Is It Time To Reassess Waste Management After Its Recent Share Price Dip?

- If you have ever wondered whether Waste Management is still a buy at around $209 a share, you are not alone. Many long term investors are asking the same question about its current value.

- The stock has dipped about 3.2% over the last week but is still up 4.3% over the past month, adding to an impressive 31.6% gain over 3 years and 94.9% over 5 years. This pattern suggests the market still sees long term strength despite short term wobble.

- Recently, Waste Management has stayed in the spotlight as investors focus on the growing importance of reliable waste and recycling infrastructure, especially in fast growing urban areas and industrial regions. In addition, the company continues to be discussed in the context of long term environmental and sustainability trends, which many see as structural tailwinds for its core business rather than a passing theme.

- Right now, Waste Management scores a 3 out of 6 on our valuation checks, suggesting it may be undervalued on some metrics but not all. In the sections that follow we will unpack those different valuation approaches while also hinting at a more insightful way to think about fair value by the end of the article.

Approach 1: Waste Management Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in dollar terms.

For Waste Management, the model starts with last twelve months free cash flow of about $2.37 billion and then uses analyst forecasts and longer-term extrapolations to build a two-stage Free Cash Flow to Equity profile. Analyst projections and Simply Wall St estimates see free cash flow rising to around $5.36 billion by 2035, with intermediate milestones such as roughly $4.51 billion expected in 2029 as cash generation steadily compounds.

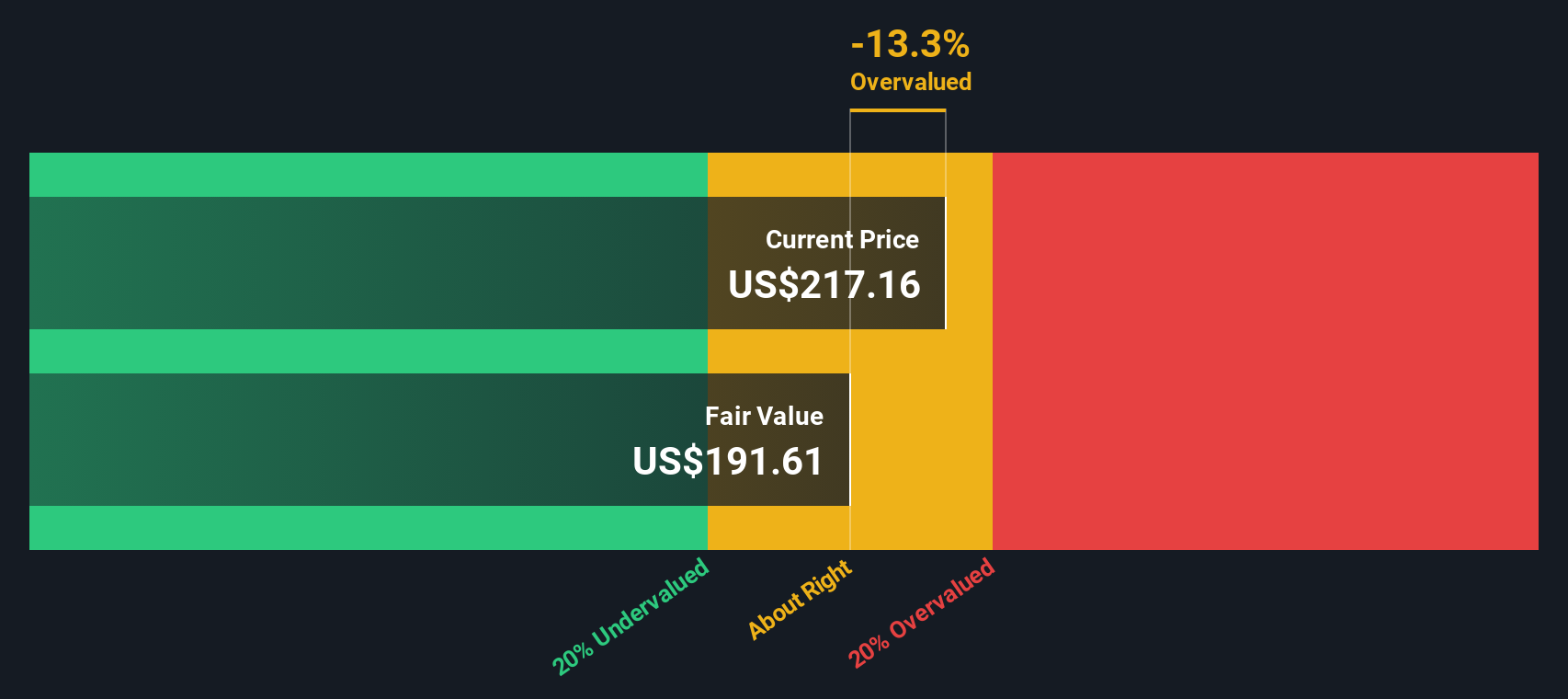

When all those future cash flows are discounted back to today, the DCF model arrives at an intrinsic value of about $241.82 per share. Compared with the current price around $209, this indicates the stock is roughly 13.5% undervalued on a cash flow basis, which points to a potential margin of safety for long-term investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Waste Management is undervalued by 13.5%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Waste Management Price vs Earnings

