Revenues Not Telling The Story For NIBEC Co., Ltd. (KOSDAQ:138610) After Shares Rise 42%

Despite an already strong run, NIBEC Co., Ltd. (KOSDAQ:138610) shares have been powering on, with a gain of 42% in the last thirty days. The annual gain comes to 222% following the latest surge, making investors sit up and take notice.

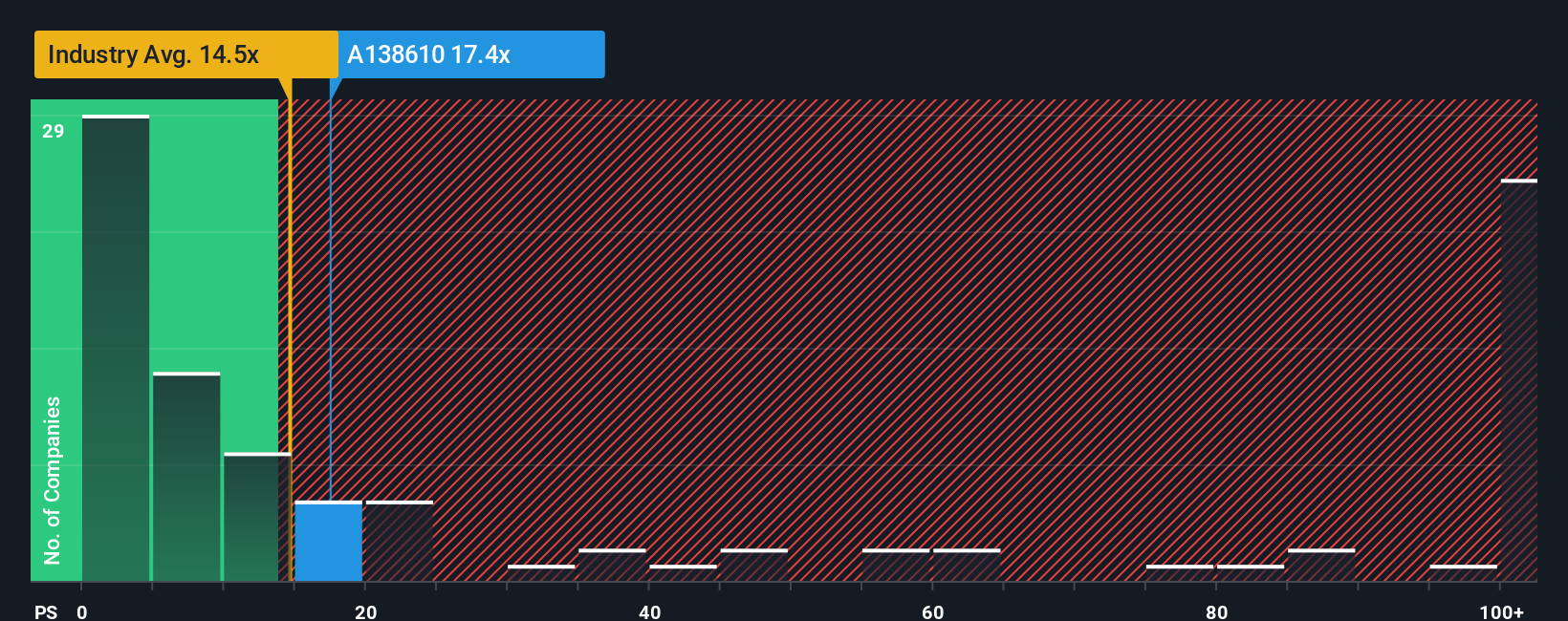

Since its price has surged higher, NIBEC may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 17.4x, when you consider almost half of the companies in the Biotechs industry in Korea have P/S ratios under 14.5x and even P/S lower than 4x aren't out of the ordinary. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for NIBEC

How Has NIBEC Performed Recently?

Recent times have been quite advantageous for NIBEC as its revenue has been rising very briskly. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on NIBEC will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like NIBEC's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 44% gain to the company's top line. The latest three year period has also seen an excellent 64% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 52% shows it's noticeably less attractive.

In light of this, it's alarming that NIBEC's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

NIBEC's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of NIBEC revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware NIBEC is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on NIBEC, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報