Is STAAR Surgical a Bargain After a 68.4% Five Year Share Price Slump?

- If you have been wondering whether STAAR Surgical is a beaten down bargain or a value trap, you are not alone. This stock has quietly become one of the more debated names in medtech.

- After years of heavy declines, with the share price still down about 68.4% over five years, the stock has slipped another 12.4% over the last month. This has many investors reconsidering both its risk and its recovery potential.

- Recently, attention has centered on STAAR's progress in expanding its implantable lens franchise and navigating competitive pressures in vision correction, themes that have driven sentiment around the stock. Headlines about regulatory clearances in key markets and shifting market share in premium ophthalmic devices have added fuel to the debate over whether the worst is already priced in.

- On our framework, STAAR Surgical scores just 2/6 on valuation checks, suggesting the market is only pricing in value in a couple of areas. In the sections ahead we will unpack what that means across different valuation methods, before finishing with an even more practical way to think about the company’s true worth.

STAAR Surgical scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: STAAR Surgical Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and then discounting those back into today’s dollars.

For STAAR Surgical, the latest twelve month free cash flow is roughly negative $42.7 million. The model therefore assumes the business will transition from cash burn to rising free cash generation. Analyst forecasts and Simply Wall St extrapolations point to free cash flow climbing to about $126 million by 2035, with intermediate milestones such as $8 million in 2026, $36 million in 2027 and $66 million in 2029. All figures are in dollars and are discounted back to reflect risk and the time value of money.

Using a 2 Stage Free Cash Flow to Equity approach, these cash flows imply an intrinsic value of about $37.30 per share. With the DCF suggesting the stock is roughly 35.7% below this estimate, the model indicates STAAR Surgical is trading at a meaningful discount to its projected cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests STAAR Surgical is undervalued by 35.7%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: STAAR Surgical Price vs Sales

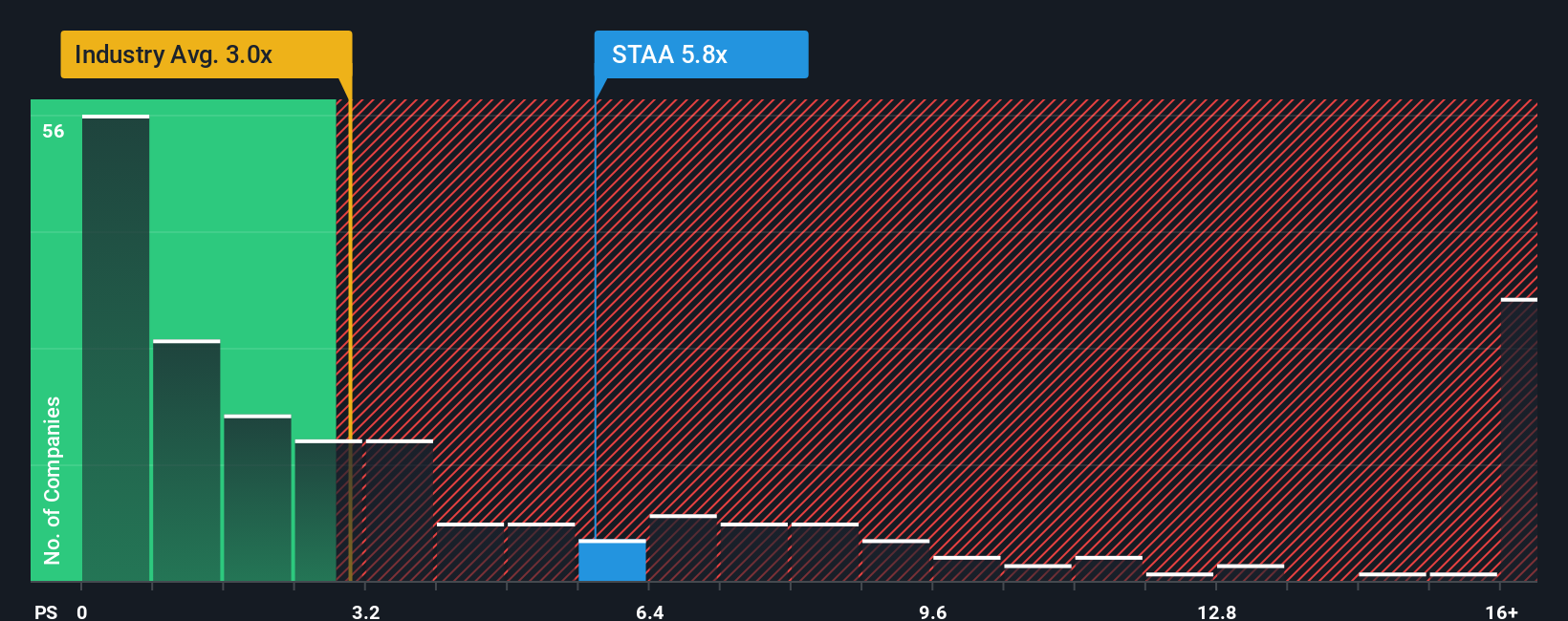

For medtech businesses that are still ramping profitability, the price to sales ratio is often the cleanest way to compare valuations, because it looks at what investors are paying for each dollar of revenue rather than volatile or negative earnings.

In general, higher growth and lower risk justify a richer multiple, while slower or more uncertain outlooks usually warrant a discount. Against that backdrop, STAAR Surgical currently trades on a price to sales ratio of about 5.18x, well above the broader Medical Equipment industry average of roughly 3.49x and also higher than the peer group average of about 3.50x.

Simply Wall St uses a Fair Ratio framework to estimate what a reasonable price to sales multiple should be, given STAAR's growth profile, profitability, risk factors, industry and market cap. For STAAR, this Fair Ratio comes out at around 3.71x, which is meaningfully below the current 5.18x. Because the Fair Ratio adjusts for fundamentals rather than relying only on blunt peer comparisons, it provides a more tailored view and suggests that, on a sales basis, the stock is pricing in quite optimistic expectations.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your STAAR Surgical Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple way to connect your view of a company with the numbers behind it.

A Narrative is your story for STAAR Surgical, where you spell out what you think will happen to its revenue, earnings and margins, and then see what fair value those assumptions imply.

In practice, Narratives link the business story, like recovery in China or new lens launches, to a financial forecast and then to an estimated fair value per share, so you can see if your outlook actually supports buying, holding or selling at today’s price.

On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy tool that show your Fair Value next to the live share price, update automatically when fresh news or earnings arrive, and make it clear how different perspectives can coexist. For example, one investor might see STAAR fairly valued around $16 a share while another believes a richer outlook justifies closer to $28.

Do you think there's more to the story for STAAR Surgical? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報