Reassessing Pool (POOL): Valuation After Stabilizing Q3 2025 Results and Reaffirmed EPS Guidance

Pool (POOL) just delivered Q3 2025 results that back up the stabilization story investors have been waiting for, with building materials revenue finally growing year over year and margins moving higher.

See our latest analysis for Pool.

The stock has been under pressure for most of the year, with a roughly 27.7 percent year to date share price decline and a 33.8 percent drop in one year total shareholder return. However, today’s post earnings bounce hints that sentiment may be starting to turn as investors reassess Pool’s recovery potential and risk profile.

If Pool’s reset has you rethinking where growth and resilience might come from next, it could be worth exploring fast growing stocks with high insider ownership as a source of fresh ideas.

With shares still well below analyst targets and fundamentals stabilizing, investors now face a key question: Is Pool quietly undervalued after a painful reset, or is the recent bounce already pricing in the next leg of growth?

Most Popular Narrative Narrative: 27.8% Undervalued

With Pool last closing at $240.58 against a narrative fair value in the low $330s, the spread points to a sizable upside gap that hinges on steady, compounding fundamentals rather than a rapid rebound story.

The analysts have a consensus price target of $333.273 for Pool based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $375.0, and the most bearish reporting a price target of just $285.0.

Curious why a mature distributor gets a premium future earnings multiple and baked in margin expansion, even as growth lags the broader market? The narrative leans on a slow build of revenue, a gentle but persistent lift in profitability, and a valuation multiple that usually belongs to faster growing sectors. Want to unpack how those moving parts combine into that fair value target, and what has to go right along the way? Dive in to see the full set of assumptions driving this call.

Result: Fair Value of $333.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing market weakness and inflation driven cost pressures could cap Pool’s growth and margins, challenging assumptions embedded in the bullish valuation narrative.

Find out about the key risks to this Pool narrative.

Another Lens on Valuation

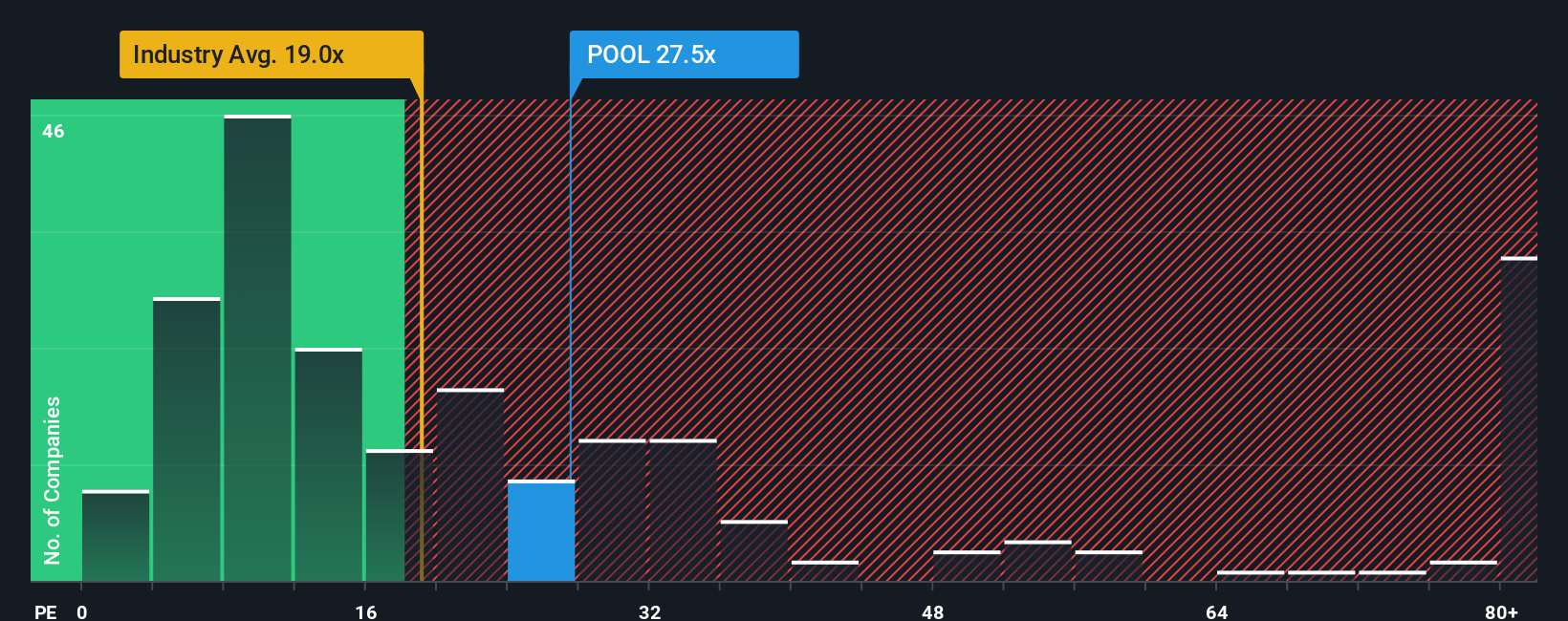

On earnings, the picture looks less generous. Pool trades on a 21.9x price to earnings ratio, richer than the global retail distributors average of 18x and well above a 15.5x fair ratio that our models suggest the market could drift toward. Is today’s discount really upside, or just less downside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pool Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a full narrative in just a few minutes: Do it your way.

A great starting point for your Pool research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next move?

Do not stop at one opportunity. Use the Simply Wall St Screener today to uncover focused stock ideas that could reshape your portfolio’s next chapter.

- Capture potential mispricings by targeting companies trading below their cash flow value with these 904 undervalued stocks based on cash flows and position yourself ahead of a possible rerating.

- Ride structural shifts in automation and machine learning through these 25 AI penny stocks, where innovation and earnings momentum often collide.

- Lock in dependable cash returns with these 12 dividend stocks with yields > 3%, focusing on businesses that offer attractive income without abandoning balance sheet strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報