OPKO Health (OPK): Revisiting Valuation After Recent Share Price Stabilisation

OPKO Health (OPK) has quietly moved higher over the past month, even as its longer term returns remain weak. This has left investors debating whether this low priced healthcare name is finally resetting expectations.

See our latest analysis for OPKO Health.

Zooming out a bit, OPKO’s roughly 3 percent 1 month share price return contrasts with a still weak 1 year total shareholder return. This suggests sentiment is stabilising rather than surging as investors reassess its turnaround prospects.

If OPKO’s recent move has you rethinking the healthcare space, it might be a good time to scan other potential opportunities across healthcare stocks.

With shares still trading below analyst targets despite improving earnings momentum, investors now face a key question: Is OPKO Health an overlooked value play with meaningful upside, or is the market already pricing in its future growth?

Most Popular Narrative: 62.2% Undervalued

With OPKO Health last closing at $1.37 versus a narrative fair value of $3.62, the valuation gap points to a highly optimistic long term reset.

The sale of BioReference's oncology and related clinical testing assets to Labcorp is expected to sharpen OPKO Health's focus on its core testing business, drive significant cost savings, and support the Diagnostics segment's transition to cash flow positive and profitability in 2025, providing margin expansion and stabilizing earnings.

Want to see what kind of revenue rebuild and margin shift could justify that gap? The narrative leans on a sharp profitability swing and a premium future multiple. Curious what has to go right for that to hold up? Read on to uncover the assumptions powering this fair value.

Result: Fair Value of $3.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses and continued share dilution could quickly undermine the bullish case if OPKO’s new diagnostics and metabolic therapies fail to scale as expected.

Find out about the key risks to this OPKO Health narrative.

Another View: Multiples Flash a Caution Sign

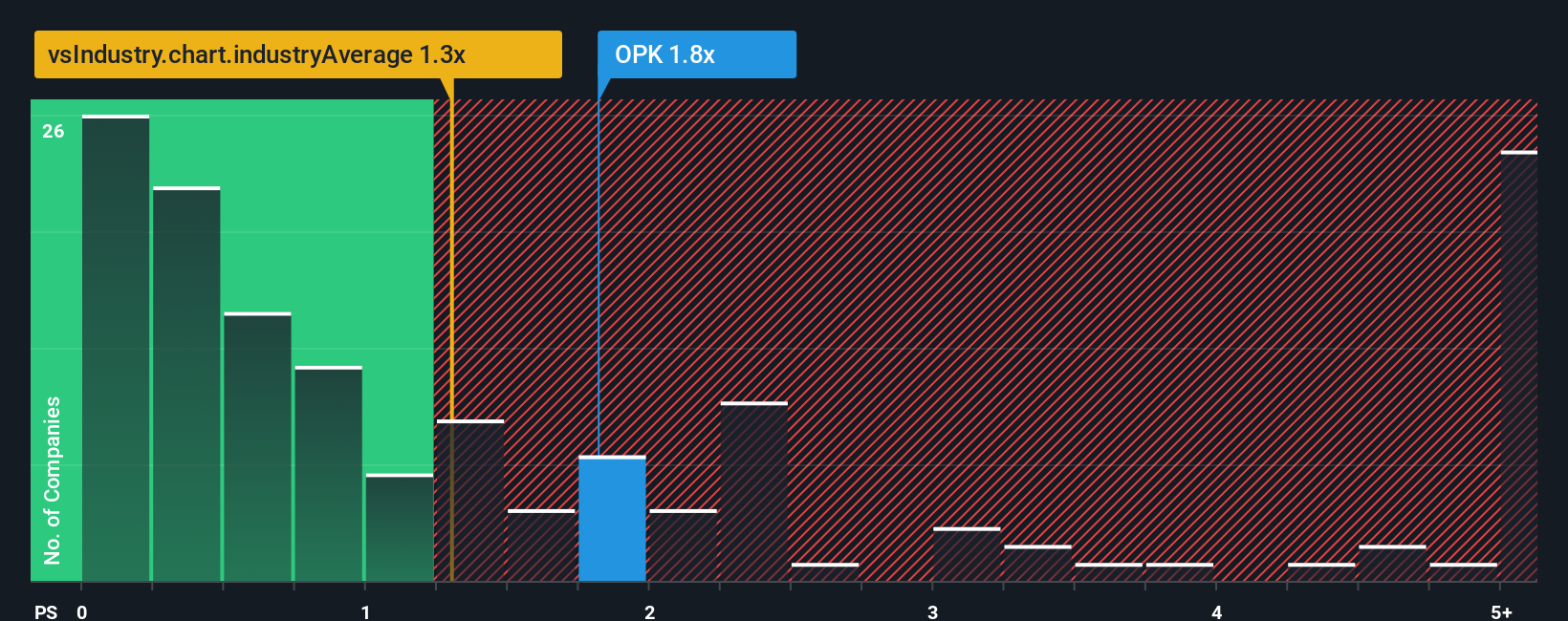

While narrative fair value points to upside, the current price to sales ratio of 1.6 times looks rich versus both peers at 1.3 times and a fair ratio of 0.5 times. If sentiment cools, could the share price drift back toward that lower anchor?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OPKO Health Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your OPKO Health research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for your next smart investing move?

Do not stop with a single idea when the market is offering many more. Use the Simply Wall Street Screener today and stay ahead of the herd.

- Capture potential mispricings before the crowd by targeting these 907 undervalued stocks based on cash flows that pair solid fundamentals with attractive entry points.

- Ride structural shifts in technology by zeroing in on these 26 AI penny stocks positioned to benefit from rapid advances in artificial intelligence.

- Strengthen your income strategy by focusing on these 12 dividend stocks with yields > 3% that can help support long term total returns through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報