Is Disney Still a Long Term Opportunity After Recent Streaming and Theme Park Strategy Shift?

- Wondering if Walt Disney at around $108 a share is still a magic kingdom for long term investors, or if the best days are already priced in, you are not alone.

- Despite a choppy five years with the stock down about 36.1%, Disney has edged up 2.9% over the last week even as it remains slightly negative year to date at around 1.8%, hinting that sentiment may be starting to turn.

- Recent headlines have focused on Disney sharpening its focus on streaming strategy, reshaping its traditional TV assets, and leaning harder into its theme parks and experiences business, all in an effort to unlock more predictable cash flows. At the same time, partnerships around sports streaming and a renewed push into franchises and park expansions are feeding a narrative that the company is moving from a pure growth story toward a more disciplined value and cash generation play.

- On our numbers, Disney scores a 4/6 valuation score, meaning it looks undervalued on most of the key checks we run, but not all of them, and that nuance matters. Next we will unpack what different valuation approaches are saying about Disney today, and then circle back to an even better way of thinking about value that pulls the whole picture together.

Find out why Walt Disney's -4.2% return over the last year is lagging behind its peers.

Approach 1: Walt Disney Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and discounting them back to a single present value in $.

For Walt Disney, the latest twelve month Free Cash Flow is about $11.8 billion, and analysts expect this to grow steadily as the business leans into streaming, content, and parks. Under the 2 Stage Free Cash Flow to Equity model, our projections see annual Free Cash Flow rising to roughly $13.3 billion by 2030, with later years extrapolated by Simply Wall St once direct analyst estimates run out.

When all those future cash flows are discounted back to today, the intrinsic value comes out at around $105.53 per share. Compared with the current share price near $108, the DCF implies the stock is about 3.1% overvalued, which is a very small gap and well within a reasonable margin of error for long term investors.

Result: ABOUT RIGHT

Walt Disney is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

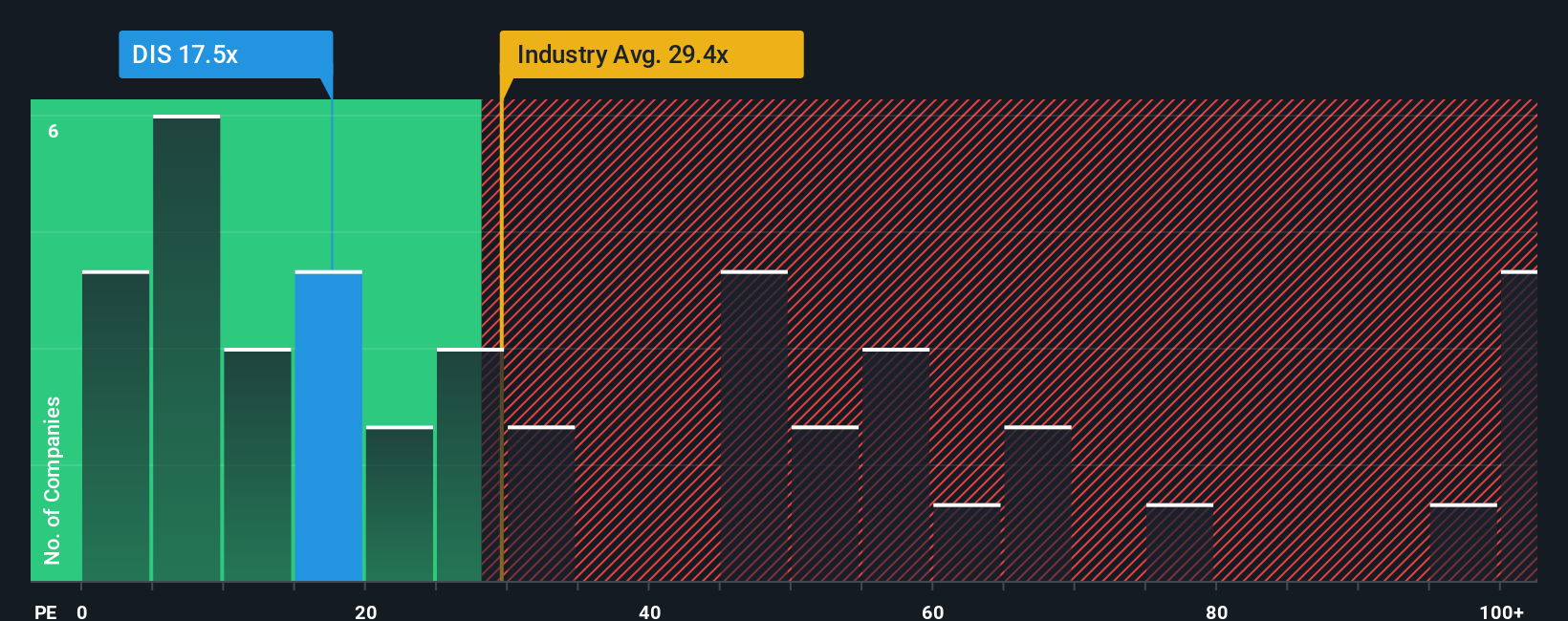

Approach 2: Walt Disney Price vs Earnings

For a profitable business like Walt Disney, the price to earnings, or PE, ratio is a useful shorthand for how much investors are willing to pay for each dollar of earnings. It naturally captures expectations about future growth and the risk of those earnings, with faster growing, lower risk companies usually deserving higher PE multiples.

