Is Ajinomoto (TSE:2802) Quietly Rewriting Its Investment Story Around Semiconductors And Biotech?

- Morgan Stanley previously upgraded Ajinomoto from Equalweight to Overweight, arguing that recent profit weakness was driven largely by one-off factors such as upfront spending to accelerate profitability at Forge.

- The bank’s confidence rests on Ajinomoto’s push into semiconductors, biotech, and overseas seasonings, signaling a broader shift beyond its traditional food roots.

- We’ll now explore how Morgan Stanley’s focus on Ajinomoto’s semiconductor and biotech potential may reshape the company’s existing investment narrative.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ajinomoto Investment Narrative Recap

To own Ajinomoto, you need to believe it can pivot from a mature food business to a more technology-focused ingredients and materials player, while keeping its core seasonings profitable. Morgan Stanley’s upgrade reinforces that narrative but does not fundamentally change the near term tension between margin pressure from raw material inflation and the key catalyst of improving returns from higher growth segments like semiconductors and biotech.

The most relevant recent announcement here is Ajinomoto’s ongoing share buyback program of up to 50,000,000 shares for ¥100,000 million, alongside new authorizations of up to 30,000,000 shares for ¥80,000 million. For investors, this capital return story now sits beside the semiconductor and biotech thesis, but also amplifies the importance of successfully lifting margins in growth segments where upfront investments have already weighed on recent profits.

Yet beneath the semiconductor and biotech excitement, investors still need to watch the risk that margin pressure in growth segments could...

Read the full narrative on Ajinomoto (it's free!)

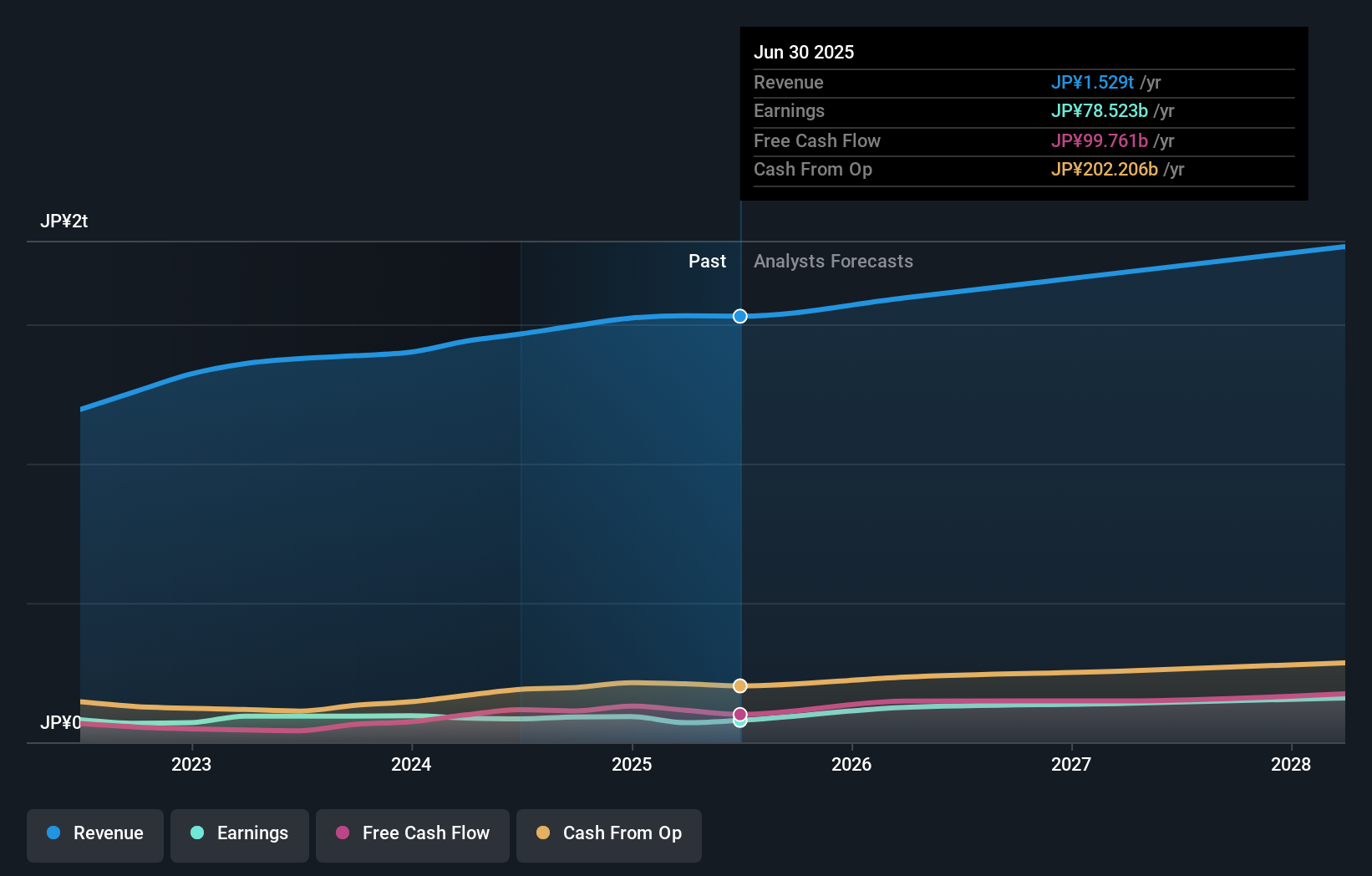

Ajinomoto's narrative projects ¥1,783.4 billion revenue and ¥156.5 billion earnings by 2028. This requires 5.3% yearly revenue growth and roughly a ¥78.0 billion earnings increase from ¥78.5 billion today.

Uncover how Ajinomoto's forecasts yield a ¥4450 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates cluster between ¥3,916 and ¥4,450, showing a fairly tight but higher band than the recent share price. Readers should weigh this against the risk that continued margin pressure in Ajinomoto’s growth segments could limit how quickly the semiconductor and biotech story feeds into stronger overall performance.

Explore 2 other fair value estimates on Ajinomoto - why the stock might be worth as much as 35% more than the current price!

Build Your Own Ajinomoto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ajinomoto research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ajinomoto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ajinomoto's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報