Trump’s Farm Policy Pressure and Board Shake‑Up Could Be A Game Changer For Deere (DE)

- Earlier this month, Deere & Company expanded its Board from 10 to 11 directors by appointing Cargill Chair and CEO Brian Sikes as an independent director and committee member, while also announcing the upcoming retirement of President, John Deere Financial and CIO Raj Kalathur in January 2026 and affirming a quarterly dividend of US$1.62 per share payable in February 2026.

- At the same time, President Donald Trump’s public pressure on farm‑equipment pricing and plans to ease environmental rules are reshaping expectations for Deere’s cost structure, pricing power, and customer demand in its core agricultural markets.

- We’ll now examine how Trump’s push for lower equipment prices and regulatory rollbacks could influence Deere’s precision-agriculture driven investment narrative.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Deere Investment Narrative Recap

To own Deere today, you need to believe its precision agriculture and automation push can offset a choppy North American farm cycle and higher tariff related costs. Trump’s pressure for lower equipment prices and looser environmental rules complicates the near term pricing and margin story, but the main risk still looks tied to soft large ag demand and elevated used inventories rather than this week’s headlines.

Among the recent updates, Deere’s decision to target a 10% annual net sales growth rate from 2025 to 2030 sits right at the intersection of these policy moves and its technology story. If farmers respond to lower ownership costs and government support by gradually upgrading to smarter, more automated machines, that growth ambition and Deere’s precision ag catalyst become even more central to how investors frame the stock’s upside and downside.

Yet while the long term tech story is appealing, investors should also be aware of the risk that weaker North American demand and high inventories could still...

Read the full narrative on Deere (it's free!)

Deere’s narrative projects $45.1 billion revenue and $8.6 billion earnings by 2028. This assumes revenues will decrease by 0.7% per year and requires an earnings increase of about $3.4 billion from $5.2 billion today.

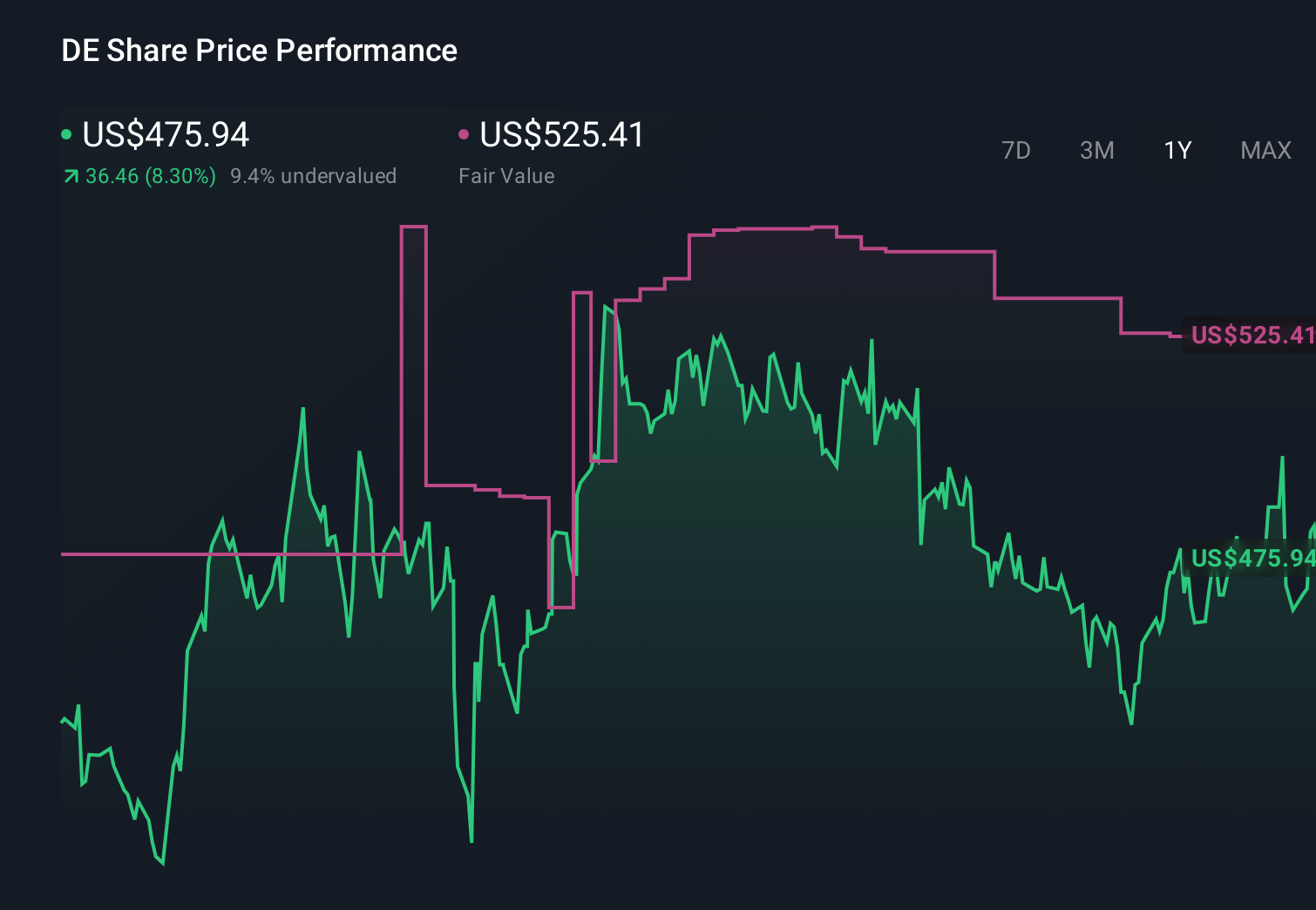

Uncover how Deere's forecasts yield a $525.41 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community see Deere’s fair value between US$430 and about US$626, showing wide dispersion in expectations. When you set those views against the current pressure on equipment pricing and North American demand, it underlines how important it is to weigh several different risk and reward cases before forming your own opinion.

Explore 5 other fair value estimates on Deere - why the stock might be worth as much as 34% more than the current price!

Build Your Own Deere Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deere research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Deere research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deere's overall financial health at a glance.

No Opportunity In Deere?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報