Is BAC Stock Still Attractive After a 22% 2025 Rally?

- Wondering if Bank of America is still worth buying after its big run, or if you are late to the party? This breakdown will help you decide whether the current price stacks up to the underlying value.

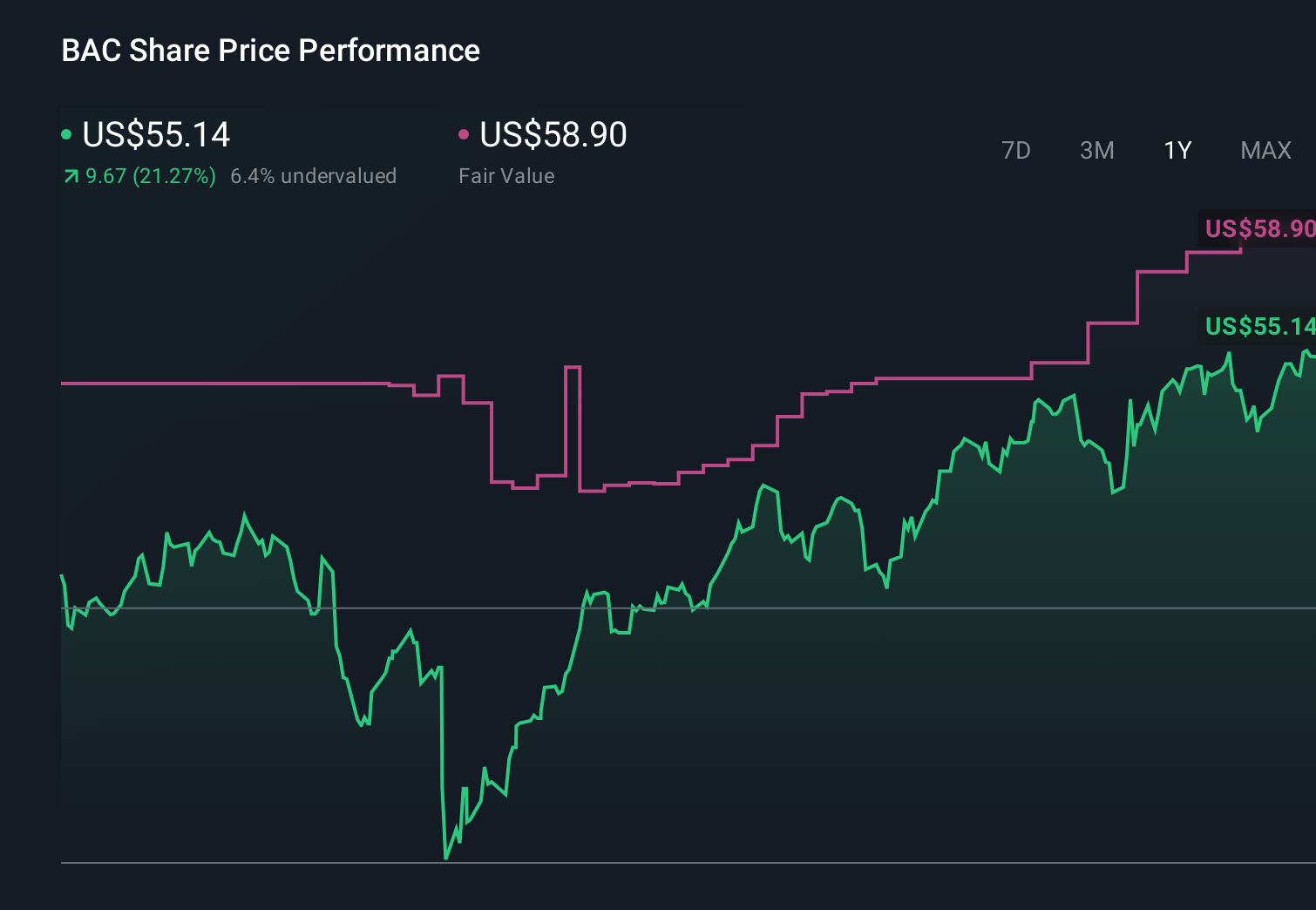

- From a recent close of $54.08, the stock is up 22.1% year to date and 112.5% over 5 years. This signals that investors have been steadily re-rating the bank despite a flatter 7-day performance and a modest 1-month move of 1.2%.

