Can Organon’s Steep 2025 Share Price Slide Signal a Long Term Opportunity?

- Wondering if Organon at around $7 is a deep value opportunity or a value trap? You are not alone. This stock has quietly slipped onto a lot of bargain hunters' watchlists.

- Despite being down about 50.8% year to date and over the last 12 months, the share price has shown some short term resilience, with a 3.1% gain over the past week even after a soft 30 day move of -2.1%.

- Much of this volatility has been driven by shifting sentiment around its women’s health and biosimilars portfolio, as investors reassess the long term cash flow potential of these franchises. At the same time, debt levels, capital allocation choices and ongoing separation overhang from its spin off context continue to frame the risk narrative around the stock.

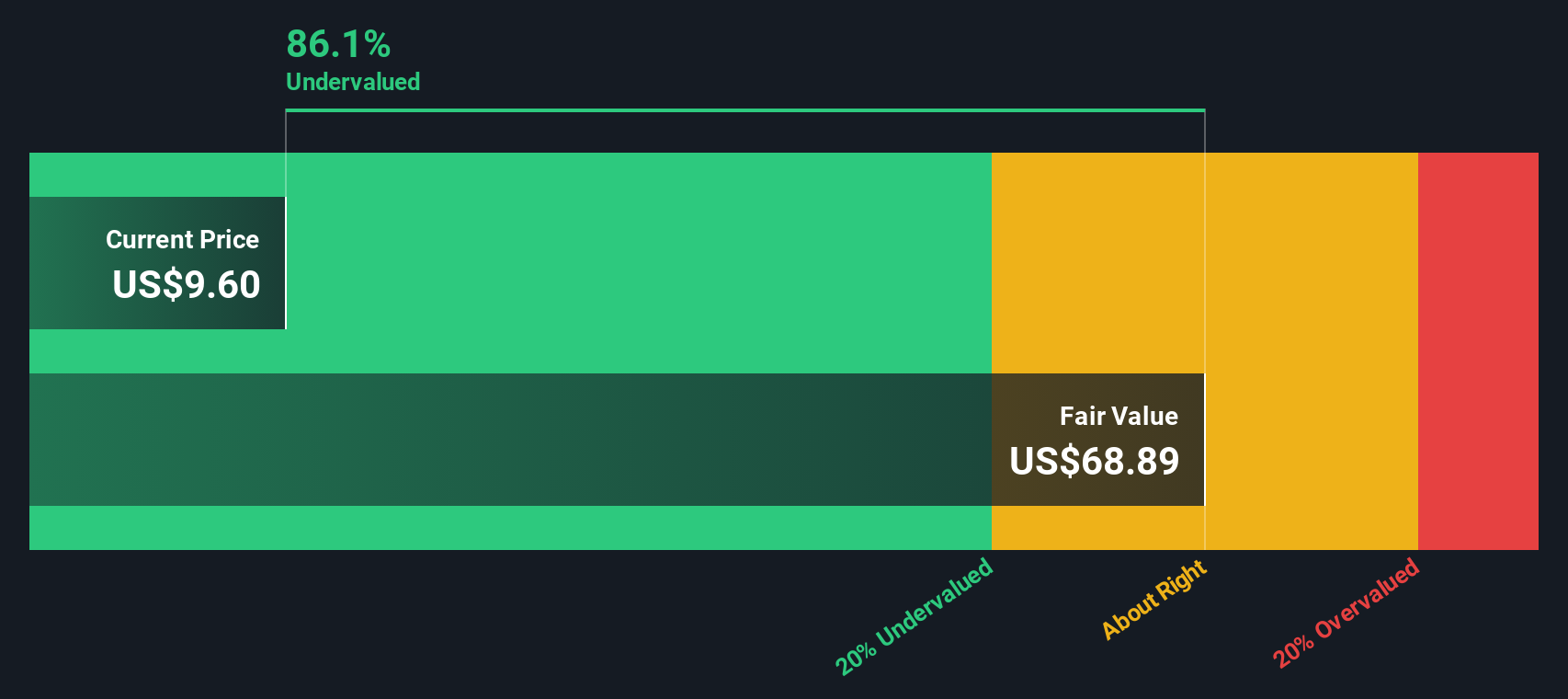

- On our checklist of 6 valuation tests, Organon scores a solid 5 out of 6, which strongly hints at undervaluation. Next we will walk through the main valuation approaches that point to this gap, and then finish with a more intuitive way to think about what the stock is really worth.

Find out why Organon's -50.8% return over the last year is lagging behind its peers.

Approach 1: Organon Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a stock should be worth by projecting the company’s future cash flows and then discounting them back to today’s dollars. For Organon, this 2 Stage Free Cash Flow to Equity model starts with last twelve months free cash flow of about $639 million and builds forward.

Analysts see free cash flow climbing toward roughly $1.28 billion by 2029, with Simply Wall St extending those forecasts out to 2035, gradually moderating growth as the business matures. All of these projected cash flows, expressed in $, are discounted back to present value to arrive at an estimated fair value per share.

