Keurig Dr Pepper (KDP): Assessing Valuation After Recent Share Price Momentum

Keurig Dr Pepper (KDP) has been quietly grinding higher, with the stock up about 10% over the past month and 8% in the past 3 months, even as its year to date return remains negative.

See our latest analysis for Keurig Dr Pepper.

That recent 30 day share price momentum of just over 10% is starting to chip away at a tougher year to date patch, even though the one year total shareholder return is still slightly negative. This suggests sentiment may be cautiously turning as investors reassess growth and valuation.

If this steady grind in beverages has you thinking about other corners of the market, it could be a good time to explore fast growing stocks with high insider ownership.

With earnings still growing and the share price trading at a notable discount to analyst targets and intrinsic value estimates, is Keurig Dr Pepper quietly undervalued, or is the market already pricing in all of its future growth?

Most Popular Narrative Narrative: 15.2% Undervalued

At a last close of $29.47 against a narrative fair value near $34.73, Keurig Dr Pepper is framed as meaningfully mispriced, with future execution in focus.

The integration of GHOST Energy and the establishment of an energy platform with significant market share are expected to contribute to revenue growth, thanks to expanded distribution and solid partnerships. The adjustment of pricing strategies across segments, especially in U.S. Coffee, to manage inflation and tariff pressures, could help stabilize earnings by mitigating cost increases and enhancing price realization.

Curious how steady single digit sales growth, surging profits, and a lower future earnings multiple can still justify a premium to today’s price? The narrative reveals the full playbook driving that valuation call.

Result: Fair Value of $34.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn weakness in U.S. Coffee and potential margin pressure from new green coffee and brewer tariffs could quickly undermine this upbeat valuation case.

Find out about the key risks to this Keurig Dr Pepper narrative.

Another View: What Do The Earnings Ratios Say?

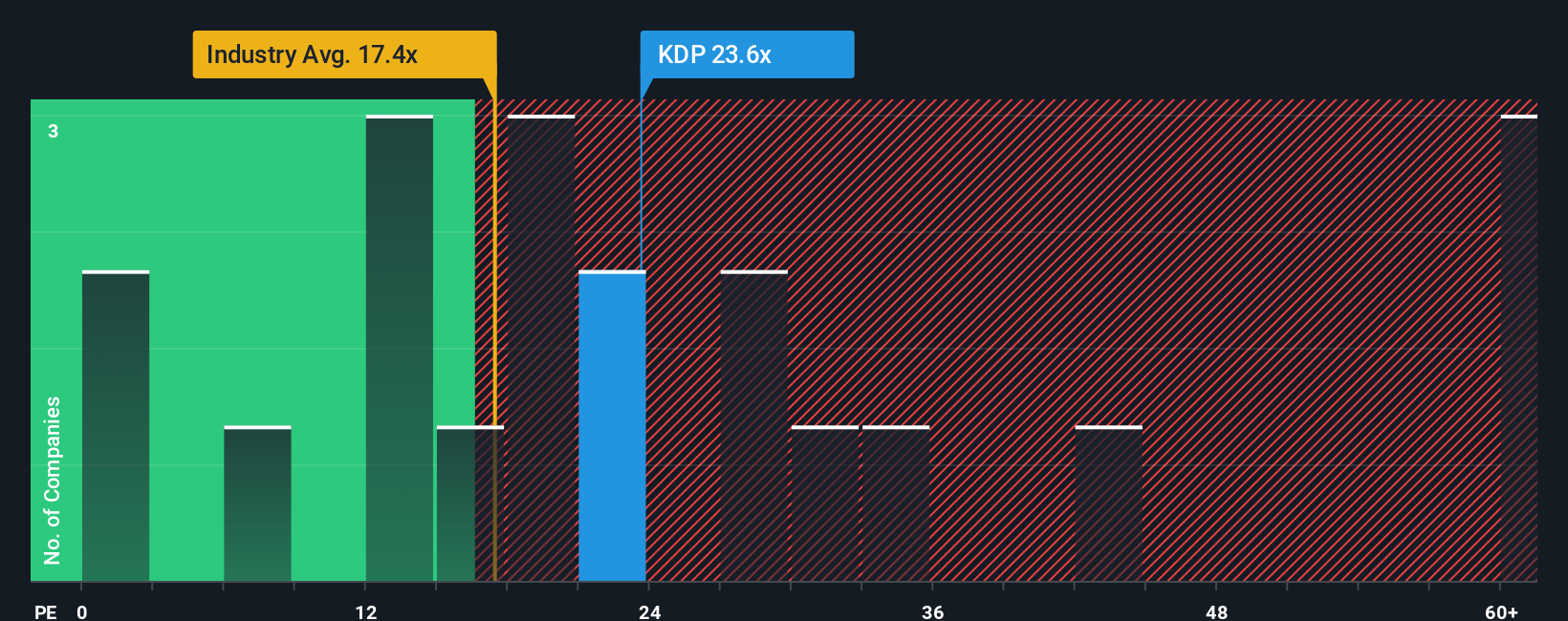

While narratives point to upside, the current price tells a sharper story. KDP trades on a 25.3x price to earnings ratio, richer than the global beverage sector at 17.6x but slightly cheaper than peers at 26.7x and below a fair ratio of 27.9x. This leaves investors weighing re rating potential against downside risk if sentiment sours.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Keurig Dr Pepper Narrative

If you are not fully convinced by this view or would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Keurig Dr Pepper research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you could miss other opportunities, so let Simply Wall St's powerful screener help you research additional candidates today.

- Explore potential income streams by scanning these 12 dividend stocks with yields > 3% that aim to keep cash flowing into your account over time.

- Focus on structural megatrends by targeting these 25 AI penny stocks positioned to benefit from advances in automation and intelligent software.

- Research the next wave of disruption by tracking these 80 cryptocurrency and blockchain stocks involved in payments, security, and digital ownership.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報