- That strength has come as markets have priced in a more resilient US consumer, improving credit quality, and hopes that interest rates will eventually settle at levels that still support bank profitability. In addition, ongoing cost cutting, digital adoption, and tighter capital discipline have all helped convince investors that large banks like Bank of America can grow earnings without taking on as much risk as in past cycles.

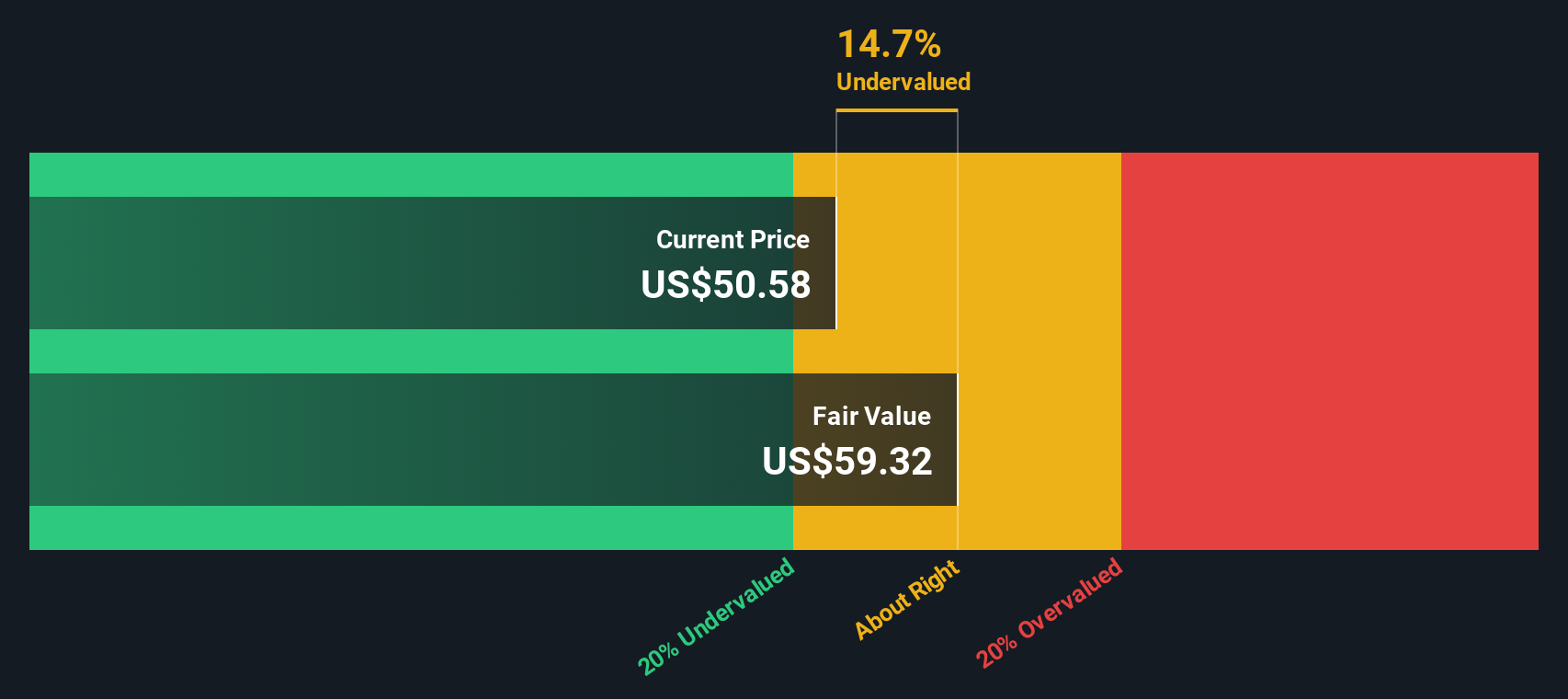

- Even with that backdrop, Bank of America only scores a 3/6 on our valuation checks. This means some metrics flag it as undervalued while others look more fully priced. Next, we will unpack what the main valuation methods say about BAC today and then finish with a more holistic way to think about its real worth.

Find out why Bank of America's 20.1% return over the last year is lagging behind its peers.

Approach 1: Bank of America Excess Returns Analysis

The Excess Returns model looks at how efficiently Bank of America turns shareholder capital into profits, and then compares those returns to the bank's cost of equity. Instead of focusing on short term earnings swings, it asks whether the bank can consistently earn more on its equity than investors require as compensation for risk.

For Bank of America, book value sits at about $37.95 per share, with a stable earnings power estimate of $4.57 per share, based on future return on equity forecasts from 11 analysts. The bank's cost of equity is estimated at $3.65 per share. This implies an excess return of roughly $0.91 per share, supported by an average return on equity of 11.16%. Looking ahead, stable book value is projected to grow to $40.94 per share, drawing on estimates from 14 analysts.

Putting these inputs together, the Excess Returns model points to an intrinsic value of roughly $57.07 per share. Compared with the recent price of $54.08, that indicates the shares are about 5.2% undervalued, which is close enough to describe them as broadly fairly priced with a slight upside bias.

