Clas Ohlson (OM:CLAS B) Margin Expansion Reinforces Bullish Profitability Narratives After Q2 2026 Results

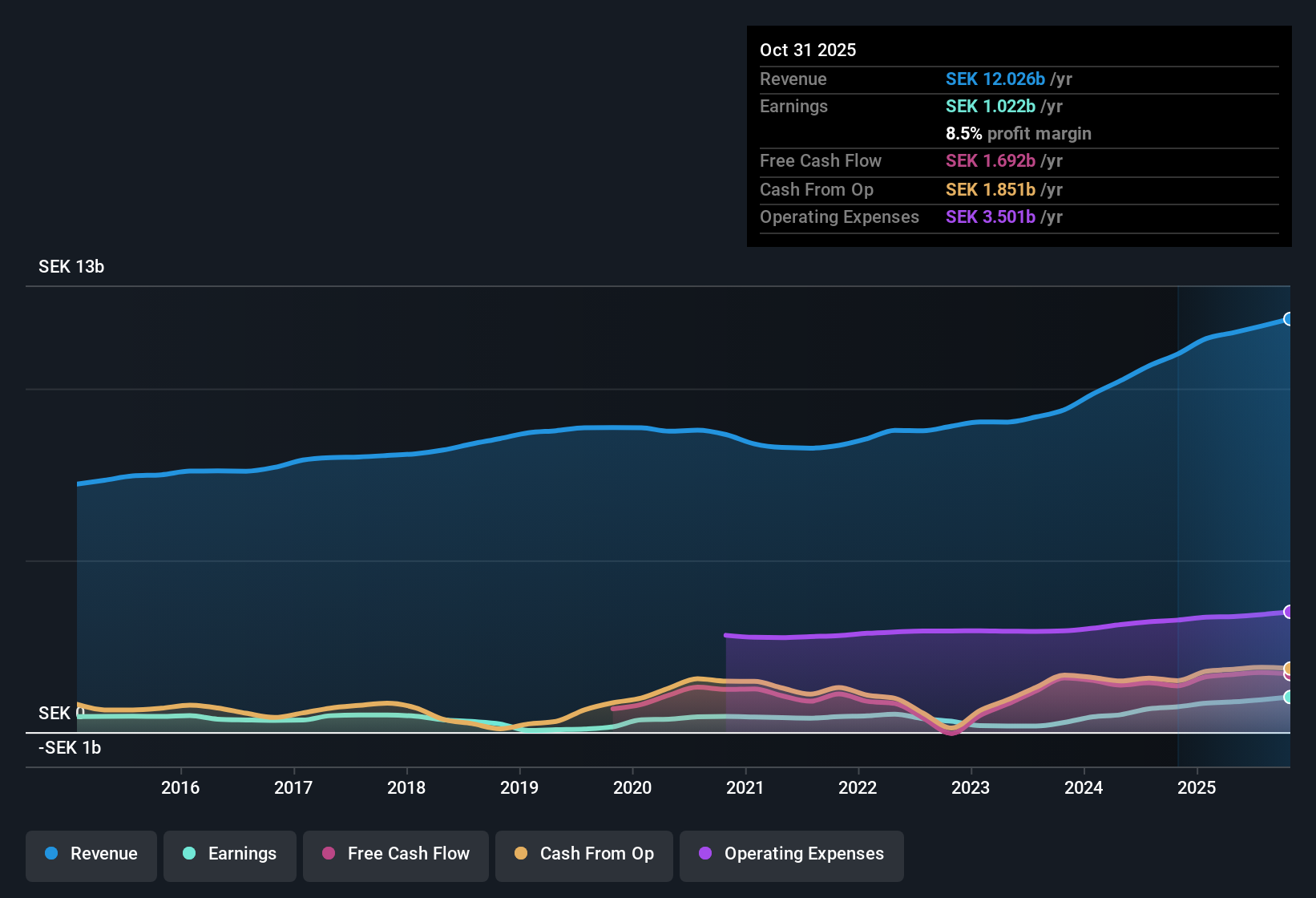

Clas Ohlson (OM:CLAS B) has just posted another solid quarter, with Q2 2026 revenue of SEK3.0 billion and basic EPS of SEK4.85, backed by net income of SEK308.3 million. The company has seen revenue move from SEK2.8 billion and EPS of SEK3.63 in Q2 2025 to SEK3.0 billion and EPS of SEK4.85 in Q2 2026. On a trailing twelve month basis, EPS sits at SEK16.11 on revenue of SEK12.0 billion and net income of SEK1.0 billion, giving investors a clear picture of sustained earnings power. Overall, the latest print points to a business that is converting sales into profit at healthy margins, which will frame how investors read the rest of this earnings season story.

See our full analysis for Clas Ohlson.With the headline numbers on the table, the next step is to see how these results line up with the dominant narratives around Clas Ohlson, and where the data might surprise or challenge prevailing views.

See what the community is saying about Clas Ohlson

Margins Climb to 8.5 Percent

- Over the last 12 months, Clas Ohlson converted SEK12.0 billion of revenue into SEK1.0 billion of net income, lifting the net profit margin to 8.5 percent from 6.7 percent a year earlier.

- Consensus narrative highlights a shift toward a multi niche model and more profitable online sales, and the margin data shows where that is already visible:

- Revenue has been growing at about 5.6 percent per year while trailing EPS has risen to SEK16.11, so profitability is increasing faster than sales.

- Analysts also expect margins to move toward 8.5 percent over the next few years, which is roughly where the latest trailing margin already sits.

38.6 Percent Earnings Growth Underpins Mixed Valuation

- Earnings grew 38.6 percent over the last year and about 19.9 percent per year over five years, while the stock trades on a trailing P E of 18.1 times, slightly above the 17.9 times European specialty retail average but below the 21.5 times Swedish market.

- Analysts' consensus view links this earnings momentum to ongoing store expansion and partnerships, yet the valuation picture is not one sided:

- The current share price of SEK291 sits above the DCF fair value of SEK215.97, so investors are paying a premium to that cash flow based estimate despite solid growth.

- At the same time, revenue growth of 5.6 percent per year is only modestly above the broader Swedish market, which means the premium is being justified more by margin gains and earnings quality than by top line outperformance alone.

Store and Online Growth Face Macro Pressures

- On a trailing basis, revenue has risen from SEK11.0 billion to about SEK12.0 billion over the past year and same store sales were reported at 7 to 9 percent in recent quarters, yet dividend payments are described as unstable, signaling that growth has not translated into a consistently predictable payout.

- Critics highlight risks around currencies, freight, and costs that could challenge the bullish growth path even with these solid numbers:

- Currency swings and rising sea freight costs directly affect purchasing and logistics, which matters when net margin is 8.5 percent and therefore sensitive to input cost shocks.

- Higher salary agreements in Finland and reliance on opening roughly 10 new stores per year could push operating expenses up, potentially slowing the 38.6 percent earnings growth if new stores underperform.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Clas Ohlson on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Share your angle, test it against the data, and shape your own narrative in just a few minutes: Do it your way.

A great starting point for your Clas Ohlson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternative Opportunities

Despite impressive margin gains and earnings growth, Clas Ohlson looks fully priced against cash flow estimates and may not justify its valuation if growth slows.

If paying a premium for a stock makes you uneasy, use our these 908 undervalued stocks based on cash flows to quickly focus on candidates where price better matches underlying cash flow strength today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報