On this basis, the DCF model suggests an intrinsic value of about $65.36 per share, implying the stock trades at an 88.7% discount to this estimate of fair value. In other words, the current market price reflects barely more than a tenth of the value implied by long term cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Organon is undervalued by 88.7%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

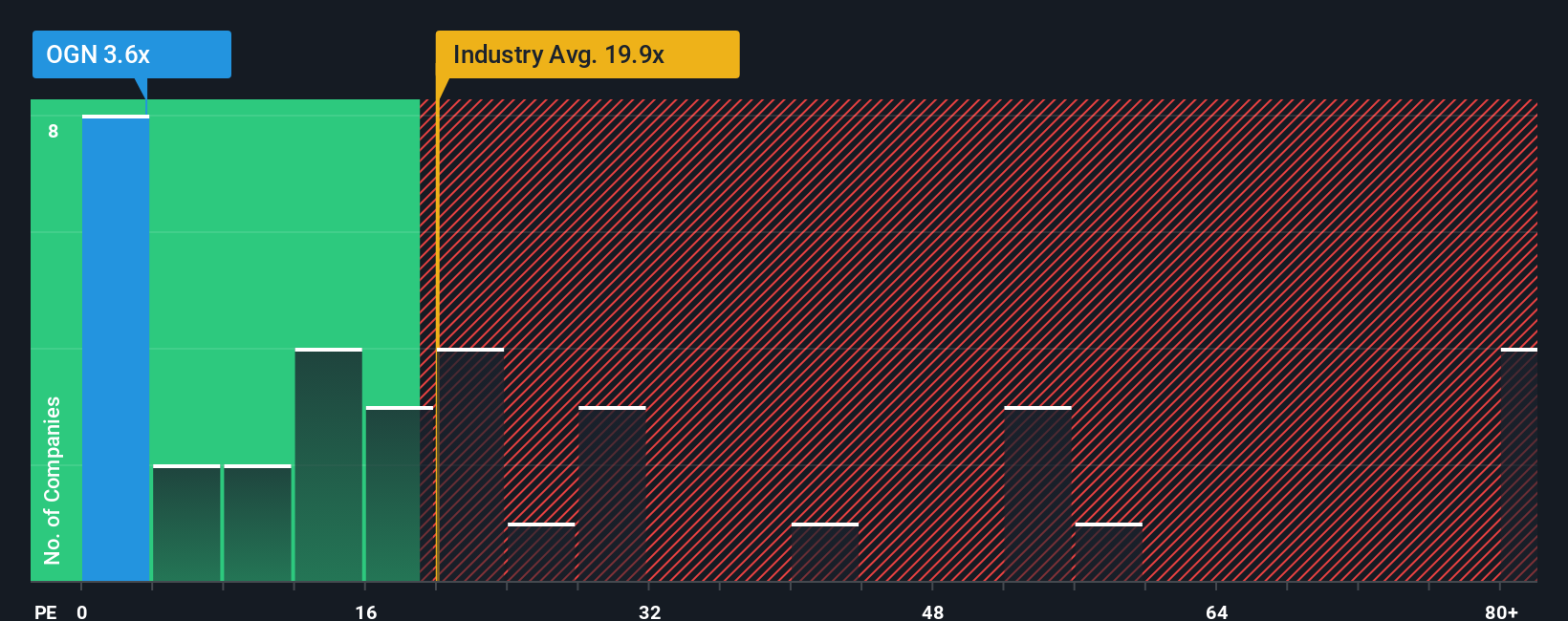

Approach 2: Organon Price vs Earnings

For profitable companies like Organon, the price to earnings, or PE, ratio is a practical way to gauge value because it links what investors pay today to the actual profits the business is generating. A higher PE can be justified when a company has strong growth prospects and relatively low risk, while slower growth or higher uncertainty usually warrants a lower, more conservative multiple.

Organon currently trades on a PE of about 3.8x, which is dramatically below both the Pharmaceuticals industry average of roughly 19.7x and the broader peer group average of around 14.6x. Simply Wall St goes a step further by estimating a Fair Ratio of 20.8x, its proprietary view of what a normal PE should be for Organon given its earnings growth outlook, margins, industry positioning, size and risk profile.

This Fair Ratio framework is more tailored than a simple peer or industry comparison because it systematically adjusts for the company’s specific fundamentals and risk characteristics, rather than assuming all drug makers deserve the same multiple. When Organon’s current 3.8x PE is compared to the 20.8x Fair Ratio, the stock appears significantly undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Organon Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Organon’s story to hard numbers like future revenue, earnings, margins and, ultimately, a fair value estimate. A Narrative on Simply Wall St is your personal storyline for a company, where you spell out why you think things like new leadership, biosimilar launches or governance risks will shape Organon’s future, then link that story to a financial forecast and a fair value that you can directly compare to today’s share price. Narratives live inside the Community page on Simply Wall St, where millions of investors can quickly build or browse them, and they update dynamically as fresh information like earnings results, FDA decisions or guidance changes comes in. For Organon, one investor might build a bullish Narrative around expanding biosimilars and improving margins that supports a fair value close to the high analyst target of $18, while a more cautious investor might focus on legacy product dependence and governance concerns and land nearer the low target of $9, using those different fair values versus the current price to decide whether to buy, hold or sell.

Do you think there's more to the story for Organon? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報