Middle Eastern Penny Stocks With Market Caps Up To US$700M

As the U.S. Federal Reserve's recent interest rate cut reverberates through global markets, most Gulf markets have shown gains, reflecting a cautiously optimistic outlook despite ongoing economic uncertainties. In this context, investing in penny stocks—though a somewhat outdated term—remains a viable strategy for those interested in smaller or newer companies that may offer growth opportunities. By focusing on stocks with solid financial health and potential for stability, investors can explore options that might provide both value and long-term potential within the Middle Eastern market landscape.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.35 | SAR1.34B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.506 | ₪179.67M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.04 | AED2.1B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.60 | AED745.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.80 | AED323.4M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.71 | AED15.73B | ✅ 2 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.842 | AED2.42B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.84 | AED510.93M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.585 | ₪202.92M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Al Dhafra Insurance Company P.S.C (ADX:DHAFRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Al Dhafra Insurance Company P.S.C. operates in the insurance and reinsurance sectors across the United Arab Emirates, other GCC countries, and internationally, with a market cap of AED486 million.

Operations: The company generates revenue through two primary segments: Investments, contributing AED52.53 million, and Underwriting, accounting for AED78.75 million.

Market Cap: AED486M

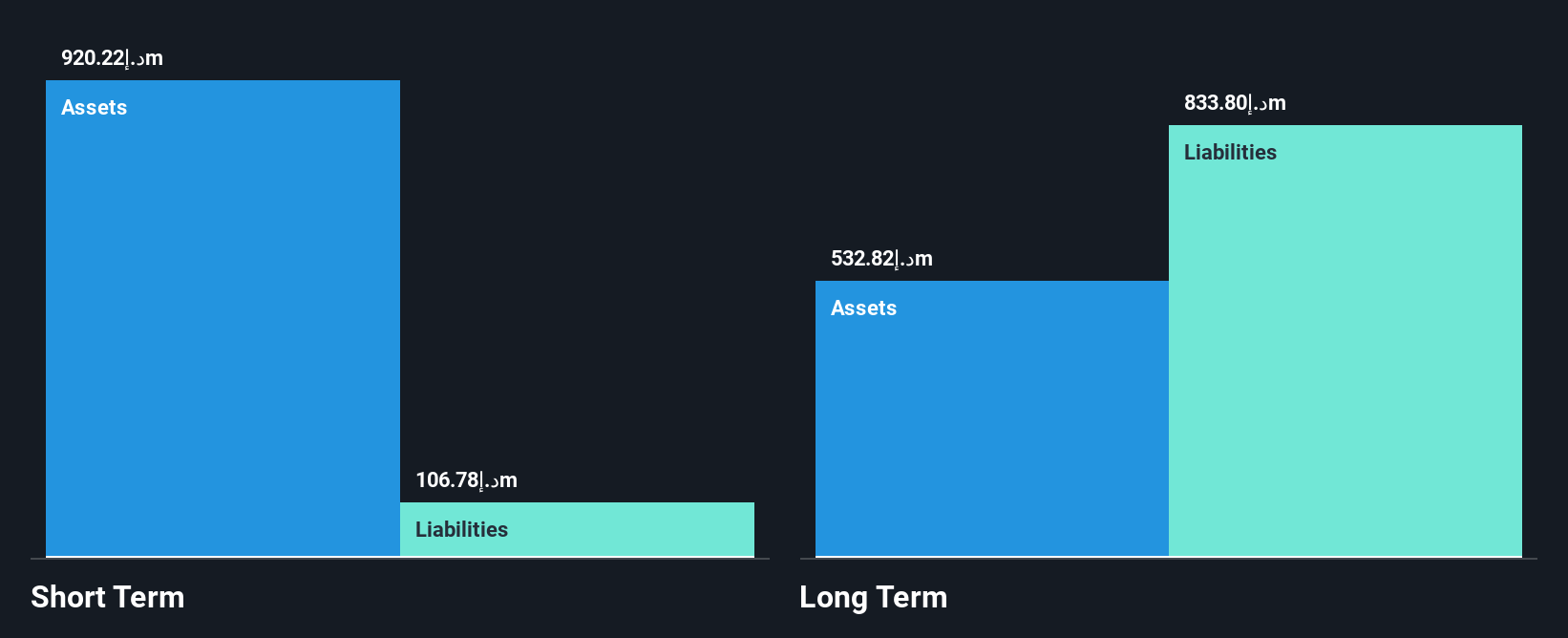

Al Dhafra Insurance Company P.S.C. has shown resilience with a market cap of AED486 million and a solid asset base, as its short-term assets significantly exceed both short- and long-term liabilities. Despite no debt, the company's return on equity remains low at 7.1%, indicating room for improvement in profitability metrics. Recent earnings results revealed net income of AED7.72 million for Q3 2025, down from AED9.49 million the previous year, though nine-month figures show modest growth compared to last year. The dividend yield of 7.2% is not well covered by free cash flows, suggesting potential sustainability concerns.

