Assessing Sano Bruno's Enterprises (TASE:SANO1) Valuation After Strong Q3 Profitability Despite Softer Sales

Sano Bruno's Enterprises (TASE:SANO1) just reported third quarter and nine month results that showed higher net income and earnings per share, despite slightly softer sales. This puts profitability firmly in focus for anyone watching the stock.

See our latest analysis for Sano Bruno's Enterprises.

The latest earnings beat on profitability comes as the share price trades at ₪417, with a solid 90 day share price return of 23.56% and a three year total shareholder return of 84.33% suggesting momentum is still building.

If Sano Bruno's steady earnings and upcoming dividend have you in research mode, this could be a good moment to broaden your watchlist and uncover fast growing stocks with high insider ownership.

Yet with the shares up sharply and trading close to some estimates of intrinsic value, investors now face a key question: Is Sano Bruno's still a buying opportunity, or has the market already priced in future growth?

Price-to-Earnings of 17.8x: Is it justified?

On a last close of ₪417, Sano Bruno's Enterprises trades on a price to earnings ratio of 17.8 times, which looks roughly in line with peers rather than obviously cheap or expensive.

The price to earnings multiple compares what investors pay today for each unit of current earnings. This can make it a useful gauge for a mature, profit generating household products business like Sano Bruno's.

Here, the stock's 17.8 times price to earnings ratio sits just below both the Israeli Household Products industry average of 18 times and the broader Asian Household Products industry average of 18 times. This hints that the market is valuing its earnings stream very similarly to comparable companies rather than assigning a significant premium or discount.

Given that context, the current valuation suggests investors are paying a going rate for Sano Bruno's earnings, with neither exuberant optimism nor deep pessimism reflected in the multiple when set against sector benchmarks.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 17.8x (ABOUT RIGHT)

However, rising competition and any slowdown in consumer spending could pressure margins and stall the steady earnings trajectory that investors are currently banking on.

Find out about the key risks to this Sano Bruno's Enterprises narrative.

Another Angle, Using Our DCF Model

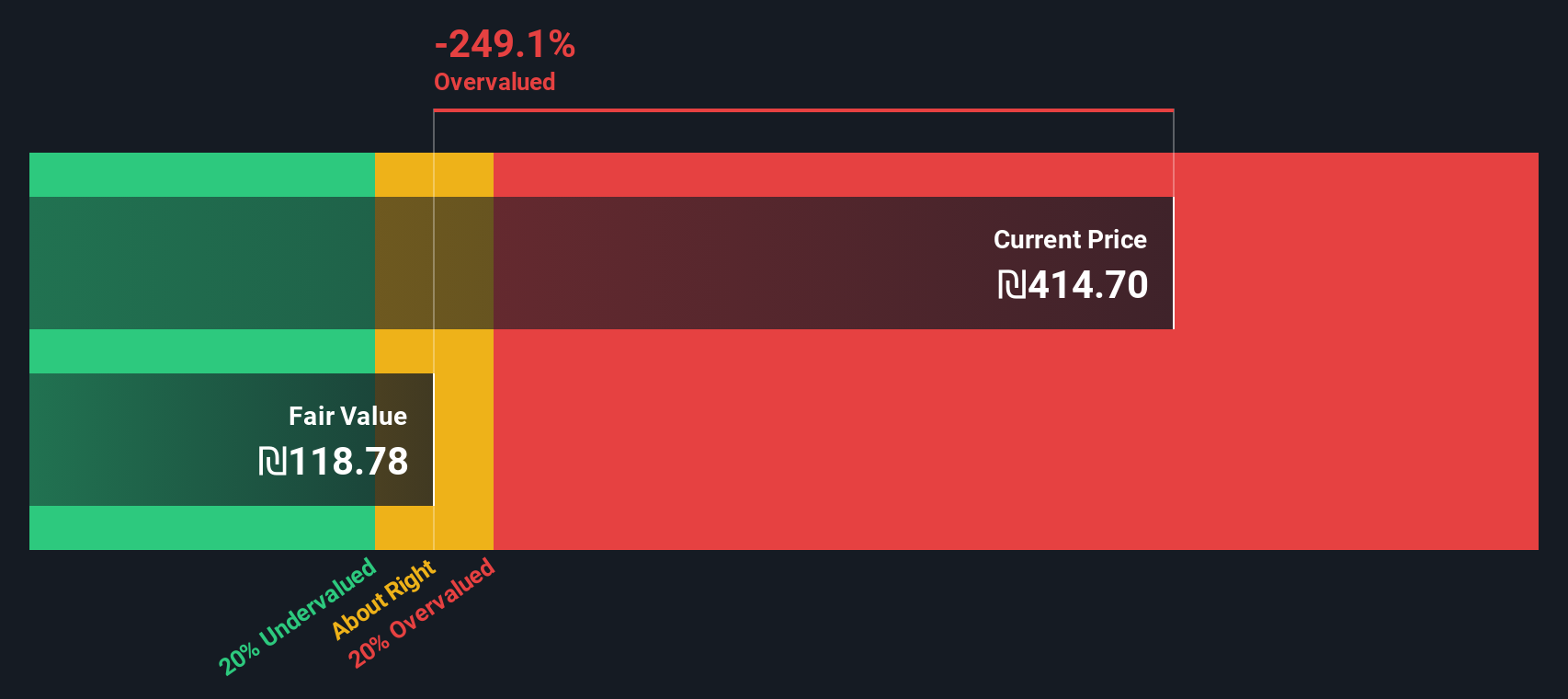

While the price to earnings ratio looks roughly fair, our DCF model presents a more cautious perspective. With SANO1 trading around ₪420 versus an estimated fair value of ₪118.78, the shares appear materially overvalued, raising the question of how much future growth is already priced in.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sano Bruno's Enterprises for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sano Bruno's Enterprises Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes using Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Sano Bruno's Enterprises.

Ready for your next investing move?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall Street's screener so you are not chasing the market later.

- Capture potential bargains early by reviewing these 904 undervalued stocks based on cash flows that strong cash flows suggest the market has not fully appreciated yet.

- Ride powerful tech trends by zeroing in on these 25 AI penny stocks positioned at the heart of the artificial intelligence acceleration.

- Strengthen your income strategy by focusing on these 12 dividend stocks with yields > 3% that can help support more reliable, long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報