Result: ABOUT RIGHT

Bank of America is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

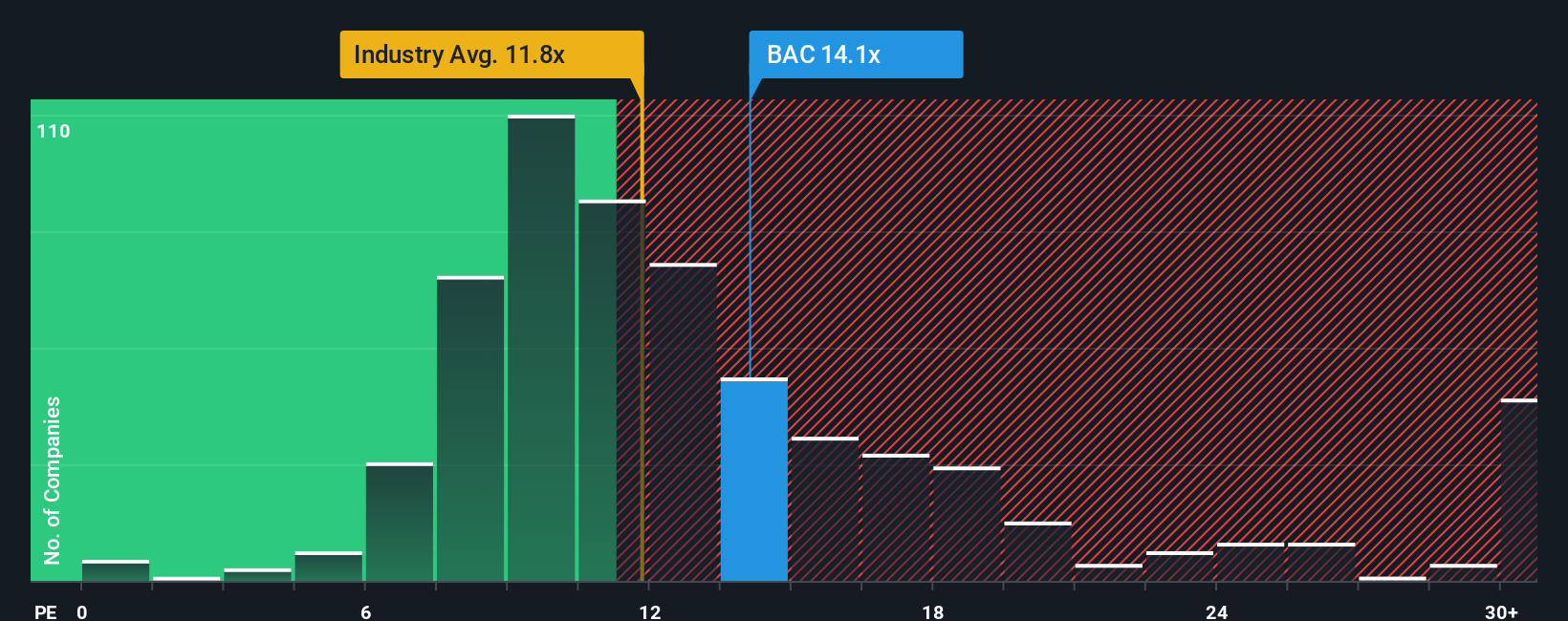

Approach 2: Bank of America Price vs Earnings

For a consistently profitable bank like Bank of America, the price to earnings, or PE, ratio is a practical way to judge whether the market price makes sense relative to the profits it generates. In general, faster earnings growth and lower perceived risk justify a higher PE, while slower growth and higher risk tend to push a fair multiple down.

Bank of America currently trades on a PE of about 14x, which is modestly above the broader Banks industry average of roughly 11.9x and roughly in line with the peer average of about 14x. Simply Wall St also calculates a proprietary Fair Ratio of 16.33x for Bank of America, which represents the PE you might expect once you factor in its earnings growth outlook, profitability, industry, size and risk profile.

This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for company specific characteristics, rather than assuming all banks deserve the same multiple. With Bank of America trading around 14x versus a Fair Ratio of 16.33x, the shares screen as moderately undervalued on a PE basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bank of America Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Bank of America’s story with a concrete forecast for its future revenues, earnings, margins and ultimately a Fair Value. On Simply Wall St’s Community page, millions of investors use Narratives to write down their assumptions, translate those into financial projections, and then see what price those assumptions imply. This makes it much easier to compare Fair Value to today’s share price and decide whether they should buy, hold, or sell. Because Narratives update dynamically when