RedCloud Holdings (RCT) Revenue Surge Tests Bullish Growth Narrative Despite Deepening Losses

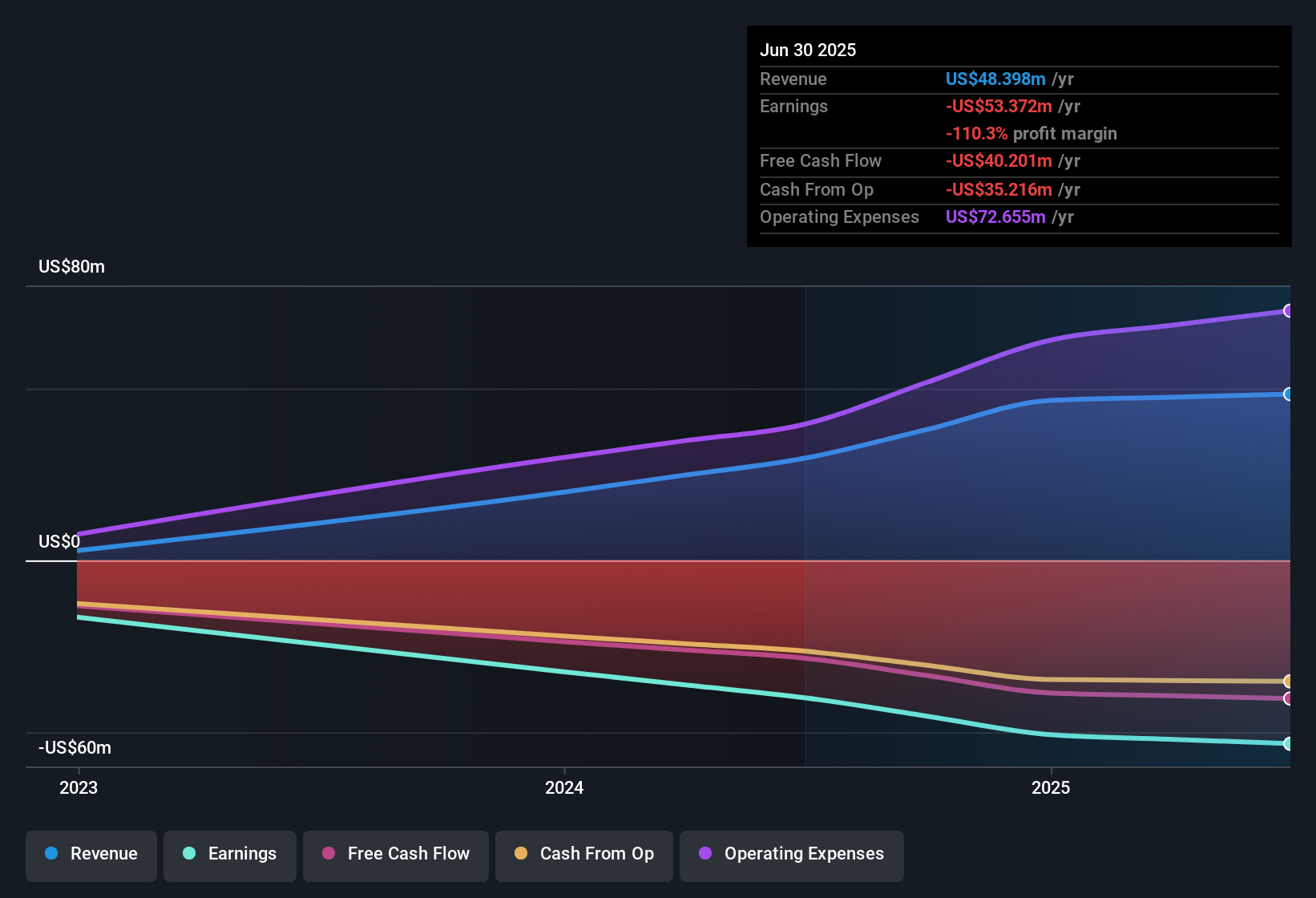

RedCloud Holdings (NasdaqCM:RCT) just posted its H1 2025 scorecard, with trailing twelve month revenue of about $48.4 million and a basic EPS of roughly -$1.76. This sets a clear backdrop of rapid top line expansion paired with ongoing losses. The company has seen revenue move from $13.6 million in H2 2023 to $16.1 million in H1 2024 and then $30.4 million in H2 2024. Over those same halves, EPS shifted from about -$4.20 to -$0.51 and then a much steeper -$17.85. That combination of fast growing sales and still pressured margins will be front of mind for investors trying to gauge how durable the growth story really is.

See our full analysis for RedCloud Holdings.With the latest numbers on the table, the next step is to compare them with the dominant narratives around RedCloud, highlighting where the growth story holds up and where persistent margin pressure raises harder questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

62.9% revenue growth versus lingering heavy losses

- Over the last 12 months, revenue rose 62.9% to about $48.4 million, while trailing net income stayed deeply negative at roughly $53.4 million.

- What stands out against the generally bullish growth story is how revenue expansion still sits beside large losses:

- In the last three reported halves, revenue climbed from $13.6 million to $16.1 million and then $30.4 million, yet net income stayed negative in each period, between about $16.1 million and $26.8 million in losses.

- Forecasts calling for roughly 37.3% annual revenue growth highlight the appeal for growth focused investors, but the expectation that RedCloud remains unprofitable over the next three years limits how far that bullish view can lean on the current earnings profile.

Negative equity and volatile share price at $1.69

- The balance sheet currently shows negative shareholders’ equity, and the share price around $1.69 has been highly volatile over the past three months compared with the broader US market.

- Bears focus heavily on this combination of financial and market risk, and the reported data provides clear support:

- Negative equity means past losses have more than absorbed the company’s accounting capital base. Together with trailing 12 month net losses of about $53.4 million, this underpins concerns about financial resilience.

- When that backdrop is paired with elevated recent share price swings, the stock can react sharply to any new revenue or cost datapoint, reinforcing the cautious stance many bearish investors take on RedCloud today.

P/S of 2.3x sits between industry and peers

- RedCloud trades on a price to sales ratio of about 2.3 times, which is more expensive than the US Retail Distributors industry average of 1 time but cheaper than the peer group average of 3.9 times.

- Valuation focused bulls and bears can both find numbers to point to here, which is why the signal looks mixed rather than one sided:

- Supporters note that paying 2.3 times sales for a business with 62.9% revenue growth and forecasts of about 37.3% annual growth looks lower than many growth oriented peers at roughly 3.9 times sales.

- Skeptics counter that the same 2.3 times multiple is still a premium to the wider retail distributors industry even though RedCloud remains loss making on trailing 12 month EPS of roughly minus $1.76 and is not expected to reach profitability within three years.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on RedCloud Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

RedCloud’s rapid revenue growth is overshadowed by deep ongoing losses, negative equity, and volatile trading, raising real questions about financial resilience and risk.

If that fragility feels uncomfortable, shift your focus toward companies with stronger cushions by using our solid balance sheet and fundamentals stocks screener (1944 results) today to target businesses built on healthier balance sheets and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報