SharkNinja (SN): Valuation Check After Shark Beauty’s Rapid Rise in U.S. Skincare Devices

SharkNinja has tapped into a fresh growth engine with Shark Beauty becoming the top skincare facial device brand in the U.S., powered by CryoGlow’s rapid adoption and the new FacialPro Glow system.

See our latest analysis for SharkNinja.

At a share price of $113.27, SharkNinja’s 1 month share price return of 22.88% and year to date share price return of 16.70% suggest momentum is building as investors price in the new beauty growth leg alongside its broader appliance franchise.

If this kind of consumer brand momentum has your attention, it could be a good time to explore fast growing stocks with high insider ownership for more potential growth stories riding similar investor interest.

Yet with revenue and earnings still growing double digits, and the stock trading at a meaningful discount to analyst targets and intrinsic value, investors must decide: Is SharkNinja still undervalued, or is future growth already priced in?

Most Popular Narrative: 15.2% Undervalued

With the most popular narrative placing fair value above SharkNinja’s last close of $113.27, the gap points to potential upside if its assumptions hold.

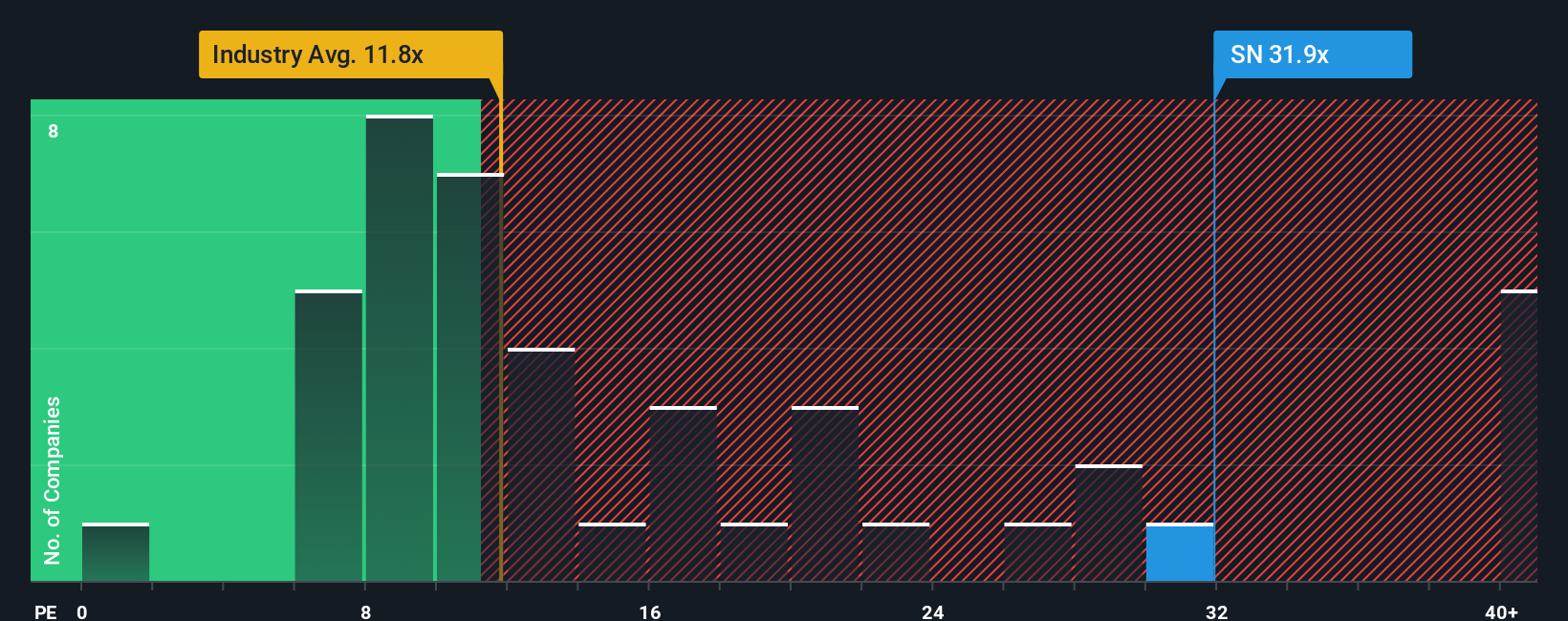

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.5x on those 2028 earnings, down from 31.4x today. This future PE is greater than the current PE for the US Consumer Durables industry at 11.5x.

The full narrative lays out the reasoning behind that valuation gap, including how today’s profitability, expected revenue trajectory, and return on equity assumptions are translated into a higher long term fair value.

Result: Fair Value of $133.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising manufacturing and tariff costs in Asia, alongside reliance on viral product hits, could quickly pressure margins and derail those bullish earnings assumptions.

Find out about the key risks to this SharkNinja narrative.

Another Take on Valuation

While the narrative points to a 15.2% upside, the earnings multiple paints a more demanding picture. SharkNinja trades on a 27.8x P/E, versus 26.6x for peers and just 11.2x for the Consumer Durables industry, and above its own 22.1x fair ratio estimate.

That gap suggests investors are already paying a premium for growth, leaving less room for error if momentum fades or forecasts slip. Is this a quality story worth paying up for, or a valuation that could compress if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SharkNinja Narrative

If you see the story differently, or simply want to dive into the numbers yourself, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding SharkNinja.

Ready for more high conviction ideas?

Before you move on, lock in your next opportunities using the Simply Wall St Screener, so you are not relying on just one winning story.

- Seize income potential with these 12 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow while markets stay unpredictable.

- Capitalize on structural growth by targeting these 30 healthcare AI stocks riding the surge in medical innovation and intelligent diagnostics.

- Position yourself early in digital finance by screening these 81 cryptocurrency and blockchain stocks shaping the future of payments, infrastructure, and decentralized platforms.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報