Vertiv (VRT) Valuation Check After Wolfe Research Downgrade and Big Post‑2022 Rally

Vertiv Holdings (VRT) just ran into a speed bump, with Wolfe Research downgrading the stock on valuation after its huge rally since 2022, even as many on Wall Street still like its data center story.

See our latest analysis for Vertiv Holdings Co.

The downgrade comes after a powerful run, with Vertiv’s 90 day share price return of nearly 34 percent and a year to date share price return above 50 percent. Its three year total shareholder return above 1,200 percent shows momentum is still firmly intact despite recent volatility and valuation jitters.

If Vertiv’s surge has you rethinking your watchlist, this could be a smart moment to explore high growth tech and AI stocks that might be riding the same powerful data center and AI infrastructure wave.

With Vertiv now trading near its latest price targets after a multi year surge, the key question is whether investors are still underestimating its data center runway or if the market has already priced in the next leg of growth.

Most Popular Narrative Narrative: 7.6% Undervalued

With Vertiv last closing at $181.82 against a fair value view near $196.83, the prevailing narrative leans toward upside still being on the table.

Increasing complexity and scale of data center deployments, including the need for integrated power and advanced liquid cooling solutions, are expanding Vertiv's addressable market and enabling premium pricing, which should support future net margin expansion as temporary operational costs normalize.

Want to see what justifies that richer future profit multiple, even after a huge rally? The narrative focuses on aggressive earnings compounding, expanding margins and a surprisingly confident long term growth runway. Curious how those moving parts translate into today’s fair value tag?

Result: Fair Value of $196.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain hiccups or big cloud customers developing in house cooling and power solutions could pressure Vertiv’s margins and dent its growth thesis.

Find out about the key risks to this Vertiv Holdings Co narrative.

Another Lens on Valuation

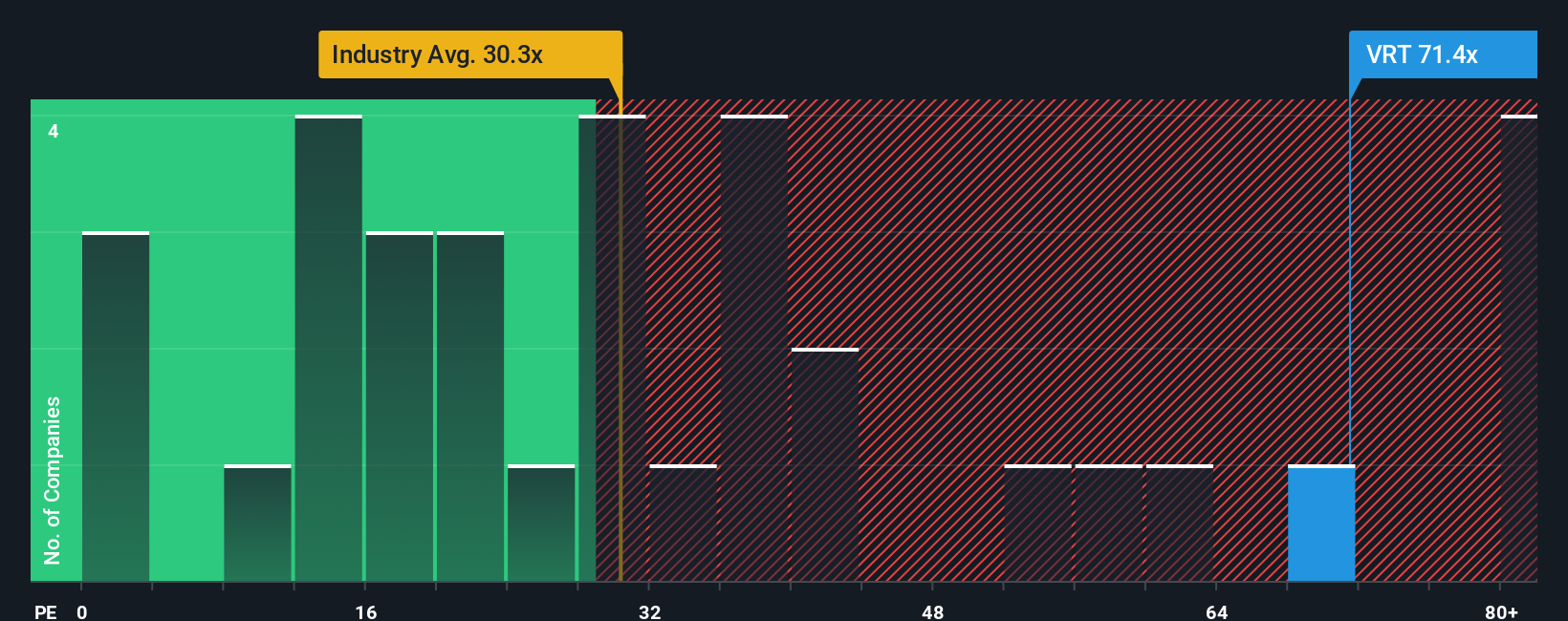

Our earnings based view suggests Vertiv is about 15 percent below fair value, but its 67.2 times earnings ratio versus 31.4 times for the US Electrical industry, 38.3 times for peers, and a 58 times fair ratio implies the market is already paying a steep premium. This raises the question of how much upside is left if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertiv Holdings Co Narrative

If you see Vertiv’s story differently or simply want to dig into the numbers yourself, you can build a custom take in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertiv Holdings Co.

Ready for your next investing move?

Before the next wave of market leaders takes off without you, use Simply Wall Street’s screener to surface fresh opportunities that fit your strategy.

- Capitalize on potential mispricing by targeting companies that look cheap on cash flow with these 907 undervalued stocks based on cash flows, keeping you ahead of slower moving investors.

- Ride the AI transformation by zeroing in on high potential innovators through these 26 AI penny stocks, before their earnings stories hit the headlines.

- Lock in stronger income potential by filtering for reliable payers using these 12 dividend stocks with yields > 3%, so your portfolio keeps working even when markets wobble.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報