Nissan (TSE:7201) Valuation Check as Hybrid Push, Thailand Shift and AI Partnership Target a Recovery Path

Nissan Motor (TSE:7201) is back in the spotlight as investors weigh its push into U.S. hybrids, plant consolidation in Thailand, and fresh AI partnerships that aim to streamline how its next generation of vehicles is developed.

See our latest analysis for Nissan Motor.

Those moves seem to be resonating with investors, with a 30 day share price return of 7.8 percent and a 1 year total shareholder return of 9.5 percent, suggesting early momentum after a tougher year to date.

If Nissan’s reset has your attention, it could be a good moment to explore other auto names and see what is standing out in auto manufacturers.

Given mixed long term returns, accelerating profit growth and strategic shifts in hybrids and AI, is Nissan still flying under the radar as a recovery story, or are markets already pricing in its next leg of growth?

Most Popular Narrative: 16.4% Overvalued

With Nissan Motor’s fair value in the most followed narrative sitting below the last close of ¥390.9, the valuation hinges on a sharp swing back to profitability.

The analysts have a consensus price target of ¥344.688 for Nissan Motor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥430.0, and the most bearish reporting a price target of just ¥250.0.

Curious how a loss making automaker gets modeled into a profit generator with expanding margins and a lower than industry earnings multiple? The most popular narrative lays out a detailed roadmap of modest revenue growth, margin repair and shrinking share count that all have to click together. Want to see the exact financial path it relies on, and how sensitive that fair value is to each step?

Result: Fair Value of ¥335.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn losses in China and ongoing negative free cash flow could quickly derail the turnaround assumptions and force a rethink on Nissan’s recovery trajectory.

Find out about the key risks to this Nissan Motor narrative.

Another Lens on Value

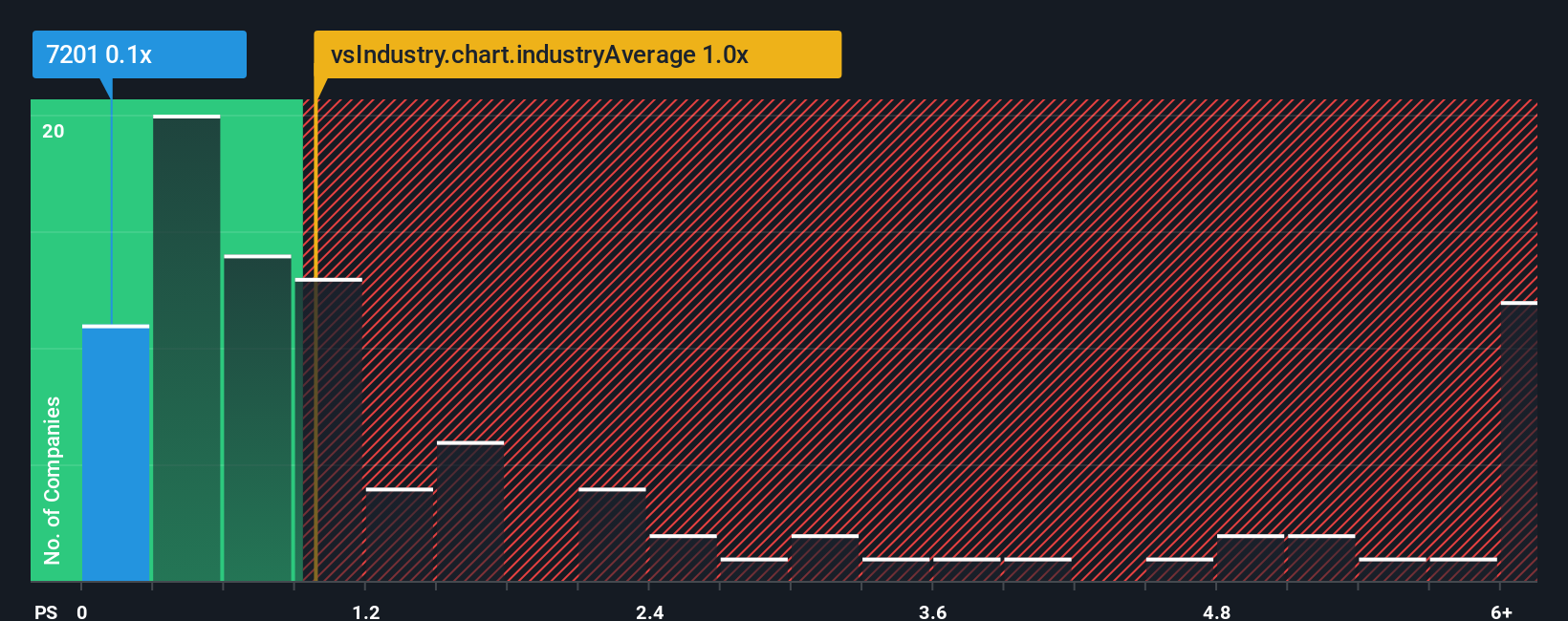

While the narrative fair value suggests Nissan is 16.4 percent overvalued, its 0.1x price to sales ratio tells a different story. That is far below peers at 0.3x, the Asian auto average near 1x, and even the 0.6x fair ratio our models point to, which hints at sizeable re rating potential if profitability normalizes. Which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nissan Motor Narrative

If you want to challenge these assumptions or dig into the numbers yourself, you can build a customised view in just a few minutes: Do it your way.

A great starting point for your Nissan Motor research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Nissan has sharpened your appetite for opportunities, now is the moment to deepen your research with targeted stock ideas built from real fundamentals and market data.

- Capture potential mispricings by scanning these 909 undervalued stocks based on cash flows that look poised for a sentiment shift as cash flows strengthen and expectations reset.

- Capitalize on innovation tailwinds by checking out these 25 AI penny stocks riding structural demand for automation, data intelligence and next generation software.

- Secure a growing stream of income by focusing on these 12 dividend stocks with yields > 3% that can support returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報