Is Elevance Health a Hidden Bargain After Recent 12.3% Share Price Rebound?

- If you are wondering whether Elevance Health at around $341 a share is a bargain hiding in plain sight or a value trap in slow motion, you are not alone. This is exactly the kind of stock where valuation really matters.

- Over the last month the stock has climbed about 12.3%, including a 3.1% gain in just the past week, even though it is still down 6.8% year to date and about 9.8% over the last year after a tougher three-year stretch.

- That turnaround in momentum has come as investors refocus on Elevance Health as a defensive healthcare name with scale, disciplined capital allocation and ongoing share repurchases, rather than a pure growth story. At the same time, shifting views on US healthcare policy and managed care competition have nudged risk perceptions. This helps to explain both the prior slide and the recent rebound.

- On our valuation framework Elevance scores a solid 5 out of 6, suggesting it screens as undervalued on most of the key checks we run. Next we will break down what different valuation methods say about the stock, before finishing with a more holistic way to decide what it is really worth.

Approach 1: Elevance Health Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in dollar terms.

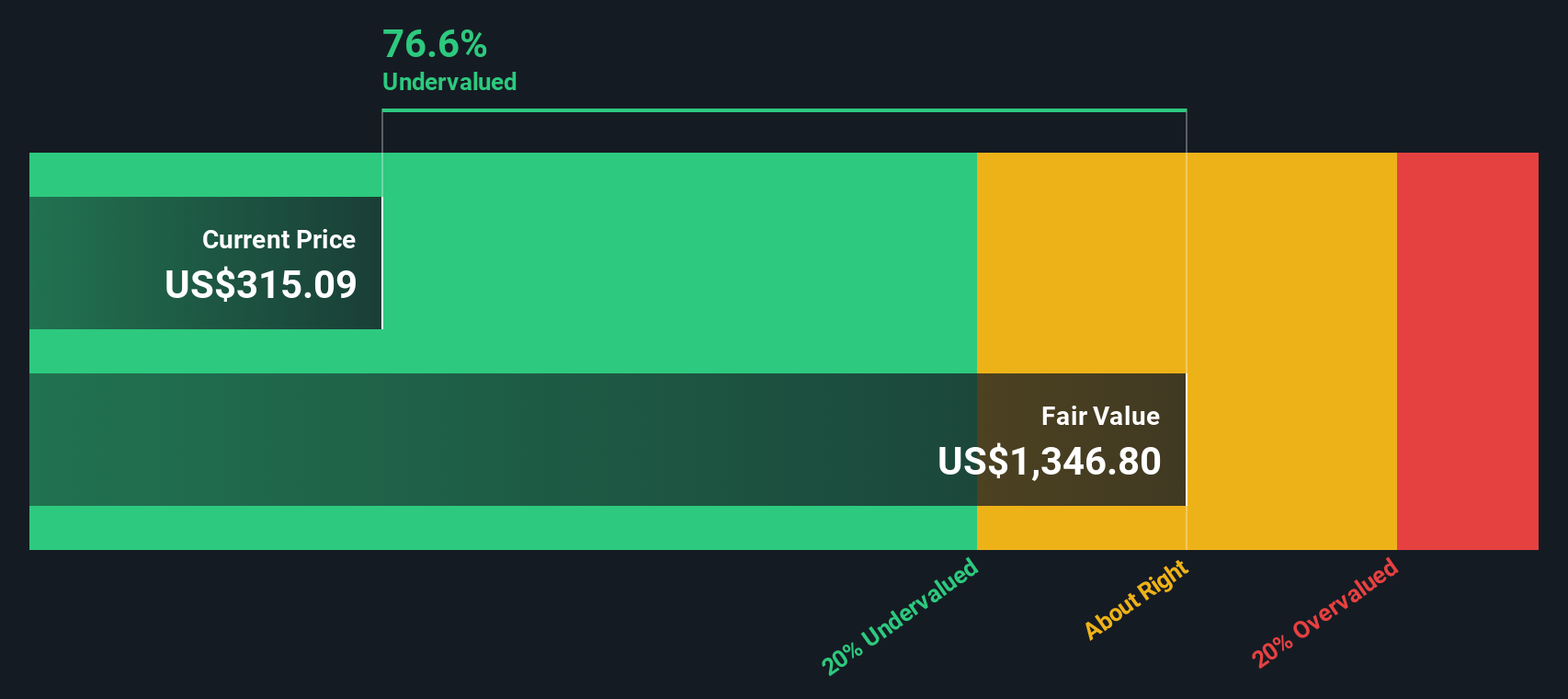

For Elevance Health, the latest twelve months Free Cash Flow is about $3.6 billion. Analysts provide detailed forecasts for the next few years. Beyond that point, Simply Wall St extrapolates the trend to build a 2 Stage Free Cash Flow to Equity model. Under this framework, Elevance’s annual Free Cash Flow is projected to rise to roughly $12.4 billion by 2035, with intermediary steps such as about $6.4 billion in 2026 and $8.7 billion by 2029, reflecting a healthy but moderating growth profile as the business matures.

