UK Penny Stocks To Watch In December 2025

The UK market has recently experienced a downturn, with the FTSE 100 index closing lower due to weak trade data from China, highlighting ongoing challenges in global economic recovery. In such fluctuating market conditions, investors often seek opportunities outside of well-known stocks. Penny stocks, despite being an older term, remain relevant for those looking to invest in smaller or newer companies that may offer surprising value and growth potential when supported by solid financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.08 | £468.07M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.00 | £161.57M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.235 | £323.86M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.80 | £12.08M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.35 | £29.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.615 | $357.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.452 | £178.79M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.45 | £70.02M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.495 | £42.67M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.085 | £174.61M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 307 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Made Tech Group (AIM:MTEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Made Tech Group Plc provides digital, data, and technology services to the public sector in the United Kingdom, with a market cap of £49.62 million.

Operations: The company generates revenue of £46.43 million from its Computer Graphics segment.

Market Cap: £49.62M

Made Tech Group has shown significant progress by achieving profitability, with a net income of £1.4 million for the year ending May 31, 2025, compared to a loss previously. The company's revenue increased to £46.43 million, indicating strong growth in its Computer Graphics segment. Despite having no debt and sufficient short-term assets (£17.4M) to cover liabilities (£4.3M), the stock remains volatile and trades below estimated fair value by 27%. Recent management changes include the departure of CFO Neil Elton and director Helen Gilder, highlighting potential instability within its leadership team.

- Dive into the specifics of Made Tech Group here with our thorough balance sheet health report.

- Examine Made Tech Group's earnings growth report to understand how analysts expect it to perform.

INSPECS Group (AIM:SPEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: INSPECS Group plc is involved in the design, production, sale, marketing, and distribution of fashion eyewear, lenses, and OEM products across multiple regions including the United Kingdom, Europe, North America, South America, Asia, Africa, and Australia with a market cap of £83.78 million.

Operations: The company's revenue is primarily derived from its Frames and Optics segment, which generated £173.22 million, complemented by its Manufacturing segment with £21.05 million.

Market Cap: £83.78M

INSPECS Group is navigating a complex landscape with recent M&A activity as Luke Johnson and Ian Livingstone plan to acquire a 94.14% stake for approximately £80.3 million, pending approvals. Despite being unprofitable, the company has improved its cash runway, maintaining positive free cash flow and covering liabilities with short-term assets (£100.2M). The company's revenue guidance for 2025 is approximately £191 million, showing resilience in its core segments despite earlier trading challenges. Investor activism has called for strategic divestment to unlock value, while management changes aim to stabilize governance amid high share price volatility.

- Navigate through the intricacies of INSPECS Group with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into INSPECS Group's track record.

Applied Nutrition (LSE:APN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Applied Nutrition Plc manufactures, wholesales, and retails sports nutritional products in the United Kingdom and internationally with a market cap of £562.50 million.

Operations: The company's revenue is primarily generated from the manufacture and sale of sports nutrition products, amounting to £107.1 million.

Market Cap: £562.5M

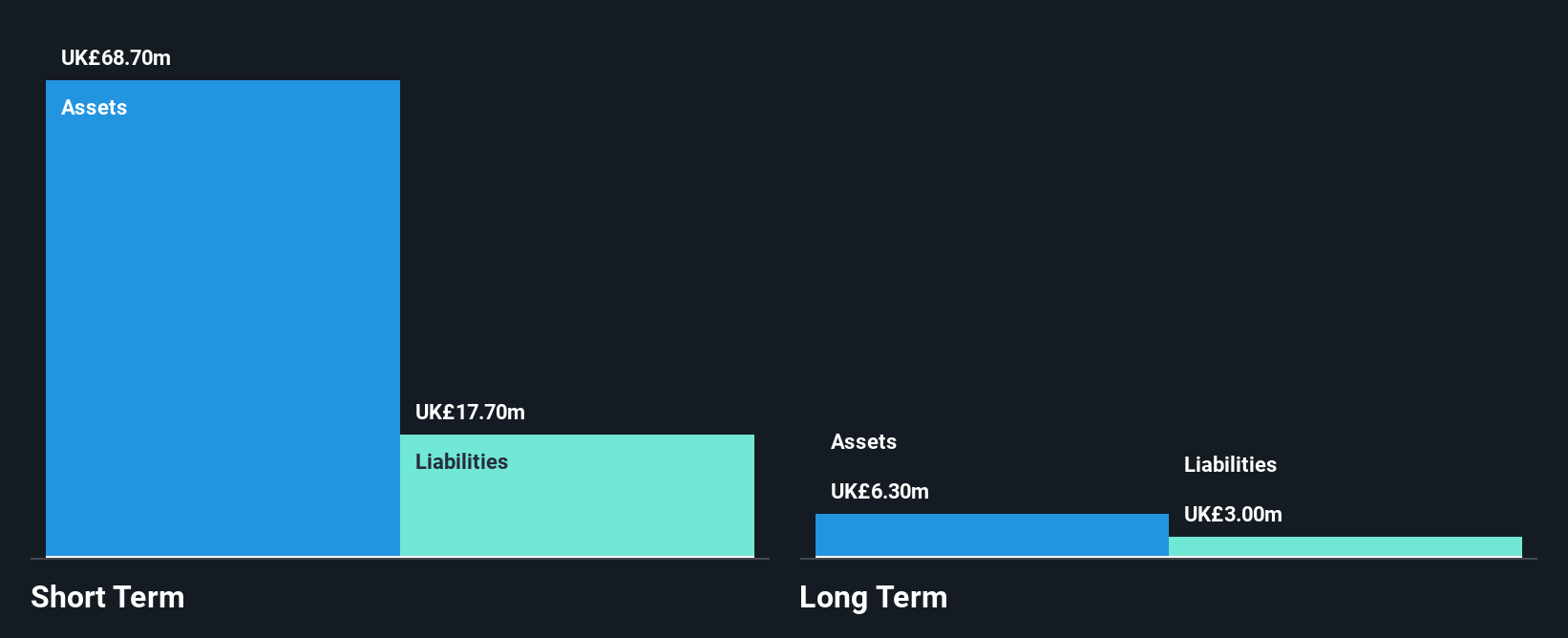

Applied Nutrition Plc, with a market cap of £562.50 million, has demonstrated financial stability and growth potential in the penny stock arena. The company reported a significant increase in sales to £107.1 million for the year ending July 31, 2025, up from £86.2 million the previous year, alongside net income growth to £21.1 million. Its strong balance sheet is underscored by high-quality earnings and no debt obligations, while short-term assets comfortably cover liabilities (£68.7M vs £17.7M). Despite a less seasoned board (1.8 years), management's experience (4.6 years) supports continued robust earnings growth forecasts of 13.42% annually.

- Take a closer look at Applied Nutrition's potential here in our financial health report.

- Understand Applied Nutrition's earnings outlook by examining our growth report.

Key Takeaways

- Get an in-depth perspective on all 307 UK Penny Stocks by using our screener here.

- Curious About Other Options? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報