First Capital REIT (TSX:FCR.UN): Assessing Valuation After a Recent Pullback in the Unit Price

First Capital Real Estate Investment Trust (TSX:FCR.UN) has quietly outperformed over the past year, and that steady climb has investors asking whether the current pullback is a healthy pause or a buying opportunity.

See our latest analysis for First Capital Real Estate Investment Trust.

Recent trading has been a bit choppy, with the share price easing back to about $18.70. Even so, the year to date share price return remains positive and the 1 year total shareholder return still points to steady, compounding gains as income and asset values build.

If you like the idea of steady cash flows but want to see what else is out there, this could be a good time to explore fast growing stocks with high insider ownership.

With the units trading below analyst targets and our estimate of intrinsic value, the market seems cautious despite solid long term returns. The key question is whether this skepticism is creating a buying opportunity, or simply reflecting future growth that is already priced in.

Price-to-Earnings of 16.1x: Is it justified?

On a price-to-earnings basis, First Capital Real Estate Investment Trust looks inexpensive at 16.1 times earnings compared to both peers and the wider Retail REITs industry.

The price-to-earnings ratio compares the current unit price with the trust's earnings per unit, giving a snapshot of how much investors are paying for each dollar of profit. For a mature, income focused real estate vehicle, this remains one of the most widely watched yardsticks because earnings power ultimately supports distributions and balance sheet strength.

Here the market is assigning FCR.UN a 16.1x multiple while similar companies trade around 32.3x. This implies investors are paying roughly half as much for each dollar of earnings. Against the broader North American Retail REITs average of 23.1x, the discount is still notable and suggests the current unit price reflects more modest expectations than many of its closest comparables.

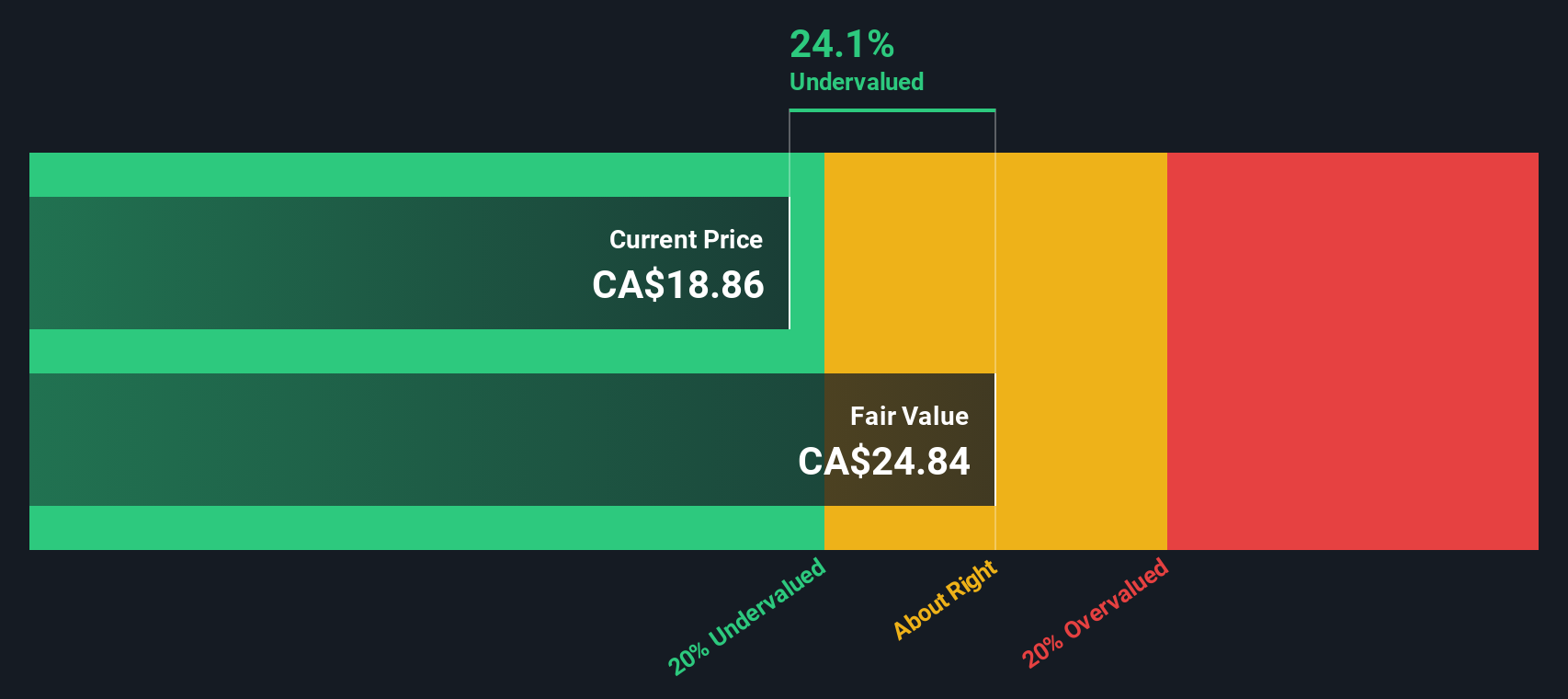

Given it is also trading 24.7% below our estimate of fair value of CA$24.84, the valuation gap versus both intrinsic value and sector multiples points to a market that remains cautious on growth and earnings quality, even as the underlying portfolio continues to compound over time.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.1x (UNDERVALUED)

However, persistent retail headwinds and any slowdown in rental growth or occupancy could pressure earnings, limiting how quickly that valuation gap can realistically close.

Find out about the key risks to this First Capital Real Estate Investment Trust narrative.

Another View on Value

Our DCF model also points to First Capital Real Estate Investment Trust trading below its estimated fair value, reinforcing what the earnings multiple is already hinting at. If both lenses are flagging potential upside, the real puzzle is how long the market will take to close that gap.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Capital Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Capital Real Estate Investment Trust Narrative

If you see things differently or simply want to dig into the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your First Capital Real Estate Investment Trust research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity. Use the Simply Wall Street screener to uncover fresh ideas that match your strategy before the rest of the market catches on.

- Capture potential bargains early by reviewing these 909 undervalued stocks based on cash flows that the market may be overlooking despite strong underlying cash flows.

- Capitalize on emerging tech shifts by scanning these 25 AI penny stocks riding powerful trends in automation, analytics, and intelligent software.

- Strengthen your income stream by evaluating these 12 dividend stocks with yields > 3% offering attractive yields supported by solid business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報