Assessing Americas Gold and Silver (TSX:USA) After Eric Sprott Trims His Stake and Shares Surge

Americas Gold and Silver (TSX:USA) just landed back on investor radar after Eric Sprott sold 5,000,000 shares, trimming his stake but stressing he still views the company through a long term lens.

See our latest analysis for Americas Gold and Silver.

The timing of Sprott’s trim comes as Americas Gold and Silver’s share price has been in a sharp upswing, with a 30 day share price return of 19.6 percent and a 90 day jump of 86.9 percent. The 1 year total shareholder return of 384.1 percent shows how quickly sentiment has flipped after years of weak performance.

If this kind of turnaround story has your attention, it could be worth scanning other metals names and beyond by exploring fast growing stocks with high insider ownership as potential next candidates for your watchlist.

With shares still trading at a double digit discount to analyst targets despite triple digit 12 month gains, investors now face a key question: Is Americas Gold and Silver still undervalued, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 41.9% Undervalued

According to Agricola, the narrative fair value of Americas Gold and Silver sits well above the last close of CA$7.14, implying substantial upside if assumptions hold.

Based on historical data and guidance, total annual revenue could approach the high hundreds of millions as Cosalá and Galena reach peak silver output and by product contributions. In this scenario, free cash flow scales rapidly once development spending rolls off, transforming the company from a turnaround story into a cash generating producer.

Curious how an unprofitable miner can support that kind of upside? The narrative focuses on aggressive production growth, rich commodity prices, and punchy profit margins. Want to see exactly how those moving parts combine into its bold valuation roadmap?

Result: Fair Value of $12.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish roadmap could unravel if silver prices disappoint or operational setbacks at Cosalá and Galena delay the expected production ramp up.

Find out about the key risks to this Americas Gold and Silver narrative.

Another View on Valuation

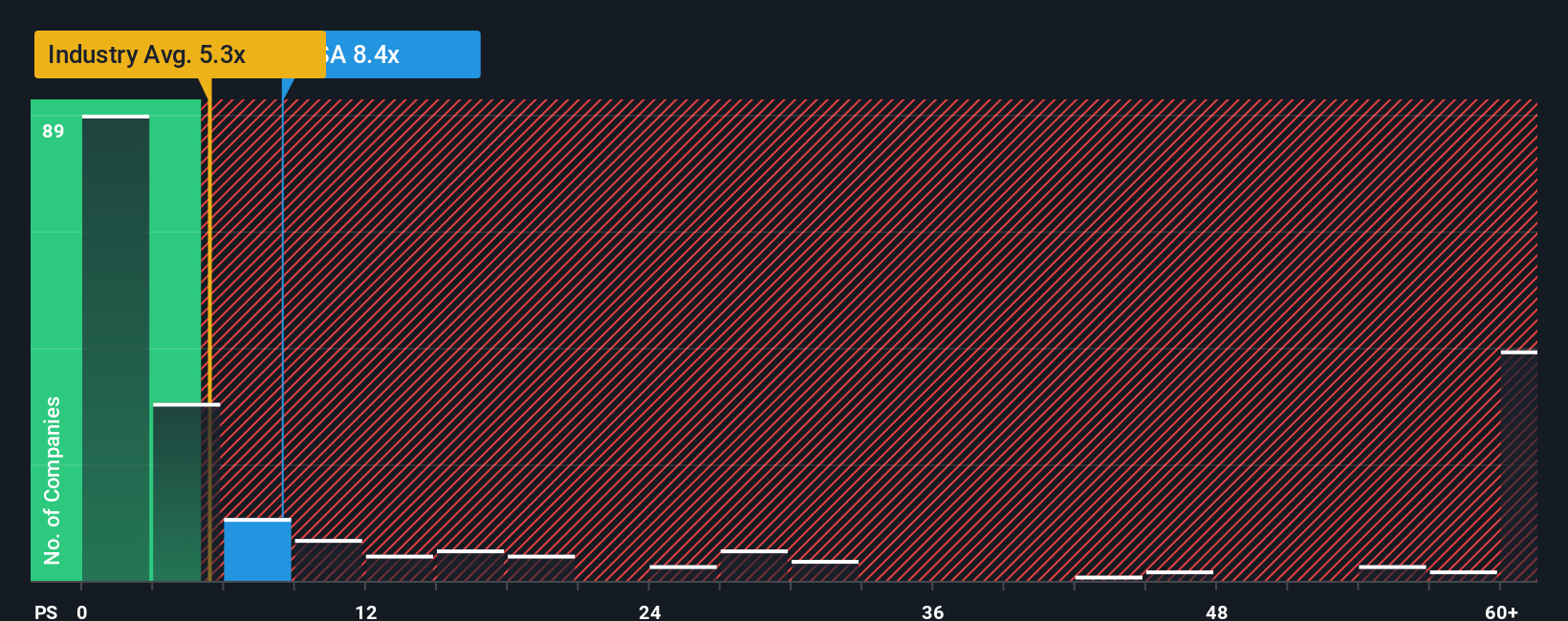

On a simple price to sales lens, Americas Gold and Silver looks anything but cheap. At 15.1 times sales, the stock trades at more than double the Canadian metals and mining average of 6.5 times and well above peer levels of 12.2 times.

Our fair ratio of 2.7 times hints that if sentiment cools or growth underdelivers, there is real downside if the market drifts back toward that lower benchmark. Is this premium a sign of justified optimism, or is it stretching the risk reward too far?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Americas Gold and Silver Narrative

If you see things differently or want to dive into the numbers yourself, you can quickly build a custom narrative in just a few minutes, Do it your way.

A great starting point for your Americas Gold and Silver research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before momentum shifts again, lock in your next ideas using the Simply Wall St Screener, built to surface opportunities that most investors overlook.

- Capture long term growth potential by scanning these 909 undervalued stocks based on cash flows that the market has not fully recognised yet.

- Position yourself for innovation by filtering for these 25 AI penny stocks accelerating real world AI adoption.

- Strengthen your income foundation by targeting these 12 dividend stocks with yields > 3% that can support returns through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報