When these future cash flows are discounted back to today, the model arrives at an intrinsic value of around $1,082 per share. Compared with the current share price near $341, the DCF implies the stock is about 68.5% undervalued, suggesting that the market is pricing Elevance far below its long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Elevance Health is undervalued by 68.5%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: Elevance Health Price vs Earnings

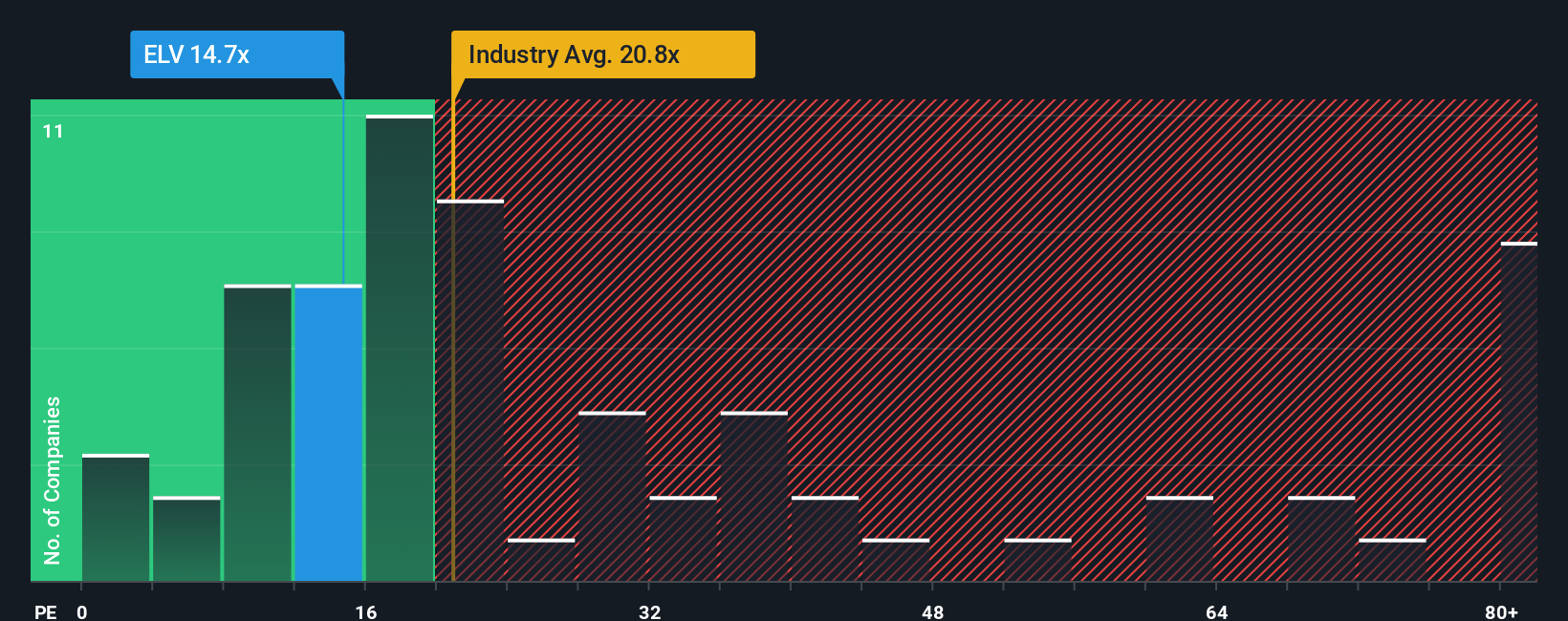

For a consistently profitable company like Elevance Health, the Price to Earnings, or PE, ratio is a useful way to gauge what investors are paying today for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty pull a fair PE down.

Elevance currently trades on a PE of about 13.7x, which is well below both the broader Healthcare industry average of roughly 23.3x and a peer group average near 23.2x. On the surface that discount suggests the market is applying a relatively cautious view to Elevance’s future earnings power compared with other managed care and healthcare names.

Simply Wall St also estimates a Fair Ratio of around 32.3x, a proprietary take on what Elevance’s PE should be after accounting for its earnings growth outlook, profitability, industry positioning, market cap and company specific risks. This Fair Ratio goes a step beyond simple peer comparisons, which can be skewed by outliers or differences in business mix. Set against Elevance’s current 13.7x PE, the Fair Ratio points to the shares trading at a meaningful discount.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Elevance Health Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Elevance Health’s business to a set of forecasts and a fair value estimate. A Narrative is the story you believe about a company, translated into numbers like future revenue, earnings and margins, so you can see how your expectations flow through to a fair value which you can then compare with today’s share price. On Simply Wall St, Narratives live inside the Community page and are used by millions of investors as an easy, guided tool to decide whether a stock looks like a buy, hold or sell, based on how far their Fair Value sits above or below the current Price. Because Narratives update dynamically when new information, such as earnings results or regulatory news, comes in, your valuation view does not stay static or stale. For Elevance Health, one investor might build a cautious Narrative around prolonged Medicaid pressures and arrive at a fair value near $297, while another leans into Medicare Advantage growth and efficiency gains to justify a much higher fair value closer to $507.

Do you think there's more to the story for Elevance Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報