BWP Trust (ASX:BWP): Valuation Check After Upgraded Half-Year Distribution Guidance

BWP Trust (ASX:BWP) has just guided to a higher half year payout, flagging a preliminary distribution of 9.58 cents per stapled security, up about 4% on the prior period.

See our latest analysis for BWP Trust.

The upbeat distribution guidance has landed against a supportive backdrop, with the share price at A$3.93 and an 18.73% year to date share price return pointing to rebuilding momentum, while the 1 year total shareholder return of 24.92% underlines how income plus modest growth has rewarded patient holders.

If this kind of income backed recovery appeals, it could be worth broadening your search and exploring fast growing stocks with high insider ownership as a source of new ideas beyond property trusts.

Yet with the units now trading just above consensus targets, but still screening attractively on intrinsic value metrics, investors face a key question: is BWP Trust a yield backed bargain or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 2% Overvalued

With BWP Trust closing at A$3.93 against a narrative fair value of about A$3.86, expectations are finely balanced around modest long term growth and compressed margins.

The surge in capital expenditure for property repurposing and upgrades (peaking at 4x historic levels in FY26) is likely to compress net margins in the short to medium term, as increased outflows are only gradually offset by future rental uplifts, putting earnings growth at risk if market rents or leasing demand underperform.

Curious why a mature retail REIT might warrant a future earnings multiple usually reserved for faster growing sectors? The narrative hinges on steady revenue, thinner margins, and a bold rerating of profit quality. Want to see which precise assumptions have to fall into place to justify that valuation path?

Result: Fair Value of $3.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if BWP keeps extending leases on attractive terms and its redevelopment pipeline delivers strong IRRs, today’s cautious valuation narrative could quickly change.

Find out about the key risks to this BWP Trust narrative.

Another View: Market Ratios Point to Undervaluation

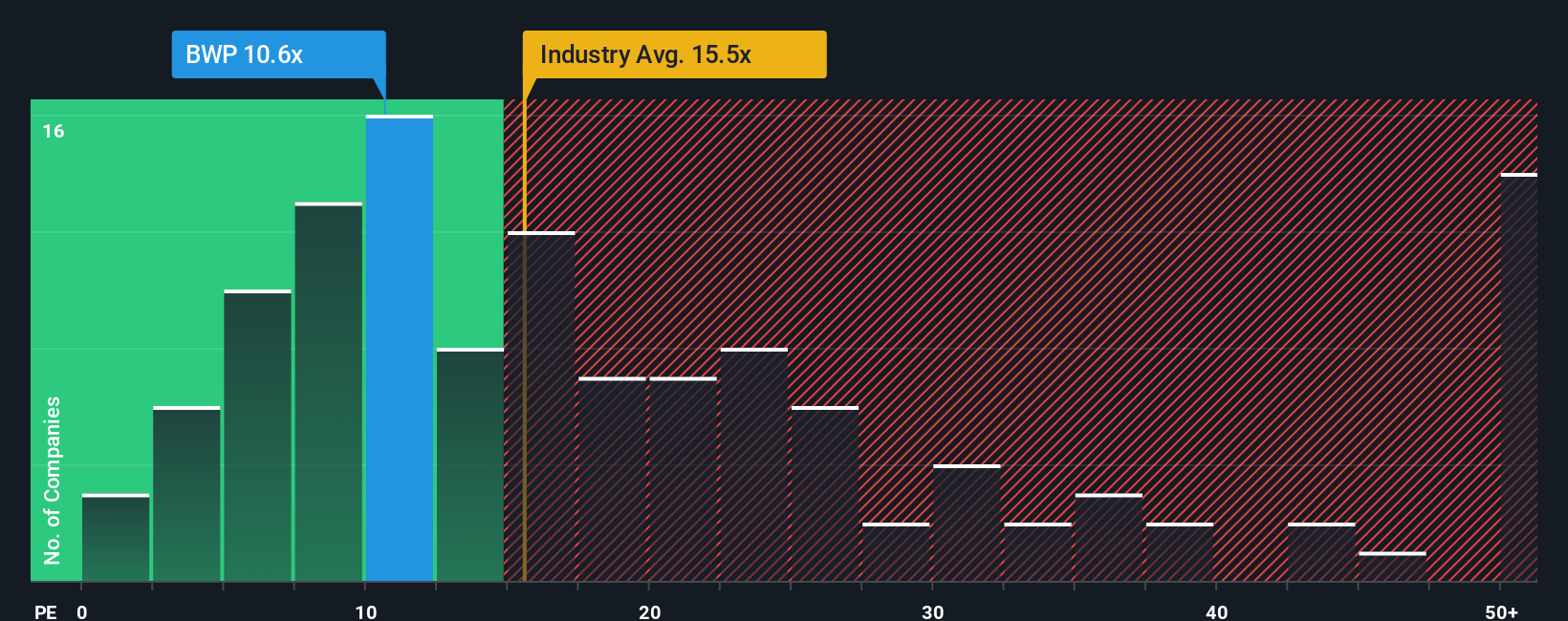

While the narrative fair value suggests BWP Trust is slightly overvalued, its current price to earnings ratio of 10.6 times looks low compared with peers at 11.3 times, the wider retail REITs industry at 15.5 times, and a fair ratio of 16.3 times. This may indicate potential upside if sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BWP Trust Narrative

If you want to dig into the numbers yourself and shape a different story, you can build a full narrative in just minutes, Do it your way.

A great starting point for your BWP Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you only stick with BWP, you could miss stronger opportunities, so take a moment to scan fresh ideas that match your goals and risk profile.

- Capture early-stage momentum by reviewing these 3609 penny stocks with strong financials that pair tiny market caps with improving fundamentals and the potential for outsized long term gains.

- Strengthen your portfolio’s income engine by scanning these 12 dividend stocks with yields > 3% offering reliable cash returns that can cushion volatility and compound your wealth over time.

- Position yourself ahead of structural change by assessing these 27 quantum computing stocks at the forefront of computing breakthroughs that could reshape multiple industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報