Philips (ENXTAM:PHIA) Valuation Check After New LumiGuide and BlueSeal MRI Launches and 2026 Outlook Reaffirmation

Koninklijke Philips (ENXTAM:PHIA) just doubled down on its 2026 outlook while rolling out two headline technologies, LumiGuide and the BlueSeal Horizon 3.0T MRI platform. This combination quietly strengthens its long term healthcare tech story.

See our latest analysis for Koninklijke Philips.

Those product launches and the reaffirmed 2026 outlook arrive after a choppy stretch, with a 30 day share price return of minus 7.99% and a three year total shareholder return of 94.89%. This suggests long term momentum remains intact despite recent volatility.

If Philips’ imaging push has you rethinking the healthcare space, this could be a good moment to explore other healthcare stocks that might complement your watchlist.

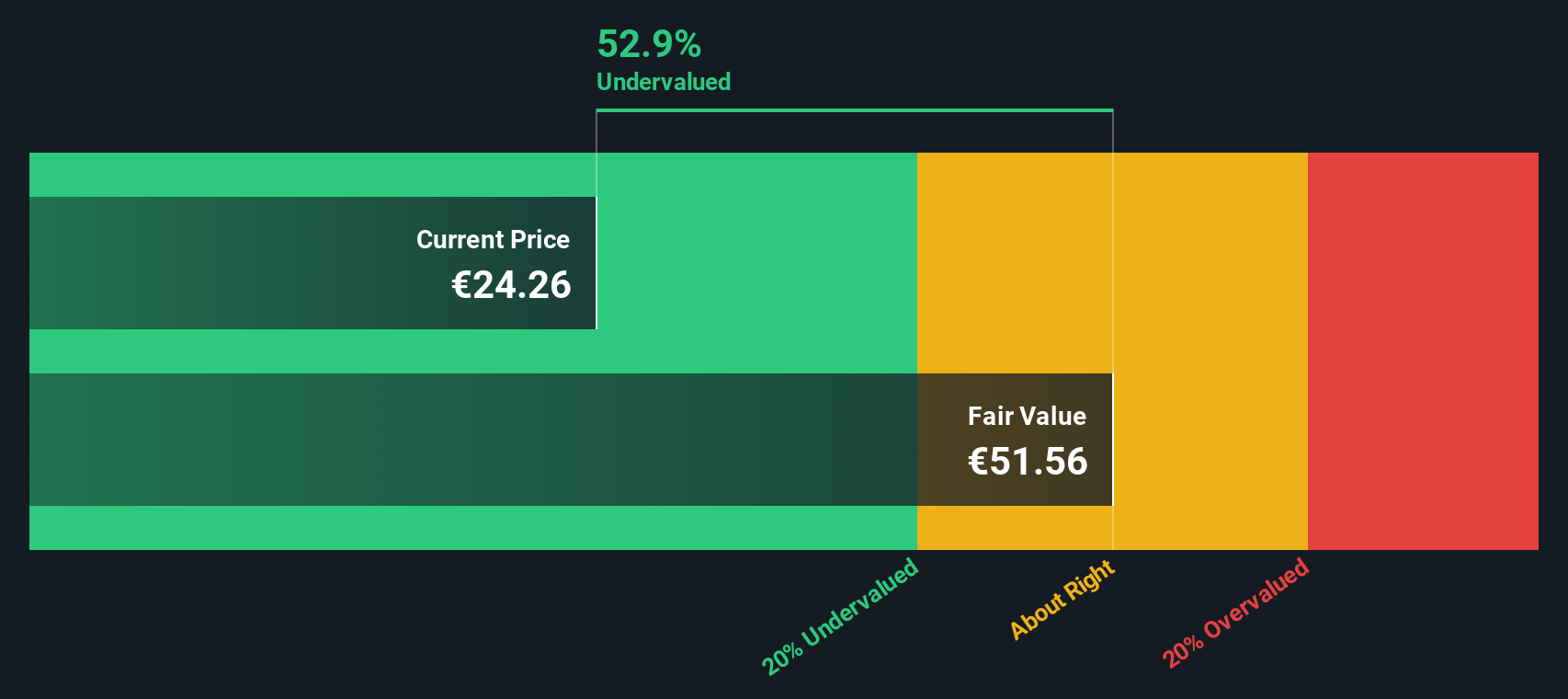

With shares still trading at a meaningful discount to analyst targets despite strong innovation and reaffirmed 2026 guidance, is Philips quietly undervalued, or is the market already baking in its next leg of growth?

Price-to-Earnings of 126.7x: Is it justified?

On a headline basis, Koninklijke Philips screens expensive, with a price-to-earnings ratio of 126.7x at a last close of €23.04, well above peers.

The price-to-earnings multiple compares the current share price to the company’s earnings, effectively showing how much investors pay today for each euro of profit. For an established healthcare technology group, it often reflects expectations for future profitability improvements and the durability of recurring, equipment and software driven revenue streams.

In Philips’ case, the high multiple suggests the market is already pricing in the company’s expected earnings acceleration and recent shift back to profitability, even though revenue growth is forecast to be moderate. With current earnings still low relative to its scale, the ratio is being stretched by a small profit base that investors expect to grow quickly.

The valuation looks even richer against the European Medical Equipment industry, where the average price-to-earnings multiple is 25x, and against Philips’ immediate peers at 31.7x. That puts Philips at a substantial premium, implying the market is assigning it a much stronger earnings recovery profile than the typical sector name.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 126.7x (OVERVALUED)

However, stretched valuation leaves little margin for error, and any slowdown in imaging demand or regulatory setbacks could quickly challenge this optimistic recovery story.

Find out about the key risks to this Koninklijke Philips narrative.

Another View: DCF Points to Deep Value

While the 126.7x earnings multiple appears expensive, our DCF model tells a different story, placing fair value around €37.46 versus today’s €23.04, a discount of roughly 38.5%. If cash flows play out as expected, is the market underestimating Philips’ recovery runway?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Koninklijke Philips for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Koninklijke Philips Narrative

If you see the data differently or would rather dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Koninklijke Philips research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Smart investors never stop scanning the horizon, so use the Simply Wall Street Screener now to uncover fresh opportunities before the crowd spots them.

- Capture potential bargain entries by targeting stocks that look mispriced on cash flows using these 908 undervalued stocks based on cash flows.

- Ride thematic trends in automation and machine learning by zeroing in on promising innovators through these 25 AI penny stocks.

- Strengthen your income strategy by hunting for reliable payouts with these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報