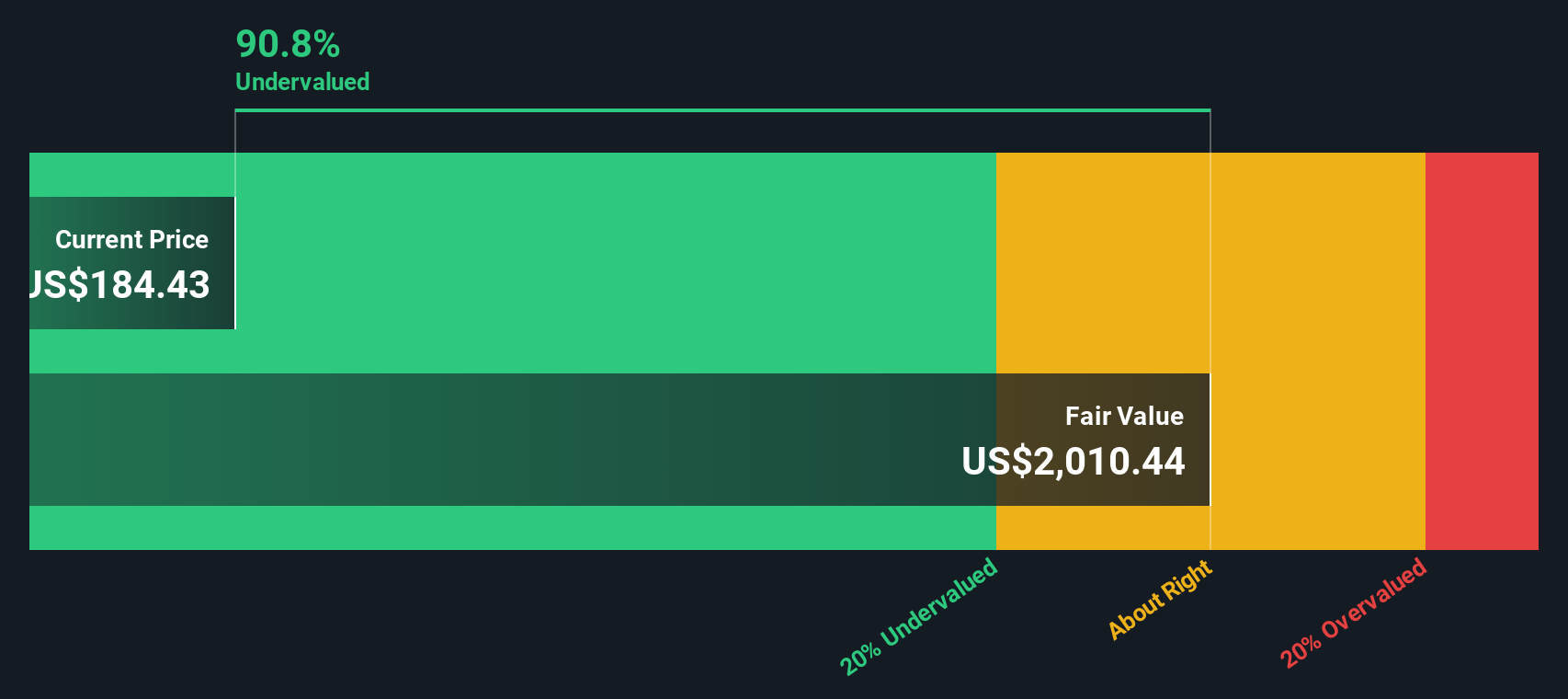

While Praxis looks expensive on a 19.5x price to book basis, our DCF model paints the opposite picture, suggesting shares trade about 89% below an estimated fair value of roughly $2,518. That kind of gap can signal either a major opportunity or very optimistic long term assumptions. Which is it?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Praxis Precision Medicines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Praxis Precision Medicines Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized narrative in just minutes: Do it your way.

A great starting point for your Praxis Precision Medicines research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Praxis might be your headline story today, but do not leave potential gains on the table when Simply Wall Street can surface other powerful opportunities tailored to your style.

- Capture potential multi baggers early by scanning these 3609 penny stocks with strong financials that already back their tiny share prices with surprisingly resilient fundamentals.

- Ride the next wave of automation by targeting these 30 healthcare AI stocks where data, diagnostics, and drug development meet in high growth, high impact businesses.

- Review these 12 dividend stocks with yields > 3% that combine meaningful yields with balance sheet strength that may help support long term payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報