Abercrombie & Fitch (ANF) Valuation Check After Fed Rate Cut Rally and Tech-Driven Growth Optimism

The latest Federal Reserve rate cut lit a fire under Abercrombie & Fitch (ANF), with shares jumping as investors leaned into interest rate sensitive retail names and revisited the company’s improving sales and technology-driven execution.

See our latest analysis for Abercrombie & Fitch.

That surge comes on top of a powerful 1 month share price return of roughly 49 percent, yet the stock is still down sharply year to date even after record sales, tech upgrades like the Nedap iD Cloud rollout, and ongoing buybacks. Momentum looks to be rebuilding after a rough patch.

If ANF’s rebound has you rethinking where growth and execution might show up next, it could be a good moment to explore fast growing stocks with high insider ownership.

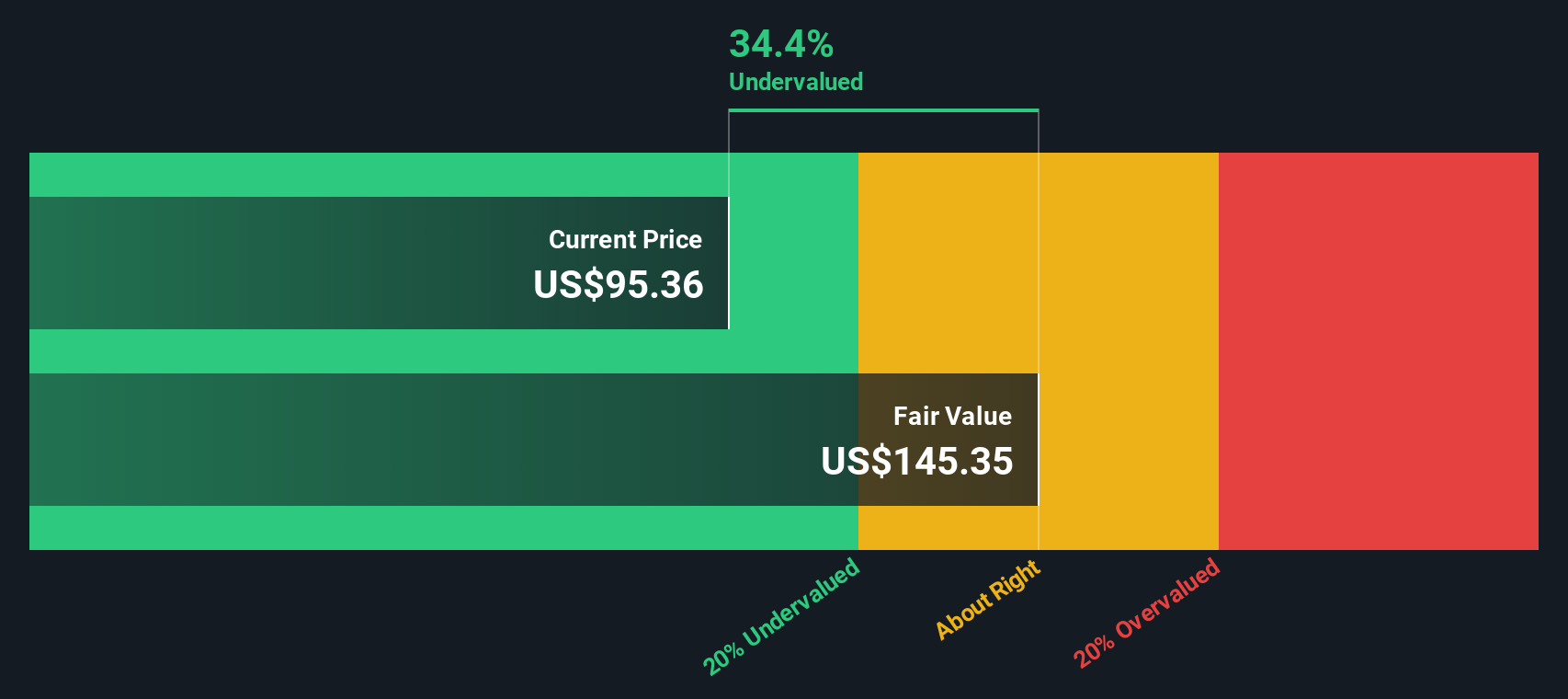

With ANF now trading just shy of analyst targets after a sharp rebound, are investors still overlooking its earnings power and digital gains, or is the market already factoring in most of the retailer’s next leg of growth?

Most Popular Narrative Narrative: 30% Undervalued

With Abercrombie & Fitch’s fair value estimate near $107 versus a last close of $107.06, the most followed narrative still sees meaningful upside built into the long term math.

Consistently high free cash flow and a continued share repurchase program (~$250M already repurchased in the year, targeting $400M for FY25), combined with top tier operating margins and prudent capital allocation, are set to boost earnings per share and unlock further value for shareholders.

Want to see what kind of revenue trajectory and future margins could justify that gap between price and value, and how aggressive the buyback assumptions really are? Read on to unpack the blueprint behind this fair value call and the profit multiple it leans on, then decide whether those expectations feel realistic or too bold.

Result: Fair Value of $107.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff headwinds and weaker Abercrombie brand sales could pressure margins and test how durable that earnings and buyback thesis really is.

Find out about the key risks to this Abercrombie & Fitch narrative.

Another Angle on Value

While the narrative leans on earnings power and buybacks, our SWS DCF model paints a cooler picture, with ANF trading above an estimated fair value of about $101.97. This suggests the shares may be slightly overvalued rather than 30 percent undervalued. Which story do you trust more: the cash flow math or the multiple based optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Abercrombie & Fitch for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Abercrombie & Fitch Narrative

If this view does not quite match your own or you would rather dig into the numbers yourself, you can build a custom take in minutes: Do it your way.

A great starting point for your Abercrombie & Fitch research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one compelling story. Use the Simply Wall Street Screener now to pinpoint fresh opportunities before other investors move in.

- Unlock income potential by reviewing these 12 dividend stocks with yields > 3% that can strengthen a long term, yield focused portfolio.

- Target innovation by scanning these 26 AI penny stocks that could reshape how businesses operate and scale earnings.

- Hunt for mispriced opportunities through these 904 undervalued stocks based on cash flows that may offer attractive upside based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報