- Take a closer look at Al Dhafra Insurance Company P.S.C's potential here in our financial health report.

- Explore historical data to track Al Dhafra Insurance Company P.S.C's performance over time in our past results report.

Finance House P.J.S.C (ADX:FH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Finance House P.J.S.C. operates in the United Arab Emirates, offering investment, consumer and commercial financing services with a market cap of AED593.06 million.

Operations: The company's revenue is primarily derived from commercial and retail financing at AED102.12 million, followed by investment activities generating AED11.01 million, and insurance services contributing AED4.46 million.

Market Cap: AED593.06M

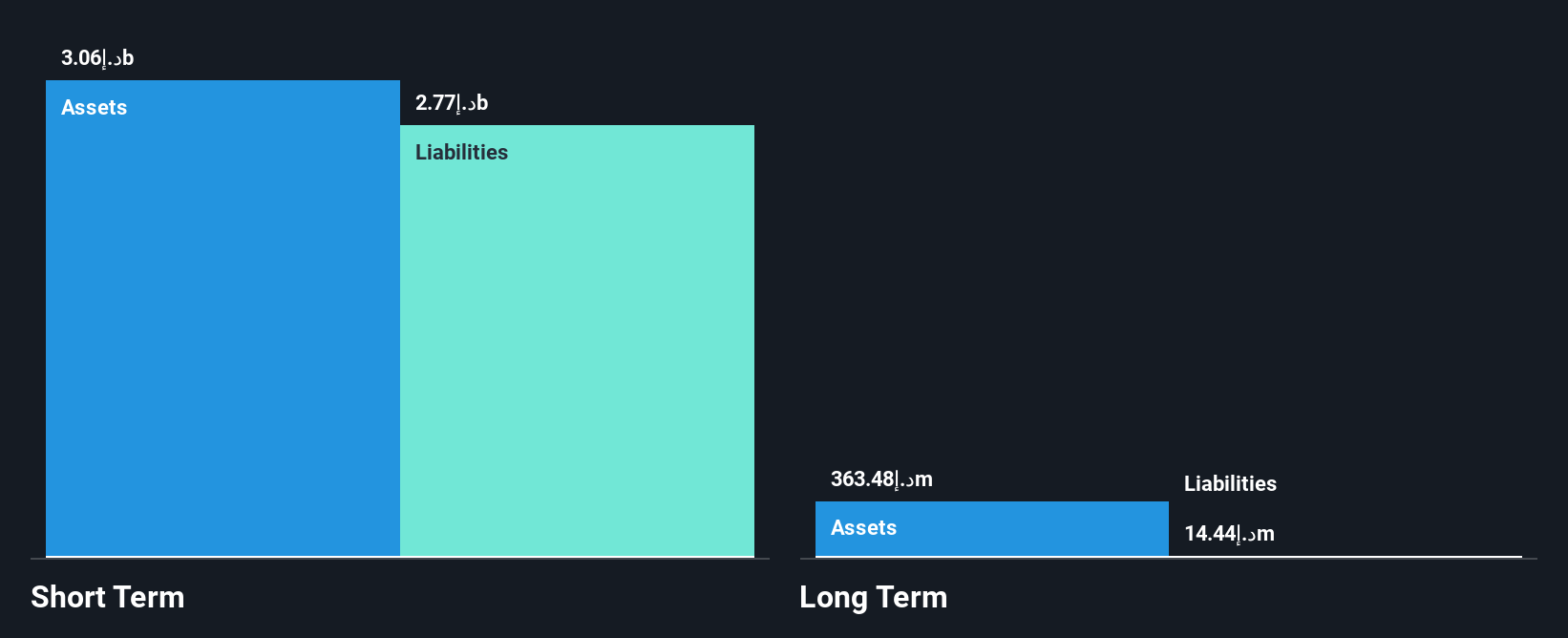

Finance House P.J.S.C., with a market cap of AED593.06 million, is unprofitable but has consistently reduced losses over the past five years by 32.1% annually. The company’s short-term assets of AED3.1 billion comfortably cover both its long-term liabilities and short-term obligations, reflecting strong liquidity management. Despite a negative return on equity at 3.05%, Finance House's debt is well covered by operating cash flow, and it holds more cash than total debt, indicating financial stability amidst challenges in profitability. Recent earnings show a decline in quarterly net income to AED2.03 million from AED9.1 million year-over-year, though nine-month results improved slightly to AED10.96 million compared to last year’s figures.

- Navigate through the intricacies of Finance House P.J.S.C with our comprehensive balance sheet health report here.

- Understand Finance House P.J.S.C's track record by examining our performance history report.

Union Properties (DFM:UPP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Union Properties Public Joint Stock Company focuses on property investment and development, with a market cap of AED2.42 billion.

