Baidu (NasdaqGS:BIDU): Revisiting Valuation After a Strong Year-to-Date Rally and Recent Pullback

Baidu (BIDU) has quietly outperformed many Chinese tech peers this year, with the stock up over 50% year-to-date, even as its past month pullback raises fresh questions about valuation and growth durability.

See our latest analysis for Baidu.

Baidu’s latest pullback looks more like a breather than a reversal, with a 7 day share price return of 7.49% and year to date share price gain above 50% signalling still strong, but not runaway, momentum compared with its mixed longer term total shareholder returns.

If Baidu’s run has you rethinking your tech exposure, this could be a good moment to explore other high growth themes through high growth tech and AI stocks and see what else is starting to gain traction.

With earnings now growing faster than revenue and the share price still trading at a discount to analyst targets, is Baidu an overlooked value play in Chinese AI, or is the market already pricing in its next phase of growth?

Most Popular Narrative Narrative: 16.9% Undervalued

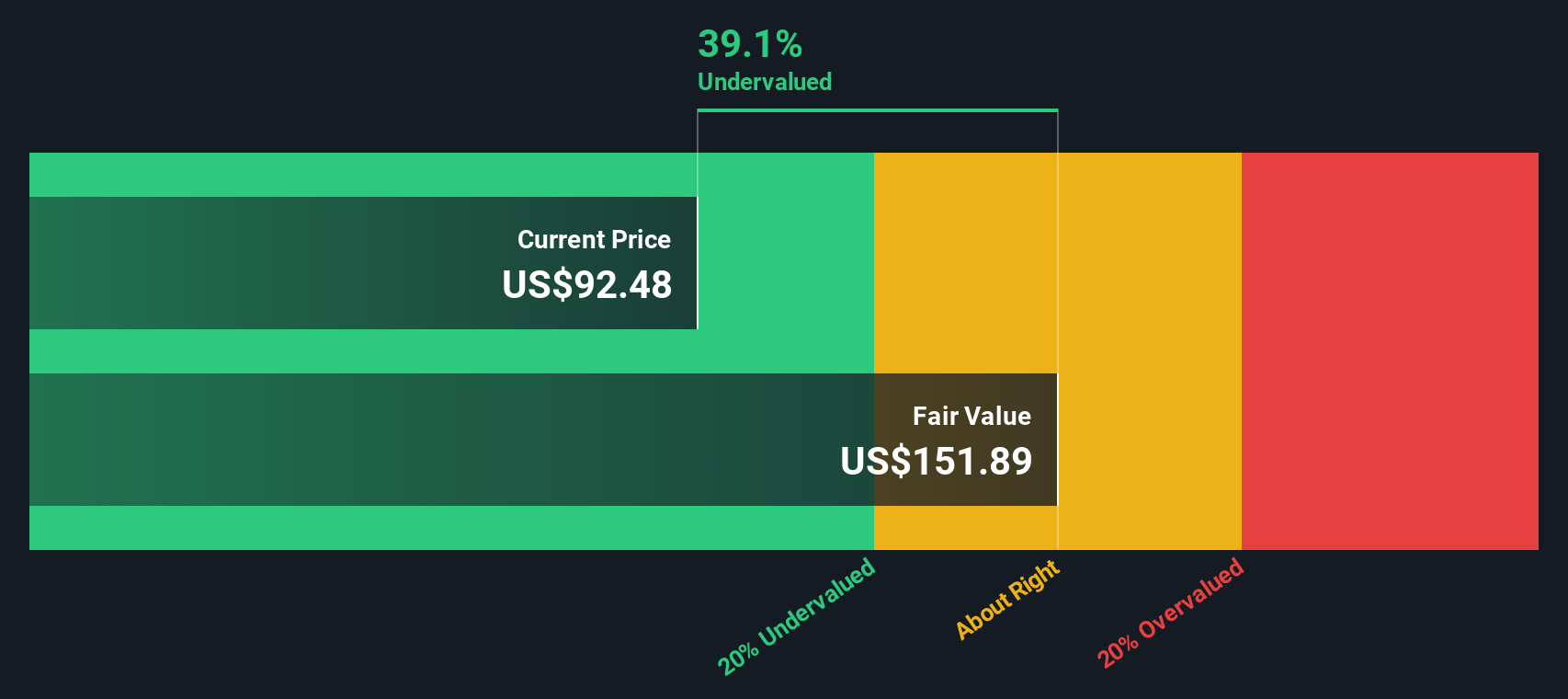

With Baidu last closing at $126.07 versus a narrative fair value near $152, the story centers on AI driven growth outrunning today’s price.

The commercialization and global expansion of Apollo Go (autonomous driving) through capital efficient, asset light partnerships with Uber, Lyft, and major international markets introduces high margin, recurring revenue streams. Successful execution could diversify income, support higher net margins, and unlock significant long term profit growth. Early, but promising, AI Search monetization testing (via agents and digital humans) is expanding Baidu's ad inventory and potential for cost per service revenue, even in hard to monetize queries. Once scaled, this transformation could meaningfully improve core advertising revenue and overall earnings leverage.

Curious how this vision justifies a richer future multiple? The narrative leans on powerful earnings growth, reshaped margins, and a bolder long term profit profile. Want the full blueprint?

Result: Fair Value of $152 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering ad weakness and heavy AI investment could delay monetization, squeeze margins, and challenge the case for a sustainably higher multiple.

Find out about the key risks to this Baidu narrative.

Another Angle on Value

Our DCF model paints a cooler picture, putting Baidu’s fair value nearer $100, below the current $126 price. That suggests the narrative fair value near $152 might be leaning on more optimistic growth and margin paths than the cash flows currently support.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Baidu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Baidu Narrative

If this perspective does not fully resonate or you prefer to dive into the numbers yourself, you can build a fresh narrative in under three minutes, starting with Do it your way.

A great starting point for your Baidu research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by using the Simply Wall St Screener to uncover focused opportunities that most investors are still overlooking.

- Capitalize on potential mispricings by zeroing in on these 903 undervalued stocks based on cash flows that the market has yet to fully recognize.

- Ride structural shifts in healthcare by targeting these 30 healthcare AI stocks that blend medical expertise with next generation algorithms.

- Position yourself early in the digital asset ecosystem with these 81 cryptocurrency and blockchain stocks that are building real businesses around blockchain and cryptocurrencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報