Assessing Magnite’s (MGNI) Valuation After Its Recent Share Price Rebound

Magnite (MGNI) has quietly pushed higher this week, extending gains that now leave the stock up about 11% over the past week and 8% over the past month, even as its past 3 months remain weak.

See our latest analysis for Magnite.

That recent strength comes after a tougher stretch, with the 90 day share price return still negative. The latest move to around $16 suggests improving sentiment rather than a full blown trend reversal, even though the three year total shareholder return remains firmly positive.

If Magnite’s rebound has you looking for other ideas in digital advertising and software, it could be a good moment to explore high growth tech and AI stocks as potential next picks.

With Magnite trading well below analyst targets yet already reflecting modest revenue and profit growth, the key question now is whether this is genuine undervaluation or simply the market pricing in its next leg of expansion.

Most Popular Narrative Narrative: 40.4% Undervalued

With Magnite last closing at 16.01 dollars against a narrative fair value near 26.86 dollars, the storyline points to a sizable valuation gap that depends on execution and market share gains.

The analysts have a consensus price target of $28.192 for Magnite based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $39.0, and the most bearish reporting a price target of just $24.0.

Curious what kind of revenue trajectory, margin lift, and earnings multiple have to come together to align with that upside heavy fair value? The underlying narrative brings those moving parts together into a single long term blueprint that could materially change what this stock looks like a few years from now.

Result: Fair Value of $26.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be knocked off course if major CTV partners insource ad tech, or if AI driven walled gardens capture more ad budgets.

Find out about the key risks to this Magnite narrative.

Another Angle on Valuation

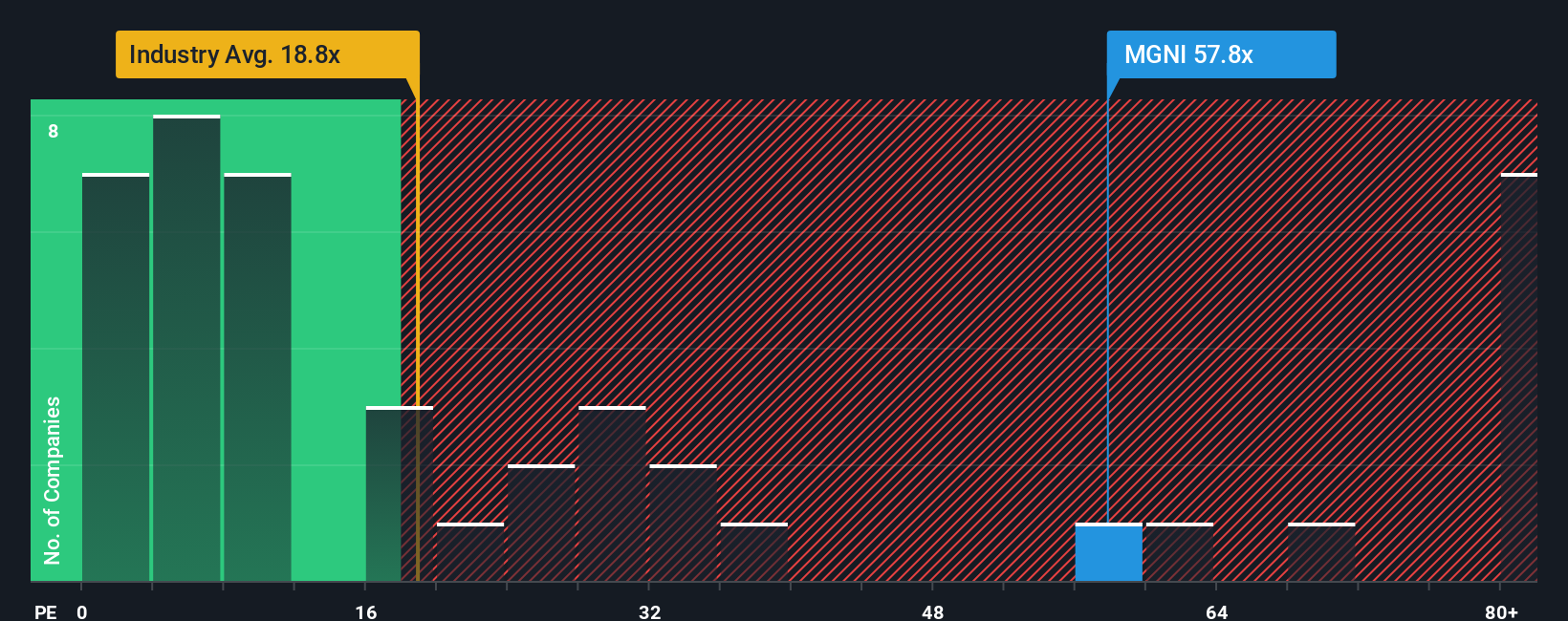

Looked at through its price to earnings ratio of 39.7 times, Magnite suddenly seems far less cheap, especially against the US Media industry at 15.9 times and a fair ratio of 17.2 times. That kind of gap can be an opportunity or a value trap, which side are you on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Magnite Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly build a personalised view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Magnite.

Ready for your next investing move?

Before markets shift again, lock in a shortlist of fresh opportunities using the Simply Wall St Screener so you are not chasing yesterday’s winners.

- Target high potential value by reviewing these 907 undervalued stocks based on cash flows that already show strong cash flow support for their prices.

- Capitalize on secular growth trends with these 25 AI penny stocks positioned at the intersection of automation and data intelligence.

- Strengthen your income strategy by scanning these 11 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報