Venture Global (VG): Reassessing Valuation After $3 Billion Refinancing, Lawsuits and New LNG Offtake Deals

Venture Global (VG) is back in focus after closing a $3 billion senior secured note offering to refinance existing debt, even as it juggles customer lawsuits and signs fresh long term LNG offtake deals.

See our latest analysis for Venture Global.

These refinancing moves and new offtake deals are landing against a tough backdrop, with Venture Global’s share price return down sharply this year as legal risks and margin pressures reset expectations, suggesting momentum is still fading rather than stabilising.

If this mix of refinancing, lawsuits, and LNG demand has you reassessing your options, it could be worth hunting for other fast growing stocks with high insider ownership that might offer cleaner growth stories.

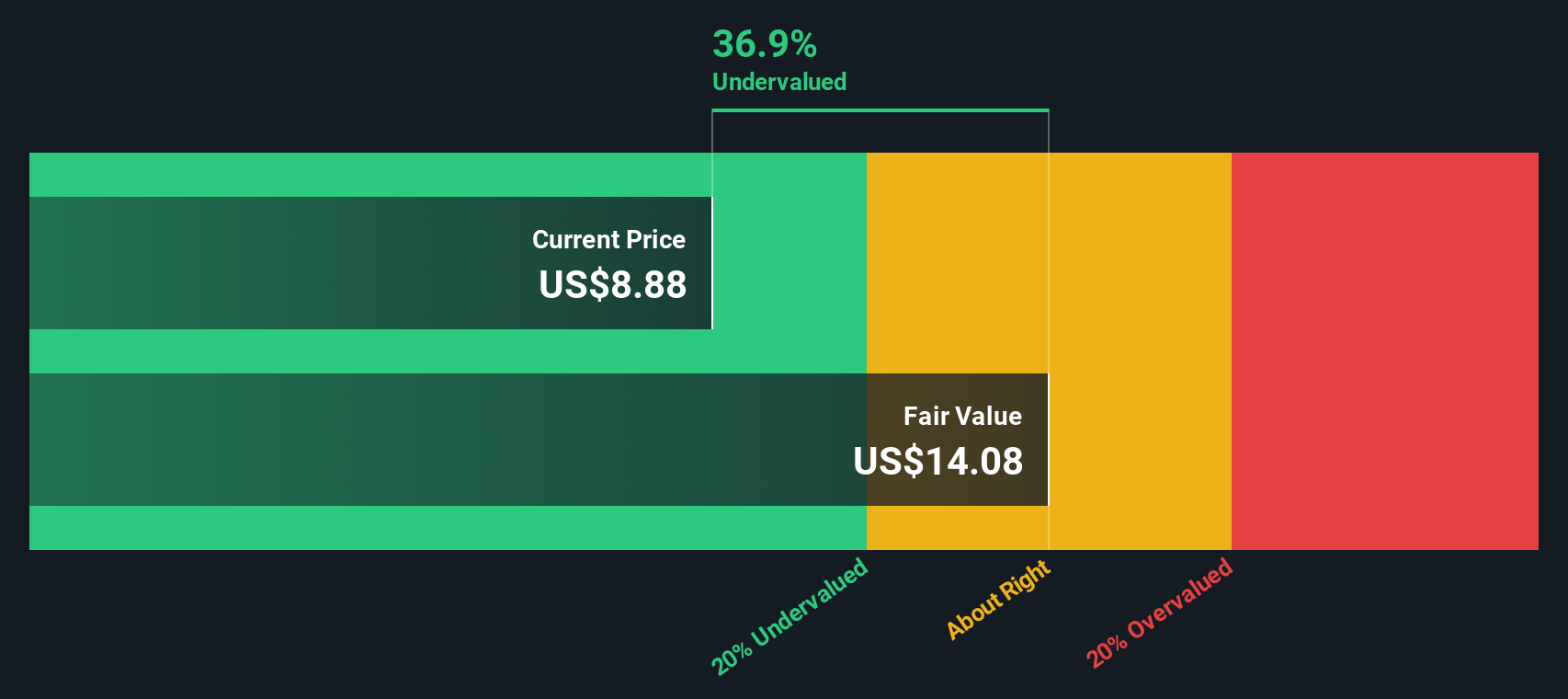

With the share price more than halved over three months but analysts still seeing upside to fair value, is Venture Global now a mispriced LNG turnaround, or is the market already discounting its future growth potential?

Price-to-Earnings of 7.2x: Is it justified?

Venture Global trades on a price-to-earnings ratio of 7.2 times, which looks inexpensive versus peers and industry benchmarks at the current 6.07 dollar share price.

The price-to-earnings multiple compares what investors are paying today for each dollar of current earnings, a key yardstick for profitable, capital intensive energy businesses like LNG exporters. In Venture Global's case, rapid earnings growth over the past year and an improved net profit margin suggest the market could be assigning a discount despite stronger recent profitability.

Relative to the broader US market, where price-to-earnings ratios are significantly higher, Venture Global's 7.2 times earnings signals that investors may be underpricing its earnings power, even as forecasts point to declining profits over the next three years. Compared with both the US Oil and Gas industry average of 13.6 times and a peer average of 23.1 times, the gap is stark. Against an estimated fair price-to-earnings ratio of 12.3 times, it highlights substantial room for the market multiple to move higher if sentiment or visibility on future earnings improves.

Explore the SWS fair ratio for Venture Global

Result: Price-to-Earnings of 7.2x (UNDERVALUED)

However, lingering legal disputes and slowing net income growth still threaten to cap any valuation re rating if sentiment sours further.

Find out about the key risks to this Venture Global narrative.

Another View on Value

Our DCF model tells a very different story, suggesting fair value is closer to 2.64 dollars per share, meaning the current 6.07 dollar price screens as overvalued rather than cheap on earnings. Is the market rightly pricing long term cash flow risk, or is the model too cautious on LNG upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Venture Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Venture Global Narrative

If you see the story unfolding differently or want to dig into the numbers yourself, you can build a personalised thesis in just minutes with Do it your way.

A great starting point for your Venture Global research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take the next step now and use the Simply Wall St Screener to uncover fresh opportunities that match your strategy before other investors move in.

- Capture potential multi-baggers early by scanning these 3602 penny stocks with strong financials with improving fundamentals and room to run.

- Position yourself at the heart of the AI revolution by targeting these 26 AI penny stocks poised to monetise powerful new technologies.

- Lock in value today by focusing on these 908 undervalued stocks based on cash flows that trade below their estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報