Firefly Aerospace (FLY): Rethinking Valuation After a Short-Term Share Price Rebound

Firefly Aerospace (FLY) has quietly staged a short term rebound, with the stock up roughly 9% over the past day and 11% over the past month, even as the past 3 months remain deeply negative.

See our latest analysis for Firefly Aerospace.

Those near term share price gains sit against a much tougher backdrop, with the year to date share price return still sharply negative. This suggests recent momentum may reflect shifting expectations about Firefly Aerospace's growth path and risk profile rather than a full change in trend.

If this rebound has you rethinking the broader space and defense theme, it might be worth scouting other names through aerospace and defense stocks for fresh ideas.

With Firefly still deeply in the red this year but trading at a steep discount to analyst targets, are investors looking at a contrarian entry point, or is the market already bracing for slower growth ahead?

Price to Sales of 30.5x: Is it justified?

Firefly Aerospace last closed at $21.30, yet on a price to sales basis it trades at a striking premium to the aerospace and defense pack.

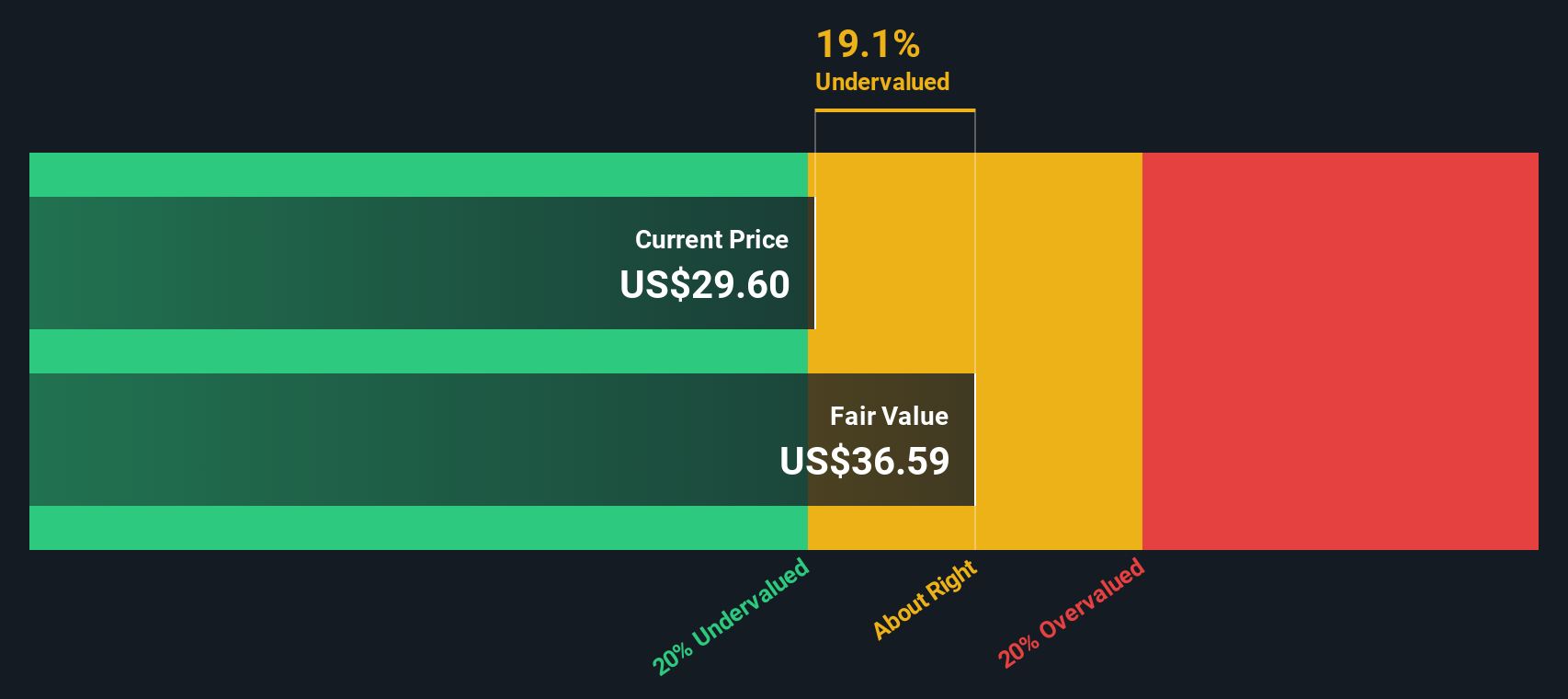

The price to sales multiple compares a company’s market value to its revenue, making it a common yardstick for fast growing but unprofitable businesses like Firefly. In this case, the company screens as deeply undervalued on our DCF fair value estimate of $53.55, while at the same time looking very expensive relative to industry and peer sales multiples.

That tension is stark, with Firefly’s 30.5 times price to sales ratio significantly higher than both the 3.1 times sector average and the 2.4 times peer average. See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Sales of 30.5x (OVERVALUED)

However, investors still face execution risk if Firefly’s rapid revenue growth stalls or losses deepen, which could quickly undermine the contrarian upside case.

Find out about the key risks to this Firefly Aerospace narrative.

Another Take on Value

Our DCF model paints a very different picture, suggesting Firefly Aerospace is trading about 60% below its estimated fair value of $53.55 per share. If cash flows really ramp as forecast, is the market underpricing the long term story, or are the assumptions too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Firefly Aerospace for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Firefly Aerospace Narrative

If you see things differently or want to dive into the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Firefly Aerospace research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investing angles beyond Firefly?

Set yourself up for the next opportunity by using the Simply Wall Street Screener to pinpoint quality ideas before the crowd moves on them.

- Capture potential multi baggers early by scanning these 3607 penny stocks with strong financials that pair tiny share prices with surprisingly solid numbers.

- Position your portfolio at the heart of automation and data transformation with these 25 AI penny stocks leading real world applications of artificial intelligence.

- Lock in attractive entry points by focusing on these 909 undervalued stocks based on cash flows that market sentiment has overlooked despite strong cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報