Modern Chinese Medicine Group Co., Ltd. (HKG:1643) Shares May Have Slumped 27% But Getting In Cheap Is Still Unlikely

Modern Chinese Medicine Group Co., Ltd. (HKG:1643) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 14%.

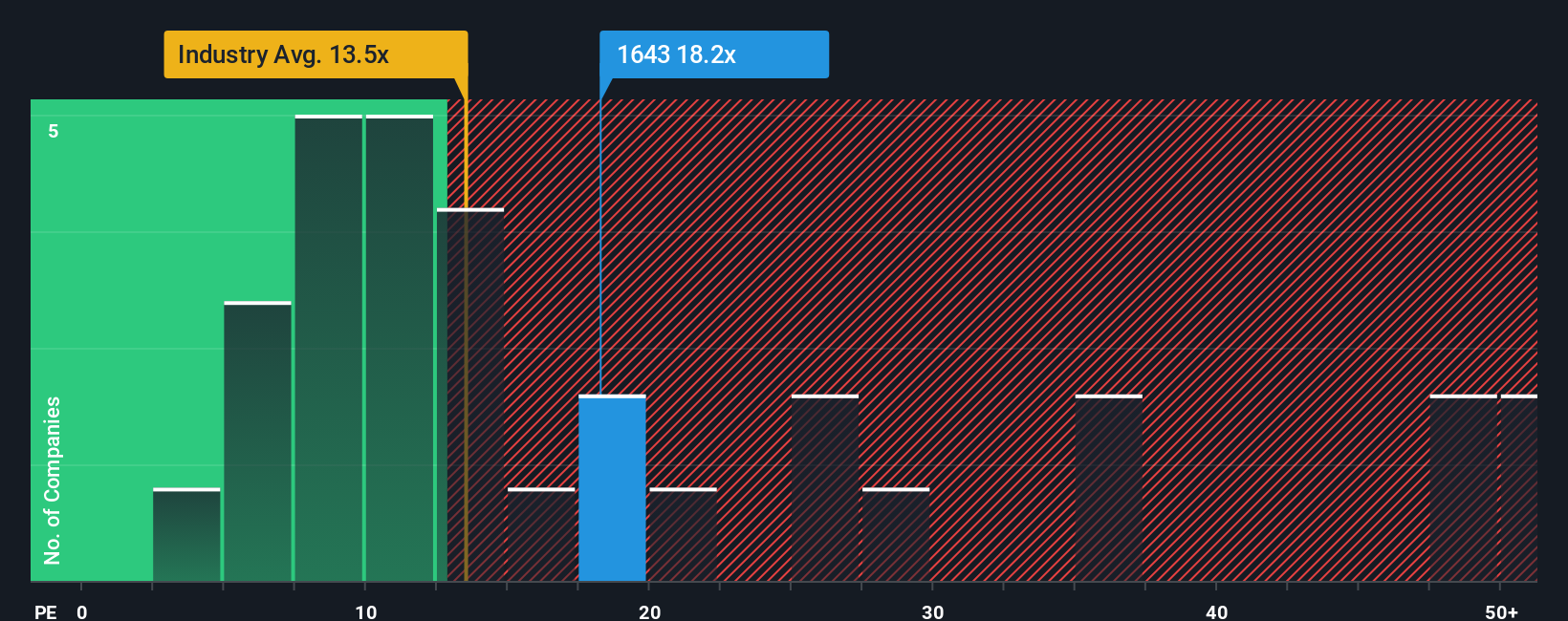

Although its price has dipped substantially, Modern Chinese Medicine Group's price-to-earnings (or "P/E") ratio of 18.2x might still make it look like a sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 12x and even P/E's below 7x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Modern Chinese Medicine Group has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Modern Chinese Medicine Group

Does Growth Match The High P/E?

Modern Chinese Medicine Group's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 32%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 82% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 21% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that Modern Chinese Medicine Group's P/E sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

What We Can Learn From Modern Chinese Medicine Group's P/E?

Despite the recent share price weakness, Modern Chinese Medicine Group's P/E remains higher than most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Modern Chinese Medicine Group revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 3 warning signs for Modern Chinese Medicine Group (1 doesn't sit too well with us!) that we have uncovered.

If these risks are making you reconsider your opinion on Modern Chinese Medicine Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報