Did Goldman’s Upgrade and Pricing Focus Just Shift Viking Holdings' (VIK) Investment Narrative?

- Earlier this week, Goldman Sachs upgraded Viking Holdings to Buy, pointing to the cruise operator’s differentiated geographic exposure and focus on higher-income travelers as strengths amid concerns about Caribbean capacity.

- The bank also emphasized Viking’s pricing power and potential future capital returns program, suggesting its business model may be better insulated than peers against broader cruise sector headwinds.

- Next, we’ll examine how Goldman’s focus on Viking’s differentiated geographic exposure reshapes the company’s existing investment narrative and risk-reward balance.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Viking Holdings Investment Narrative Recap

To own Viking Holdings, you need to believe in the durability of demand from affluent, experience-focused travelers and Viking’s ability to convert that demand into growing earnings despite high leverage and cost pressures. Goldman’s upgrade, centered on differentiated geography and pricing power, broadly supports this thesis but does not materially change the near term focus on filling future capacity at attractive yields or the key risk that a pullback in high-end travel spending could bite harder than expected.

Among recent updates, Viking’s Q3 2025 results stand out alongside Goldman’s call, with revenue of US$1,999.64 million and net income of US$514.09 million reinforcing the story of strong advance bookings and pricing at work. For investors tracking catalysts, those numbers give more context to claims that Viking’s premium positioning and geographic mix could help it sustain occupancy and pricing even as parts of the cruise industry worry about oversupply and rising costs.

Yet beneath this optimism, investors should also be aware of how Viking’s concentrated European river cruise exposure could...

Read the full narrative on Viking Holdings (it's free!)

Viking Holdings' narrative projects $8.5 billion revenue and $2.0 billion earnings by 2028. This requires 13.6% yearly revenue growth and about a $1.3 billion earnings increase from $694.2 million today.

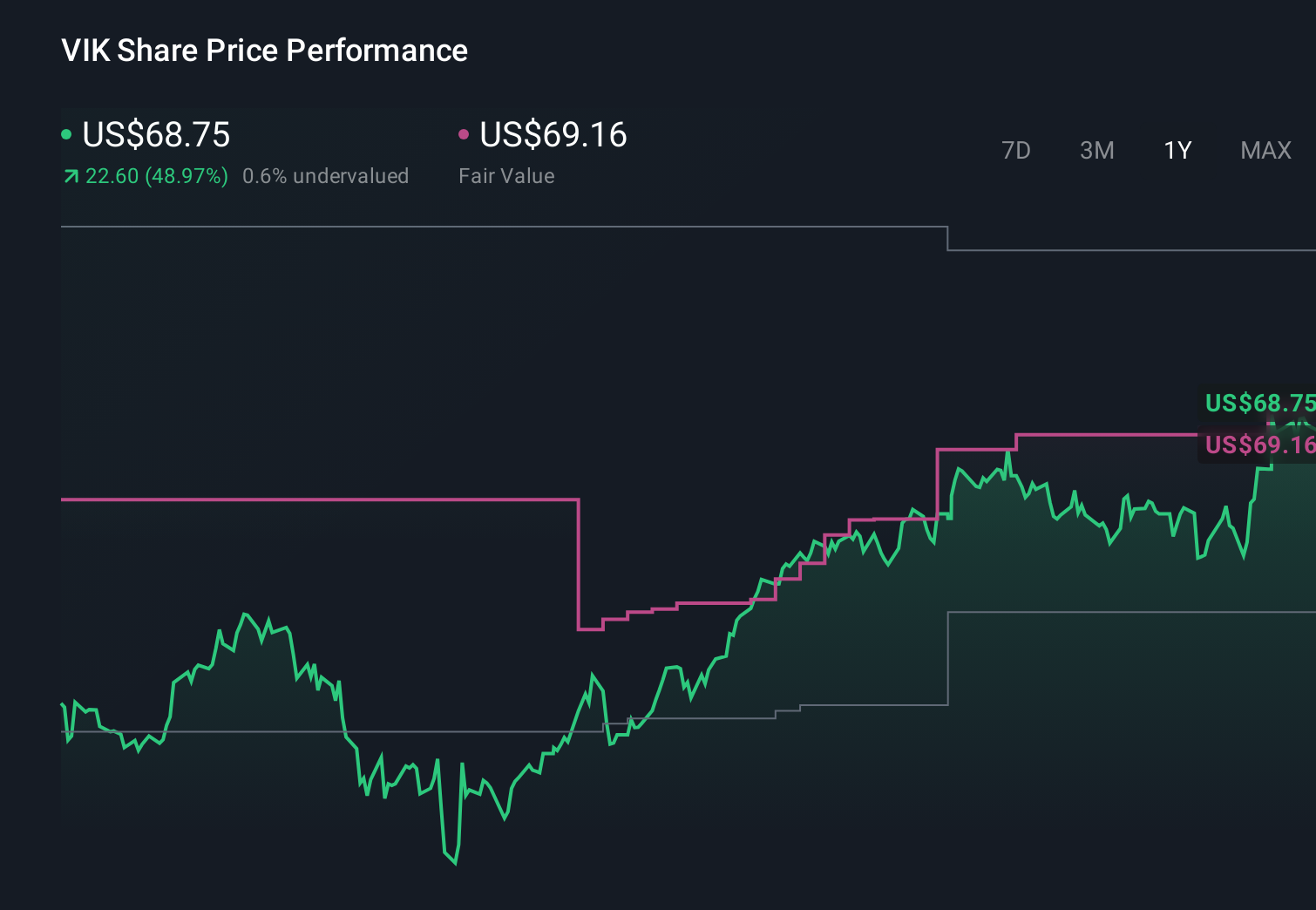

Uncover how Viking Holdings' forecasts yield a $69.16 fair value, in line with its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently value Viking between US$34.20 and US$80.21 per share, underscoring how far apart individual expectations can sit. Set against concerns about fuel, operating and expansion costs compressing margins, these contrasting views invite you to weigh several frameworks for thinking about Viking’s future performance.

Explore 5 other fair value estimates on Viking Holdings - why the stock might be worth as much as 17% more than the current price!

Build Your Own Viking Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viking Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Viking Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viking Holdings' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報