Operations: The company's revenue is primarily derived from its Goods and Services segment, contributing AED483.65 million, followed by Real Estate and Others at AED73.69 million, and Contracting at AED54.82 million.

Market Cap: AED2.42B

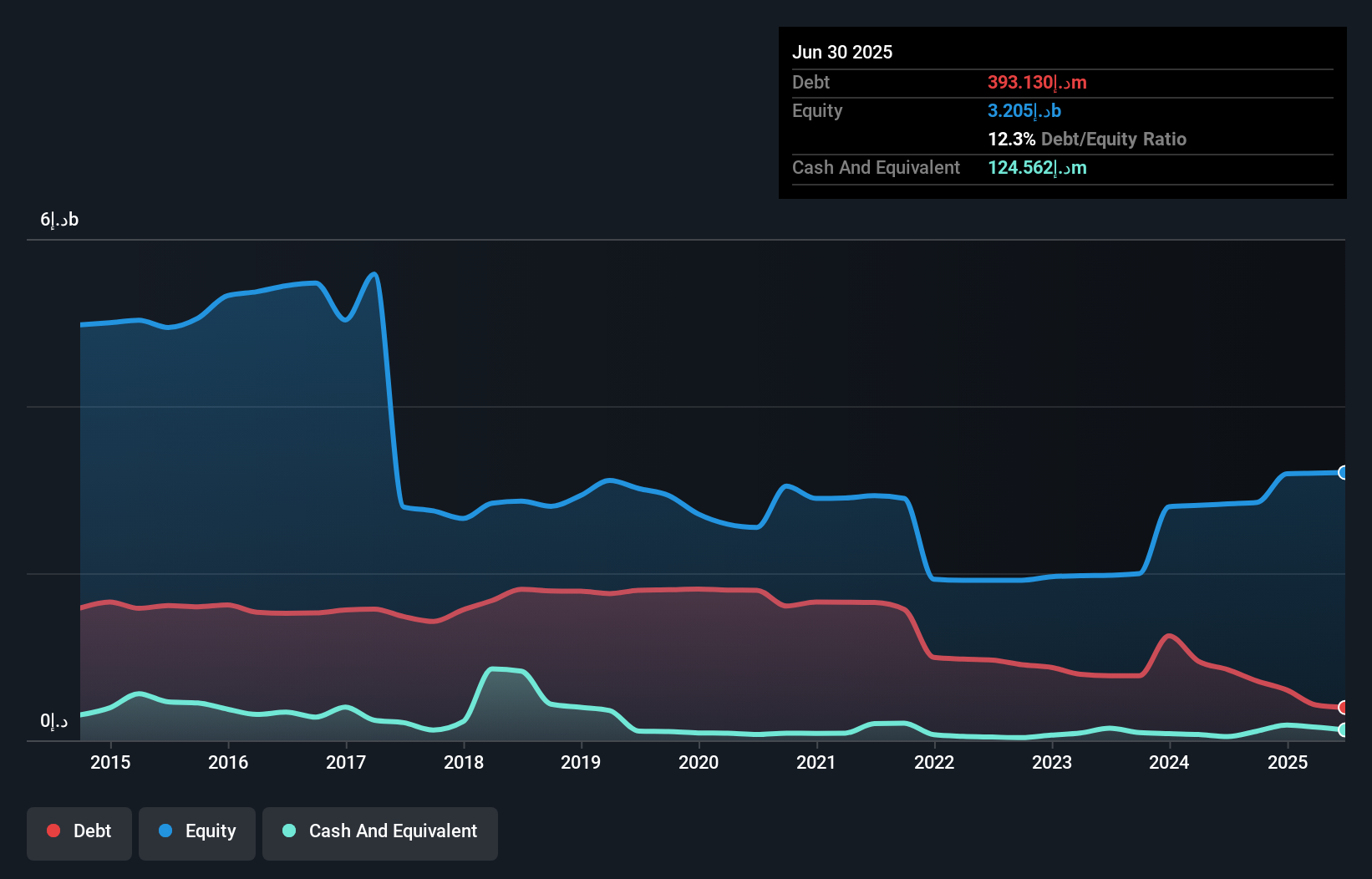

Union Properties, with a market cap of AED2.42 billion, has shown significant improvement in its financial health by reducing its debt-to-equity ratio from 52.8% to 9.9% over five years and maintaining more cash than total debt. Despite a low return on equity of 10.9%, the company's short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management. Recent earnings reveal substantial growth in net income for Q3 2025 to AED124.67 million from AED18.37 million year-over-year, although past earnings were impacted by large one-off gains, suggesting caution when evaluating profitability trends.

- Get an in-depth perspective on Union Properties' performance by reading our balance sheet health report here.

- Gain insights into Union Properties' outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Click through to start exploring the rest of the 75 Middle Eastern Penny Stocks now.

- Interested In Other Possibilities? We've found 12 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報