Teva (NYSE:TEVA) Valuation Check After New Schizophrenia Drug Filing and Growing Growth Optimism

Teva Pharmaceutical Industries (TEVA) just put another stake in the ground with its FDA submission for a once monthly olanzapine injectable for schizophrenia, adding fresh momentum to a stock that has already been trending higher.

See our latest analysis for Teva Pharmaceutical Industries.

The NDA caps a string of upbeat catalysts for Teva, from a golden cross on the chart to stronger branded drug growth and fresh interest from big investors like Glenview. The stock’s 30 day share price return of 22.84 percent and 1 year total shareholder return of 70.77 percent signal that momentum is building rather than fading, with the latest schizophrenia asset reinforcing that improving sentiment.

If Teva’s run has you rethinking your healthcare exposure, it could be a good moment to scout other medicine makers through our screener for healthcare stocks.

With shares sitting around analyst targets but still trading at a steep discount to some intrinsic value models, the key question now is simple: Is Teva still mispriced, or is the market already baking in its turnaround?

Most Popular Narrative: 4.2% Overvalued

With Teva closing at 29.80 dollars against a narrative fair value of about 28.60 dollars, the story now hinges on how far margins can stretch.

The accelerating launch cadence of biosimilars (with 8 launches targeted through 2027 and a goal to double biosimilar revenue), backed by favorable regulatory trends increasing biosimilar adoption in major markets, should unlock incremental, higher margin revenue streams and offset headwinds from traditional generics, powering long term EBITDA growth.

Want to see what is really powering that higher valuation, beyond the headline turnaround story? The narrative leans on a bold mix of modest sales growth, sharply better margins, and a future earnings multiple more often associated with market favorites than repair stories. Curious how those moving parts fit together into one price tag? Dive in to unpack the full playbook behind this fair value call.

Result: Fair Value of $28.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on key branded launches or deeper than expected IRA related pricing pressure on Austedo could quickly challenge that upbeat margin narrative.

Find out about the key risks to this Teva Pharmaceutical Industries narrative.

Another Lens on Valuation

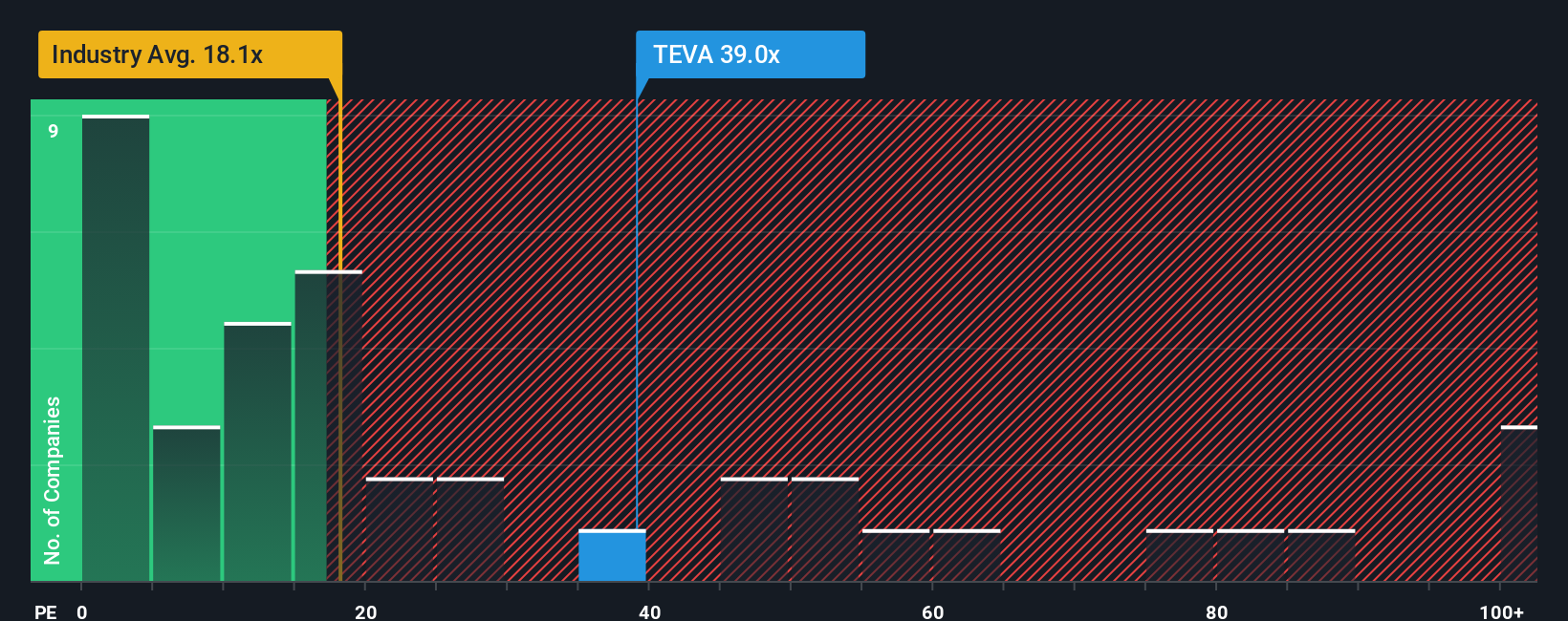

Step away from the fair value narrative and Teva suddenly looks pricey. At around 48 times earnings versus a 19.7 times industry average, and a fair ratio of 29.8 times, the stock trades at a rich premium that could unwind quickly if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Teva Pharmaceutical Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Teva Pharmaceutical Industries Narrative

If you see the story differently or prefer your own due diligence, you can build a fresh, personalized view in just minutes: Do it your way.

A great starting point for your Teva Pharmaceutical Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Teva may be front of mind today, but smart portfolios are built from many edges, so use the Simply Wall Street Screener to lock in your next opportunities.

- Capture mispriced potential before the crowd by scanning these 909 undervalued stocks based on cash flows that pair solid fundamentals with attractive entry points.

- Ride structural growth trends in automation and machine learning by targeting these 25 AI penny stocks positioned to benefit from surging demand for intelligent software and infrastructure.

- Boost your income stream and reinvestment power with these 12 dividend stocks with yields > 3% offering yields above 3 percent backed by dependable cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報