Kratos Defense & Security Solutions (KTOS): Valuation Check After New Vancouver PT6 Engine Overhaul Facility Expansion

Kratos Defense & Security Solutions (KTOS) just opened a new 10,000 square foot PT6A and PT6T engine overhaul facility in Vancouver, a strategic expansion aimed at tightening its North American service network and improving operational efficiency.

See our latest analysis for Kratos Defense & Security Solutions.

The new Vancouver site adds to a year where momentum has clearly been building, with a roughly 191 percent year to date share price return and a remarkable 707 percent three year total shareholder return signaling investors are increasingly backing Kratos growth story.

If this expansion has you thinking more broadly about the defense space, it could be a good moment to scan other opportunities across aerospace and defense stocks.

But after such explosive returns and double digit revenue and earnings growth, is Kratos still trading below its long term potential, or are investors already paying up for every dollar of future expansion?

Most Popular Narrative Narrative: 23.5% Undervalued

With a fair value estimate of about $100.56 against a last close near $76.91, the prevailing narrative argues the recent rally still leaves room.

Kratos' early investments in serial production of tactical drones (e.g., Valkyrie) and rapid scaling in missile propulsion and microelectronics put it ahead of competitors as demand for unmanned and autonomous solutions escalates globally. With sole source and first to market positions, Kratos is positioned for incremental revenue and higher margin growth as large contracts come online, particularly as international orders (with premium margins) ramp up.

Want to see why this growth story commands a valuation more often reserved for elite tech names? The narrative focuses on surging defense demand, widening margins, and an earnings ramp that reshapes what Kratos could earn a few years from now. Curious which specific growth levers and profit assumptions are doing the heavy lifting in that fair value math? The full narrative breaks down the numbers behind this view.

Result: Fair Value of $100.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Kratos still faces meaningful risks from heavy up front investment and reliance on U.S. defense budgets, which could disrupt margins and delay growth.

Find out about the key risks to this Kratos Defense & Security Solutions narrative.

Another View: Rich Multiples Tell a Different Story

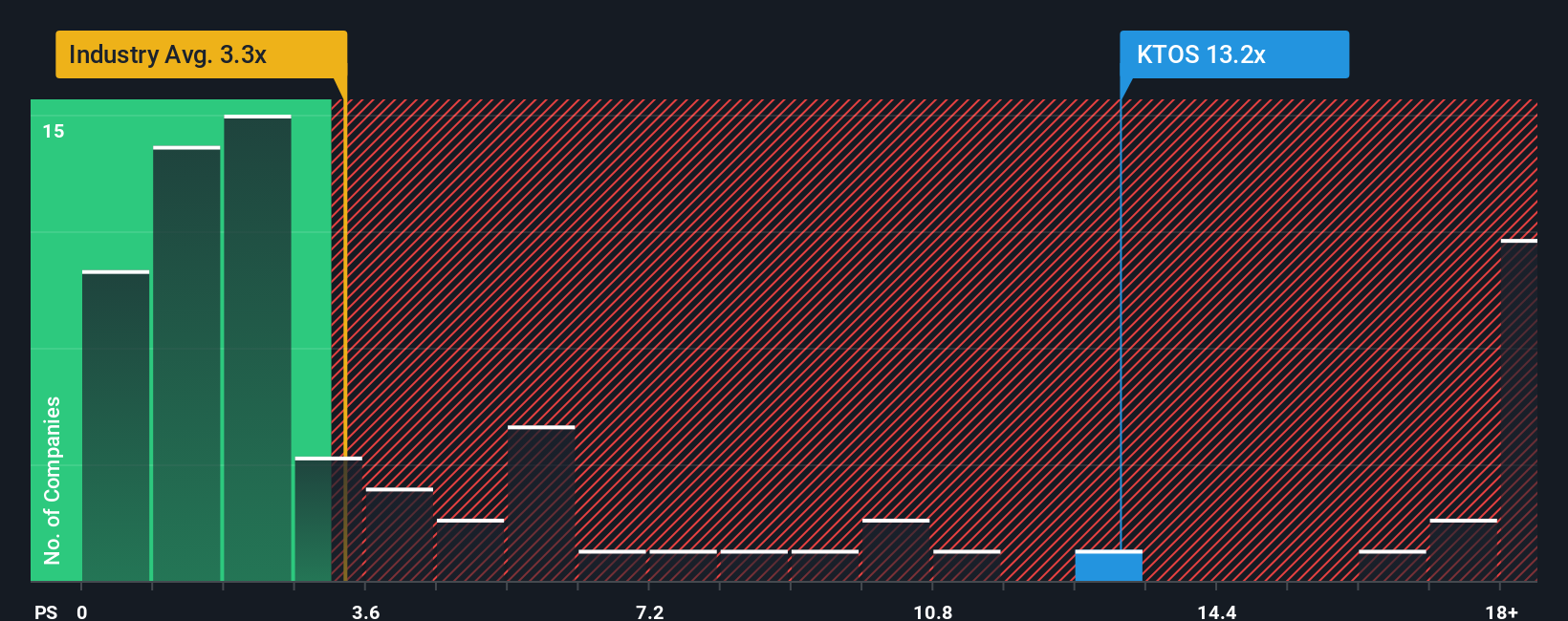

Not everyone sees a bargain. On a sales basis, Kratos trades at about 10.1 times revenue, far above the US Aerospace and Defense average of 3.1 times and even its own fair ratio of 2.7 times. This implies meaningful valuation risk if sentiment cools. Is the market overpaying for growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kratos Defense & Security Solutions Narrative

If you are not fully convinced by these views, or want to dive into the numbers yourself, you can build a complete narrative in just a few minutes, Do it your way.

A great starting point for your Kratos Defense & Security Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas before you act?

Before you make your next move on Kratos, broaden your opportunity set with fresh ideas from the Simply Wall St screener so you do not miss the next wave.

- Capture potential bargains early by scanning these 909 undervalued stocks based on cash flows that may be trading well below what their future cash flows suggest they are worth.

- Ride powerful secular trends by targeting innovators at the intersection of medicine and machine intelligence through these 30 healthcare AI stocks.

- Boost your portfolio's income engine by focusing on companies offering reliable yields using these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報