AutoZone (AZO): Has the 21% Three-Month Pullback Opened a Valuation Opportunity?

AutoZone (AZO) has quietly slipped about 10% over the past week and more than 20% over the past 3 months, even though revenue and earnings are still ticking higher year over year.

See our latest analysis for AutoZone.

Zooming out, that recent 21.44% 3 month share price pullback and softer 1 year total shareholder return of 2.35% come after a strong 5 year total shareholder return of 187.37%. This suggests momentum has cooled even as fundamentals keep improving.

If AutoZone’s shift in momentum has you reassessing your watchlist, it could be worth exploring other auto players via our screener of auto manufacturers.

With earnings still growing, shares trading nearly 30% below analyst targets, but a modest intrinsic value discount, is AutoZone now a mispriced compounder in a temporary slump, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 25.3% Undervalued

With AutoZone’s narrative fair value sitting well above the last close of $3,421.13, the spread hints at meaningful upside if the assumptions land.

The analysts have a consensus price target of $4,202.41 for AutoZone based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $4,900.00, and the most bearish reporting a price target of $2,900.00.

Curious what powers that gap between price and fair value? The narrative leans on steady growth, sturdy margins, and a punchy future earnings multiple. Want the full playbook?

Result: Fair Value of $4,579.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several risks could derail that upside, including persistent margin pressure from inflation and tariffs, or weaker DIY demand if macro conditions soften.

Find out about the key risks to this AutoZone narrative.

Another Lens on Valuation

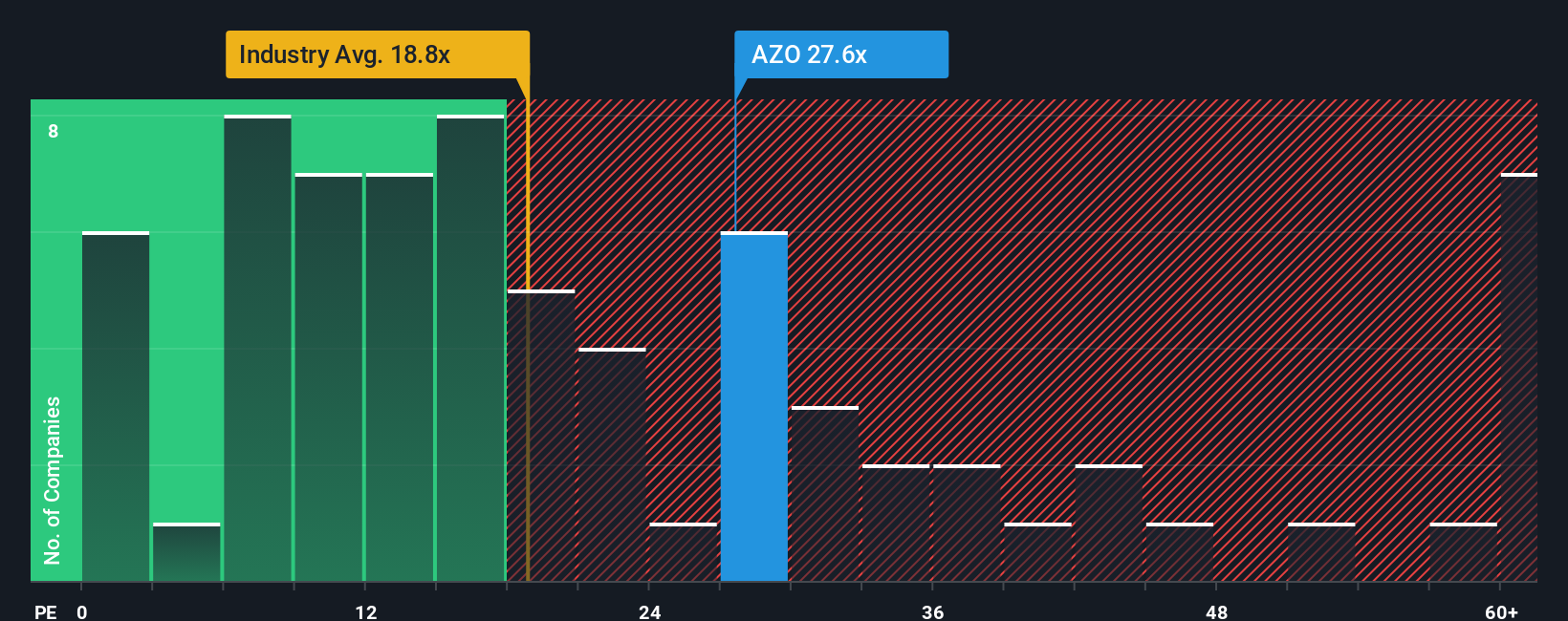

Step away from narratives and analyst targets, and the plain price earnings view looks less generous. AutoZone trades at 23 times earnings versus a 19.7 times industry average and a 19.9 times fair ratio, implying investors are already paying up for execution.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AutoZone Narrative

If you see the story differently or want to dig into the numbers yourself, you can spin up a custom narrative in just a few minutes: Do it your way.

A great starting point for your AutoZone research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about sharpening your portfolio, do not stop at AutoZone when you can quickly surface fresh, data backed opportunities across the market.

- Capture early stage potential by reviewing these 3607 penny stocks with strong financials that pair tiny market caps with surprisingly solid fundamentals and room for significant upside.

- Position yourself for the next wave of innovation by assessing these 25 AI penny stocks that harness artificial intelligence to support growth and reshape entire industries.

- Focus on quality at a compelling price by targeting these 909 undervalued stocks based on cash flows that cash flow analysis suggests may be trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報