ZoomInfo (GTM): Reassessing Valuation After Forrester’s Total Economic Impact Study Highlights Strong ROI

ZoomInfo Technologies (GTM) is back in the spotlight after releasing a Forrester commissioned Total Economic Impact study, which highlights a 316% ROI and a payback period of under six months for enterprise customers using its platform.

See our latest analysis for ZoomInfo Technologies.

The upbeat Forrester findings arrive after a choppy run, with the share price at $10.13 and a negative 90 day share price return suggesting fading momentum, despite management pointing to improving fundamentals and margin leverage.

If this kind of efficiency story has your attention, it is worth exploring other data driven names using our screener for high growth tech and AI stocks to see what else stands out.

Yet with shares still well below prior highs and trading at a discount to analyst targets despite revenue and earnings growth, investors face a key decision: is ZoomInfo mispriced value, or is future growth already fully reflected?

Most Popular Narrative Narrative: 18.0% Undervalued

With the most followed narrative putting fair value near $12.35 versus the $10.13 close, the gap hinges on how far margins and AI demand can stretch.

A strategic focus on upmarket customers, who have higher lifetime value, greater stickiness, and significantly higher margins compared to downmarket clients, combined with internal AI driven efficiency gains (reductions in headcount and resource reallocation) is creating operating leverage and positioning the company for structurally higher net and operating margins over time.

Want to see the math behind that upside gap? This narrative leans on rising margins, accelerating earnings and a future profit multiple that may surprise you.

Result: Fair Value of $12.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering downmarket weakness and the risk of larger clients pulling back could quickly derail the margin expansion story that underpins this upside case.

Find out about the key risks to this ZoomInfo Technologies narrative.

Another Take on Valuation

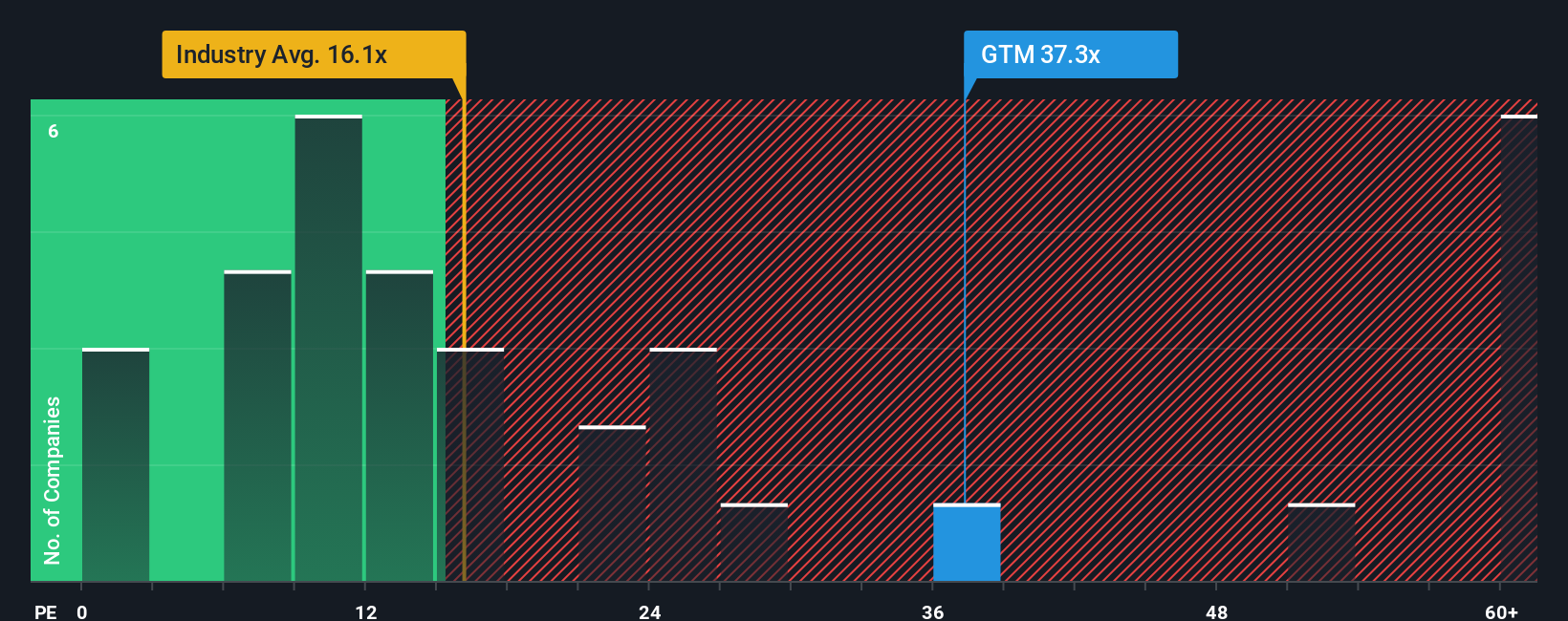

Looking at earnings, ZoomInfo trades on a 30.3x price to earnings ratio, far richer than the US Interactive Media and Services average of 17.6x and above its own 20.9x fair ratio. That stretch suggests less margin for error if growth or margins fall short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ZoomInfo Technologies Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can shape a fresh narrative in just a few minutes: Do it your way.

A great starting point for your ZoomInfo Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity using our powerful screeners, so you are not relying on just one stock story.

- Target steady income streams by scanning these 12 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash flows.

- Capitalize on innovation by reviewing these 26 AI penny stocks that are shaping the future of automation, data, and intelligent software.

- Position yourself for value gains by hunting through these 906 undervalued stocks based on cash flows where the market may be underestimating long term cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報