Tronox Holdings (NYSE:TROX): Valuation Check After Major Government-Backed Financing for Rare Earths Expansion

Tronox Holdings (NYSE:TROX) is back on investor radar after lining up up to $600 million in potential government backed financing to expand its rare earths supply chain across Australian mining and processing assets.

See our latest analysis for Tronox Holdings.

The news lands at an interesting moment for Tronox, with the latest $4.52 share price sitting well below where it started the year. This comes despite a sharp 30 day share price return of 25.21 percent, which suggests momentum may be turning as investors reassess its long term critical minerals story.

If you are weighing how this kind of government backed growth angle compares with other opportunities, it could be worth exploring fast growing stocks with high insider ownership as a curated way to spot similar potential inflection stories.

Yet with Tronox still trading deeply below its longer term highs and only a modest gap to analyst targets, investors now face a key question: does this upswing signal an undervalued turnaround, or is the market already pricing in future rare earth growth?

Most Popular Narrative: 6.2% Undervalued

With Tronox trading at $4.52 versus a narrative fair value near $4.82, the story hinges on a sharp rebound in margins and earnings power.

The company's ongoing cost improvement program and operational efficiency initiatives including vertical integration and strategic mining investments are anticipated to deliver $125 million to $175 million in sustainable annual savings by the end of 2026 and lower unit feedstock costs in 2026, which should enhance net margins and overall profitability beyond current expectations.

Want to see what happens when slower growth meets radically higher margins and a compressed earnings multiple, all in one modelled outcome? The numbers may surprise you.

Result: Fair Value of $4.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high leverage and ongoing TiO₂ overcapacity could squeeze margins, weaken cash generation, and quickly undermine the current undervaluation thesis.

Find out about the key risks to this Tronox Holdings narrative.

Another View: Cash Flows Paint a Darker Picture

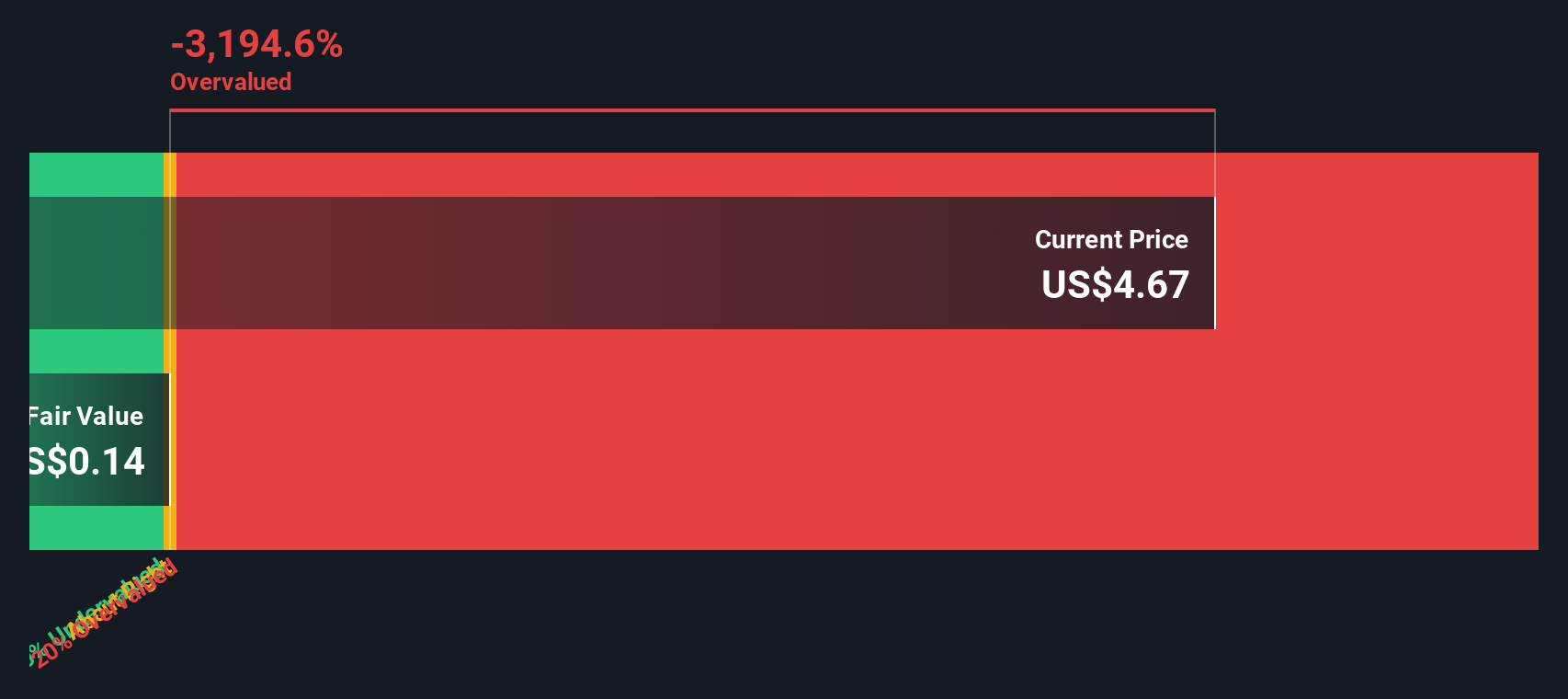

While the narrative suggests Tronox is modestly undervalued, our DCF model tells a very different story. Based on cash flow assumptions, fair value sits near $0.14 per share, implying the current $4.52 price looks heavily overvalued and leaves little room for execution missteps.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tronox Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tronox Holdings Narrative

If this perspective does not fully align with your own view, or you would rather dive into the numbers yourself, you can craft a personalized narrative in just a few minutes, Do it your way.

A great starting point for your Tronox Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for your next investing edge?

Before you move on, lock in a shortlist of fresh opportunities with the Simply Wall St Screener, so you are not relying on just one idea.

- Capture powerful long term income potential by scanning these 12 dividend stocks with yields > 3% that combine attractive payouts with solid underlying businesses.

- Jump ahead of the next innovation wave by targeting these 26 AI penny stocks positioned at the intersection of rapid growth and transformative technology.

- Strengthen your margin of safety by focusing on these 907 undervalued stocks based on cash flows where prices still lag behind their long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報