MGP Ingredients (MGPI): Reassessing Valuation After Chairman’s Share Sale and Ongoing Margin Pressures

After the Chairman of the Board moved to sell a sizable block of shares, MGP Ingredients (MGPI) quickly drew fresh scrutiny as investors weighed this signal against already weakening sales and margin pressure.

See our latest analysis for MGP Ingredients.

The share sale comes after a rough stretch, with the share price down sharply on a year to date basis and multi year total shareholder returns deeply negative. However, this week’s double digit 7 day share price return hints at traders reassessing how much bad news was already priced in.

If this kind of volatility has you thinking about diversification, now could be a good moment to explore fast growing stocks with high insider ownership as a way to spot other compelling stories on your radar.

With the stock down heavily over one and three years but now trading at a steep discount to analyst targets and intrinsic estimates, investors face a key question: is this a contrarian entry point, or is weak growth already fully reflected?

Most Popular Narrative Narrative: 32.4% Undervalued

With MGP Ingredients last closing at $26.35 against a most popular narrative fair value of $39, the gap points to a potentially mispriced recovery story.

The company's operational investments, including the ramp up of its biofuel plant to lower waste disposal costs and ongoing upgrades at the Atchison plant to streamline ingredient operations, are already delivering cost savings and are expected to drive further gross margin expansion and profitability improvement. Industry wide inventory rationalization and disciplined production cuts both at MGP and across American whiskey producers are setting up a favorable supply/demand balance, likely restoring pricing power and contract stability.

Want to see how shrinking losses, rising margins, and a re rated earnings multiple all combine into that higher fair value? The full narrative unpacks the precise revenue path, profit swing, and discount rate assumptions that power this upside case.

Result: Fair Value of $39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent excess whiskey inventories and extended contract pauses, along with pressure on mid tier spirits, could delay margin recovery and undermine the undervalued thesis.

Find out about the key risks to this MGP Ingredients narrative.

Another Angle on Value

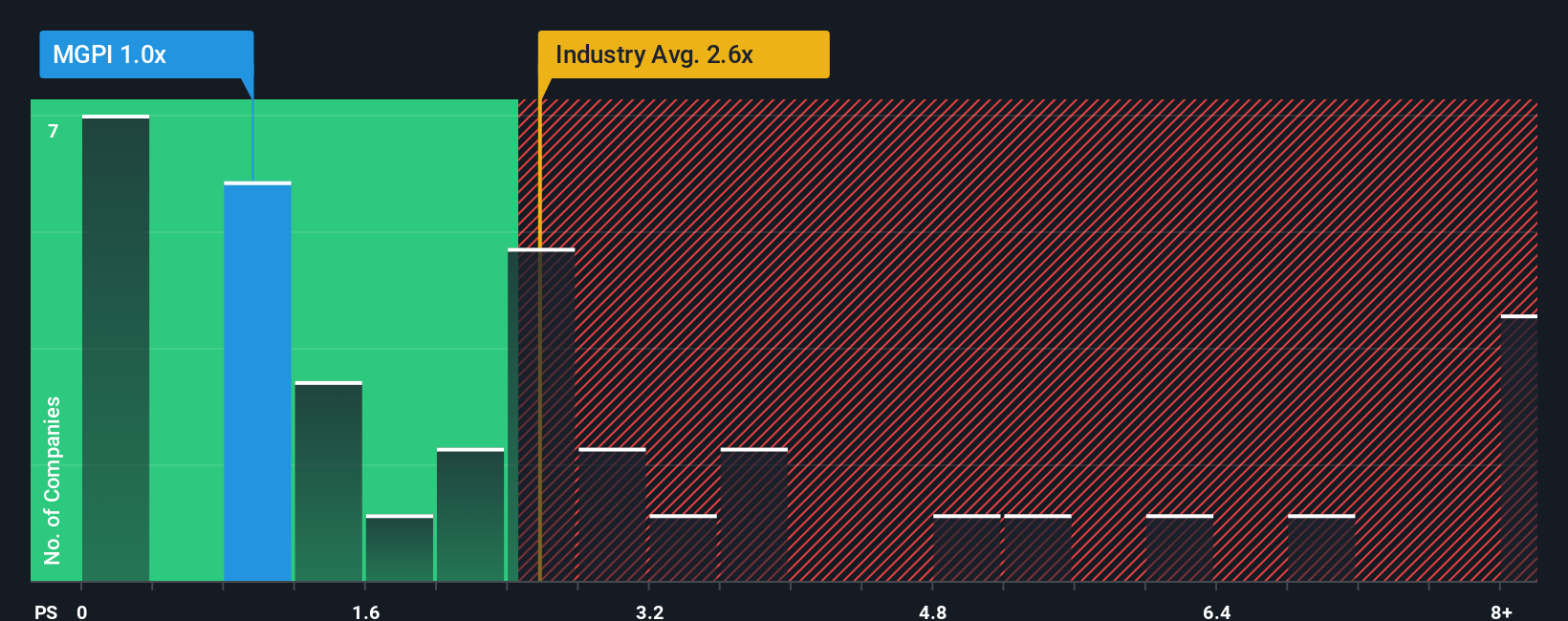

Looking through a simple sales based lens, MGPI trades on a 1x price to sales ratio, well below the US Beverage industry at 2.3x and peers at 3.2x, yet above its fair ratio of 0.7x. This suggests both upside and downside as sentiment normalizes. Which way will the market lean?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MGP Ingredients Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized view in minutes, starting with Do it your way.

A great starting point for your MGP Ingredients research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next smart move?

Before you log off, set yourself up for the next opportunity by using the Simply Wall St Screener to uncover clear, data driven stock ideas in minutes.

- Target reliable income streams by checking out these 12 dividend stocks with yields > 3% that aim to balance yield with sustainable payout potential.

- Chase transformational growth by reviewing these 25 AI penny stocks positioned at the forefront of artificial intelligence breakthroughs.

- Strengthen your value hunting playbook with these 909 undervalued stocks based on cash flows that may be trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報