In practice, what counts as a normal or fair PE depends on both the company and its environment. Higher expected earnings growth, stronger competitive advantages and more predictable cash flows can all justify a richer multiple, while cyclical earnings or elevated risk should pull that multiple down.

Right now, Disney trades on a PE of about 15.66x, below both the Entertainment industry average of roughly 21.80x and the broader peer group average of around 71.37x. Simply Wall St’s proprietary Fair Ratio for Disney is 23.51x, which is the PE expected based on its earnings growth outlook, industry, profit margins, market cap and risk profile. This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for those company specific fundamentals rather than assuming all firms deserve the same multiple. With Disney’s actual PE sitting well below its 23.51x Fair Ratio, the stock screens as undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Walt Disney Narrative

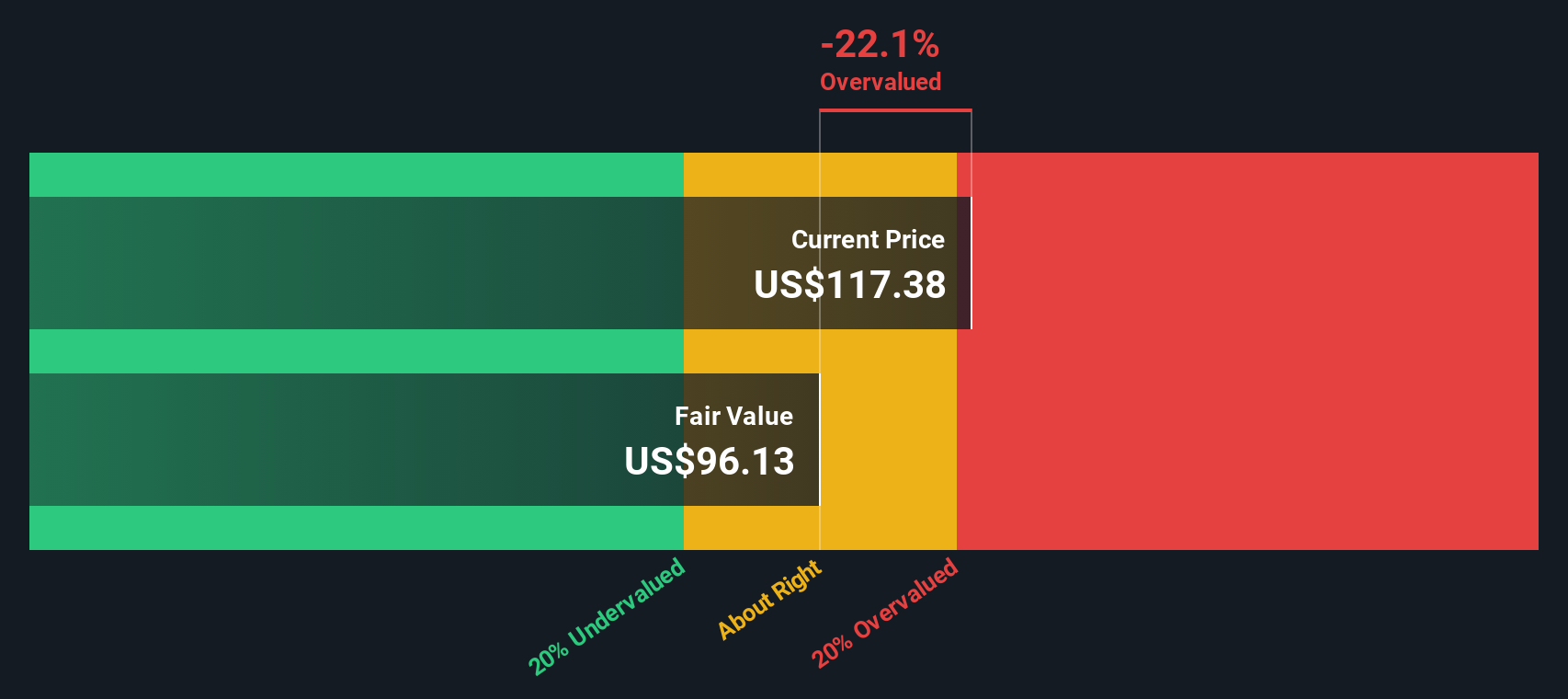

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s future to concrete numbers like revenue, earnings, margins and ultimately a fair value estimate. A Narrative is the story you believe about Walt Disney, or any stock, translated into a structured forecast that ties the company’s strategy and risks to projected financials, and then to what you think the shares are actually worth. On Simply Wall St, Narratives live in the Community page and are used by millions of investors as an accessible tool to frame when to buy or sell by comparing their Fair Value to today’s Price, with those values automatically updating as new news, earnings or guidance comes in. For example, one Walt Disney Narrative currently sees fair value around $131.50 per share while another pegs it closer to $79.00, reflecting very different beliefs about how strongly streaming, sports and parks will drive the next phase of growth.

Do you think there's more to the story for Walt Disney? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報