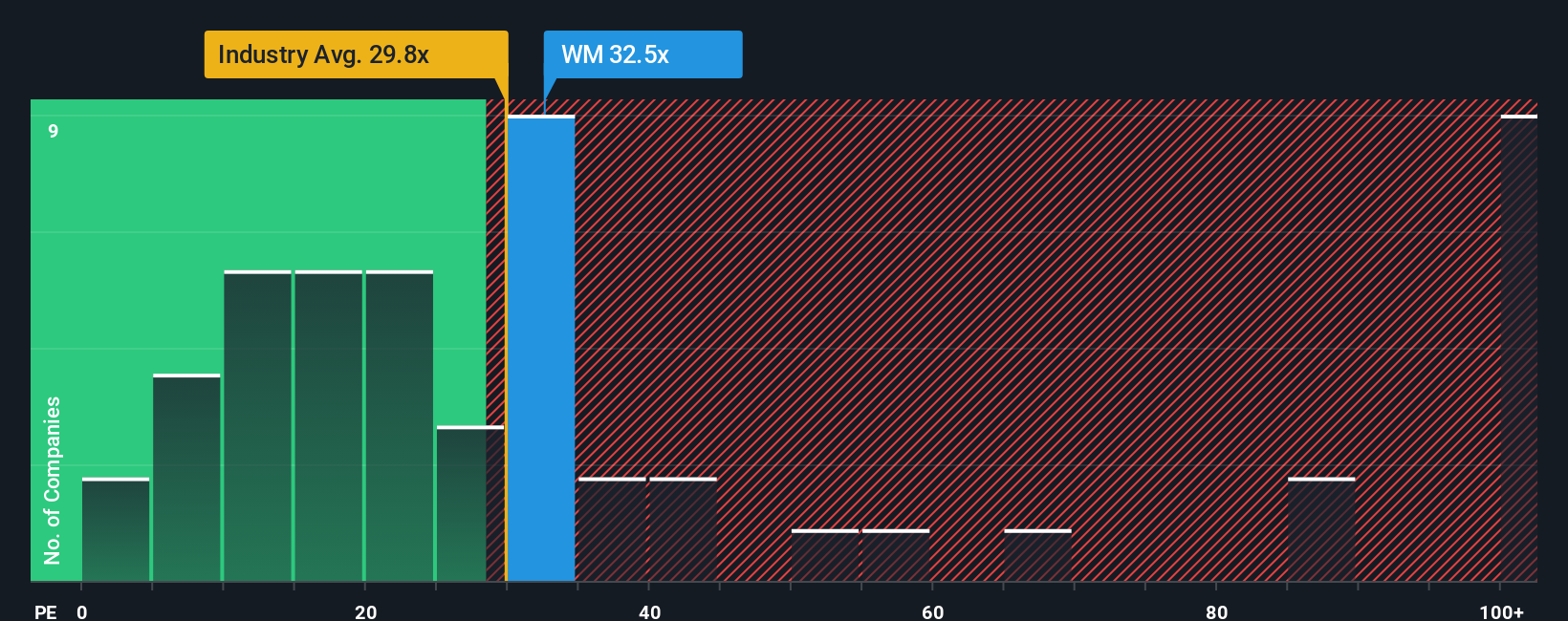

For a mature, consistently profitable business like Waste Management, the price to earnings ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current profit. In general, companies with stronger, more reliable growth and lower perceived risk can justify higher PE ratios, while slower growing or riskier businesses usually deserve lower ones.

Waste Management currently trades on a PE of about 32.9x, which is well above the Commercial Services industry average of roughly 24.3x but still below the 45.2x average of its closest peers. Simply Wall St also calculates a Fair Ratio of 35.2x, a proprietary estimate of what a reasonable PE should be after accounting for the company’s specific earnings growth outlook, margins, risk profile, industry dynamics and market cap. This tailored Fair Ratio is more informative than a simple industry or peer comparison because it adjusts for the fact that not all Commercial Services companies have the same quality or prospects. With the current PE sitting below the 35.2x Fair Ratio, Waste Management appears modestly undervalued on this earnings based lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Waste Management Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Waste Management’s future with the numbers behind revenue, earnings, margins and ultimately fair value. A Narrative is your story about the company, translated into a financial forecast that then produces a fair value you can directly compare to today’s share price to decide whether it looks like a buy, a hold or a sell. On Simply Wall St, millions of investors build and explore Narratives on the Community page, where each Narrative is updated dynamically as new information like earnings, news or guidance comes in, so your story and valuation do not stand still. For example, one Waste Management Narrative might assume successful network expansion, rising margins and a fair value near the most bullish target of about $277, while a more cautious Narrative might focus on regulatory risks and softer recycling prices and land closer to the bearish end around $198. Comparing either of these fair values to the current market price helps you quickly see which story you think is more realistic and what to do next.

Do you think there's more to the story for Waste Management? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報