Applied Materials (AMAT): Valuation Check After Analyst Upgrades and AI-Fueled Earnings Momentum

Applied Materials (AMAT) just stepped back into the spotlight after a fresh wave of bullish analyst calls built on strong earnings, accelerating DRAM and foundry demand, and heavy institutional buying interest around the AI semiconductor buildout.

See our latest analysis for Applied Materials.

That bullish setup has been mirrored in the tape, with the share price climbing to about $275 and delivering a powerful 30 day share price return of 17 percent and a 90 day share price return of nearly 62 percent. The 5 year total shareholder return above 220 percent underlines how long term momentum is still very much intact.

If you are weighing how AMAT fits into the broader AI hardware boom, this is a good moment to scan other high growth opportunities across high growth tech and AI stocks.

Yet with AMAT now trading above many analyst targets after a blistering run, the key question is simple: are investors still getting in ahead of the next leg of AI driven growth, or is the future already priced in?

Most Popular Narrative Narrative: 14% Overvalued

Compared with the last close at $275.15, the most followed narrative pegs Applied Materials’ fair value noticeably lower, framing a premium AI expectations story.

Structural growth in AI and high performance computing is reshaping semiconductor demand, driving heavy investments in advanced chip architectures such as gate all around (GAA) transistors, high bandwidth memory (HBM), and advanced packaging. Applied is set to benefit from these device inflections due to its leadership in materials engineering and strong customer adoption of new process technologies, which are expected to deliver outsized revenue and market share gains as these nodes ramp from 2026 onward.

Curious how this story turns future AI chip cycles into today’s premium price tag, the narrative leans on ambitious revenue, margin, and earnings upgrades. If you want the full playbook, including the profit multiple they think the market will still pay for AMAT in a few years, read on and see how those moving parts lock together.

Result: Fair Value of $241.69 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent China export uncertainty and intensifying equipment competition could derail those upbeat forecasts, putting pressure on AMAT’s market share and valuation assumptions.

Find out about the key risks to this Applied Materials narrative.

Another View: Earnings Multiple Sends a Softer Signal

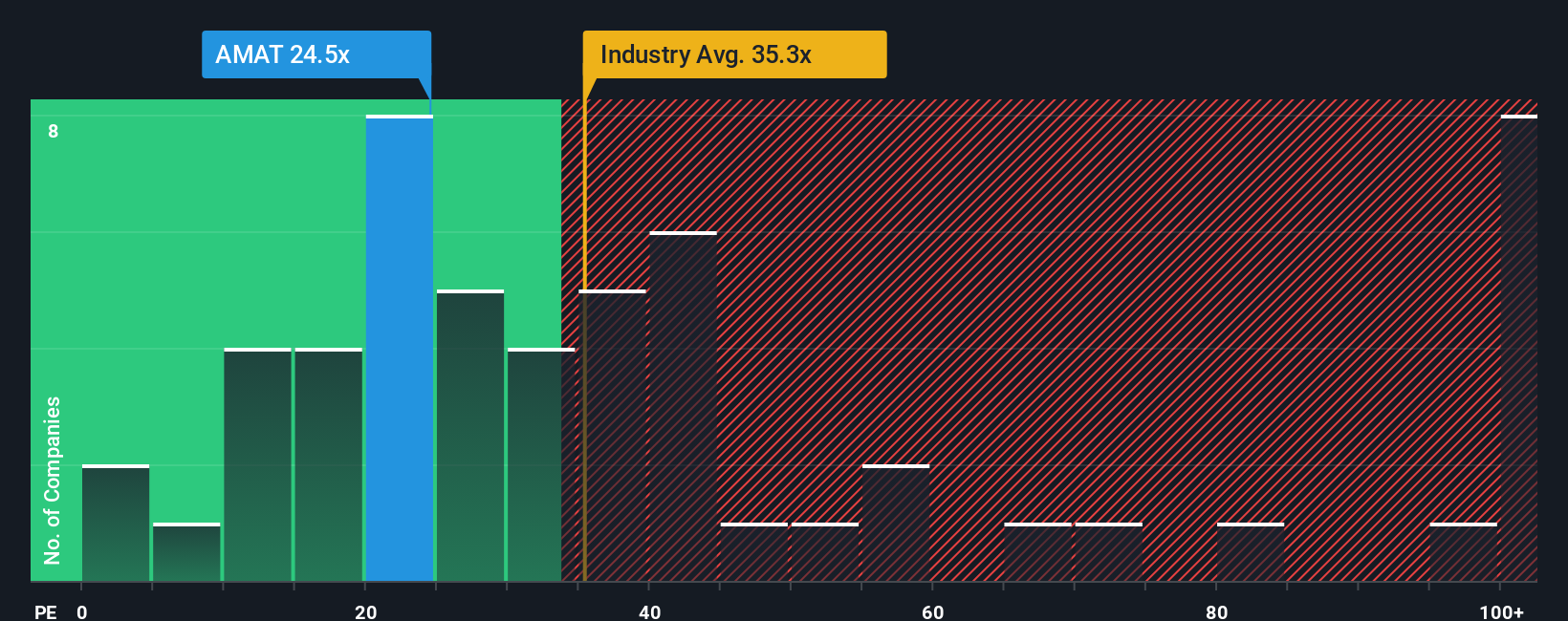

While the narrative based fair value points to AMAT being 14 percent overvalued, its 31.3x price to earnings ratio actually sits well below US semiconductor peers at 38.1x and only slightly above its fair ratio of 29.6x. This suggests a thinner valuation cushion than the story implies.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Materials Narrative

If you want to challenge these assumptions or dig into the numbers yourself, you can build a personalized view of AMAT in minutes: Do it your way.

A great starting point for your Applied Materials research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas worth your attention?

Before the next AI wave moves the market again, use the Simply Wall Street Screener to pinpoint your next opportunity with data backed conviction and clarity.

- Capitalize on mispriced quality by targeting these 907 undervalued stocks based on cash flows that the market has not fully recognized yet, before sentiment and prices catch up.

- Ride the next leg of the AI revolution by focusing on these 26 AI penny stocks positioned to benefit from surging demand for intelligent software and infrastructure.

- Strengthen your income strategy with these 12 dividend stocks with yields > 3% that can enhance portfolio yield while keeping fundamentals and sustainability in focus.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報