What Riot Platforms (RIOT)'s Weaker Recent Bitcoin Output and Sales Mean For Shareholders

- Riot Platforms recently reported that in October 2025 it sold 383 Bitcoin for net proceeds of US$37.0 million, while November 2025 Bitcoin production fell to 428 coins from 495 a year earlier.

- These back-to-back declines in both Bitcoin production and sales highlight potential operational or market pressures that matter for investors tracking Riot’s growth plans and capital use.

- We’ll now examine how Riot’s lower recent Bitcoin production and sales volumes may influence its existing investment narrative around mining and data centers.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Riot Platforms Investment Narrative Recap

To own Riot Platforms, you need to believe it can turn its Bitcoin mining scale and power capacity into durable cash flows, especially through higher value data center usage. The recent drop in monthly Bitcoin production and sales looks more like normal volatility than a change to the key short term catalyst, which is still the execution and leasing progress in its growing data center footprint, while intensifying mining competition remains the most immediate operational risk.

The latest November 2025 production update, showing 428 Bitcoin mined versus 495 a year earlier, directly ties into that competition risk, as a rising global hash rate can constrain Riot’s output even as it invests in new hardware. For investors, this makes it more important to track whether data center and power monetization can offset any pressure on mining volumes and margins over time.

Yet behind the appeal of Riot’s scale and balance sheet, investors should be aware of how rising network difficulty and falling monthly output could...

Read the full narrative on Riot Platforms (it's free!)

Riot Platforms' narrative projects $992.8 million revenue and $125.7 million earnings by 2028.

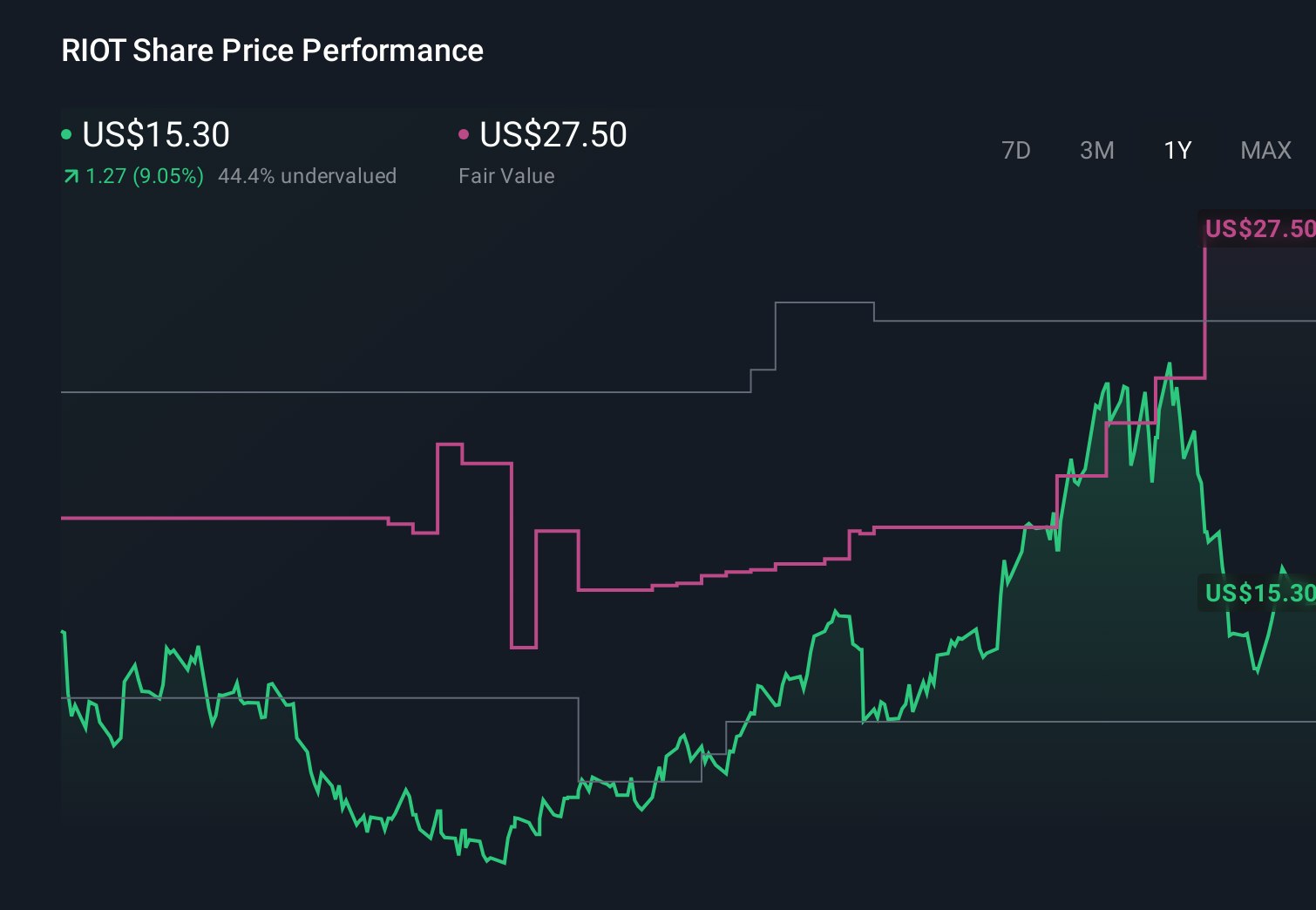

Uncover how Riot Platforms' forecasts yield a $27.50 fair value, a 77% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly US$11.79 to US$27.50, underscoring how far apart individual views can be. You can compare these against the risk that rising global hash rate is already showing up in Riot’s softer recent production, and consider how that might influence the company’s ability to sustain its current performance.

Explore 5 other fair value estimates on Riot Platforms - why the stock might be worth as much as 77% more than the current price!

Build Your Own Riot Platforms Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Riot Platforms research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Riot Platforms research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Riot Platforms' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報