new information like earnings, regulatory changes, or big news hits, your Fair Value estimate automatically reflects the latest data instead of going stale. For example, one Bank of America Narrative on the platform assumes stronger digital growth, resilient net interest income and a Fair Value near $59 per share, while a more cautious Narrative, which bakes in regulatory and recession risks, lands closer to $43. This shows how different but reasonable stories can lead to very different investment decisions.

For Bank of America however we'll make it really easy for you with previews of two leading Bank of America Narratives:

Fair value: $58.90 per share

Implied undervaluation: 8.2% versus the recent $54.08 price

Forecast revenue growth: 7.8% a year

- Leans on digital engagement, AI driven efficiencies, and higher quality loan growth to support steady revenue and margin expansion.

- Assumes ongoing buybacks and disciplined capital management will lift earnings per share and help the stock track analyst targets.

- Sees the current price as broadly in line with consensus fair value, with modest upside if execution and macro conditions cooperate.

Fair value: $43.34 per share

Implied overvaluation: 24.8% versus the recent $54.08 price

Forecast revenue growth: 10.6% a year

- Recognises BAC’s strong brand, net interest income tailwinds, and digital progress but stresses that sector risks and sentiment remain fragile.

- Highlights regulatory, macroeconomic, and political uncertainty, along with the signalling risk if Berkshire Hathaway accelerates selling.

- Applies more conservative long term growth and valuation multiples, which pull fair value well below the current share price.

Do you think there's more to the story for Bank of America? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報