More Unpleasant Surprises Could Be In Store For Cogstate Limited's (ASX:CGS) Shares After Tumbling 27%

The Cogstate Limited (ASX:CGS) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 78%, which is great even in a bull market.

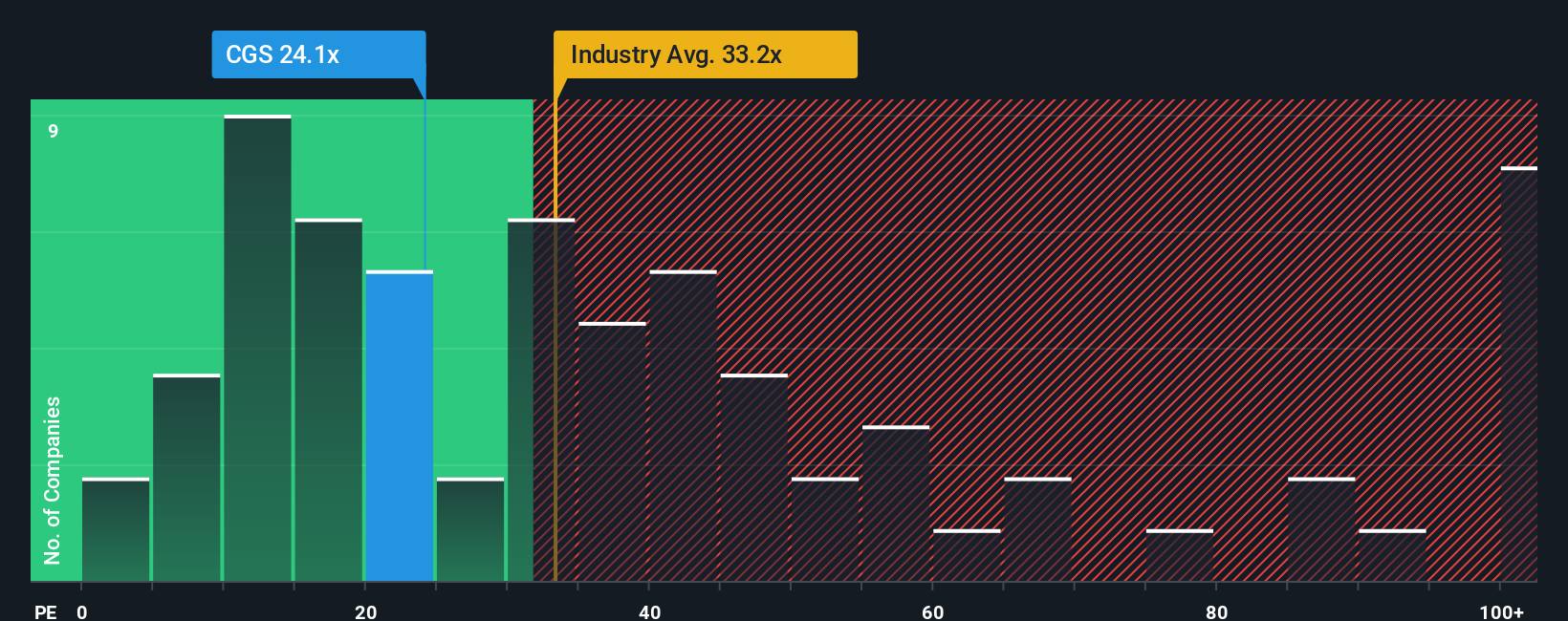

Although its price has dipped substantially, given around half the companies in Australia have price-to-earnings ratios (or "P/E's") below 21x, you may still consider Cogstate as a stock to potentially avoid with its 24.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings growth that's superior to most other companies of late, Cogstate has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Cogstate

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Cogstate would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 87% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 36% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 18% per year as estimated by the two analysts watching the company. That's shaping up to be similar to the 18% per year growth forecast for the broader market.

With this information, we find it interesting that Cogstate is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Despite the recent share price weakness, Cogstate's P/E remains higher than most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Cogstate currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Cogstate with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Cogstate. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報